| FEATURE ARTICLE, OCTOBER 2007

IS A COST SEGREGATION STUDY WORTH CONSIDERING?

When implemented correctly under the right circumstances, a cost segregation study is a powerful tax-saving strategy.

Masahiko Kamata

Since the IRS issued the Cost Segregation Audit Techniques Guide in 2004, cost segregation studies (CSS) — studies that identify personal property components to accelerate depreciation for taxation purposes — have been gaining popularity among property owners around the country. Many situations exist in which CSS could be employed to benefit property owners that own qualifying properties via accelerated depreciation and increased cash flow.

For federal income tax purposes, in general, assets used in business or investment activities that have a useful life of 1 year or longer must be capitalized and depreciated. In the case of commercial and investment real estate properties — excluding land purchase price, initial clearing and shaping costs, which are non-depreciable — those real estate holdings are depreciated over 39 years (or 27.5 years for residential property) straight-line. In other words, they are depreciated evenly over the prescribed period.

A CSS enables the taxpayer or property owner to do two things: they can identify certain components of a building and reclassify them as shorter-life assets, and they also can depreciate them on an accelerated basis instead of straight-line basis. In a nutshell, a CSS can identify certain components of a building as personal property1 or land improvements2, and the identified personal property and/or land improvements are depreciated based on an accelerated method instead of a straight-line method. By accelerating the depreciation, the taxpayer is deferring federal income tax and could potentially see some great benefits.

Time Value of Money. Historically, the present dollar value is worth more than it will be in the future. Hence, accelerating depreciation deduction means the taxpayer will be saving money even though the taxpayer would be taking the same amount of depreciation deduction if the building was held until fully depreciated.

Increased Cash Flow. Accelerating depreciation means increased depreciation deduction, resulting in reduced income tax and a significant increase in cash flow. The extra cash could be used for facility improvements/expansions, accelerating debt retirement, activities that drive business, or could be invested in some investment vehicle.

A few examples of items that could be classified as personal property are removable flooring, cabinets, canopies, interior blinds, electrical circuits and plumbing systems for specialized business components and component level assets used in the direct pursuit of the business enterprise. Typical land improvements items include site development, landscaping, parking lots, wheel stops, striping, lighting, underground utilities, signage and fencing. Foundation, walls, roof, general building plumbing, general building electrical, building-associated mechanical systems and fire protections systems are primarily considered the structural components and systems associated with the main building and typically do not qualify as either personal property or land improvements.

Engineering-based CSS is the IRS’ preferred method of identifying and quantifying property that qualifies for a shorter depreciation life. It consists of a detailed examination of construction and accounting records by a professional consultancy comprised of accountants and engineers with prior cost segregation experience. IRS-approved construction costing methods are used to supplement the actual cost detail when the existing detail is not sufficient. The study will then identify the specific components of a building that can be reclassified as either personal property or land improvements.

One of the misconceptions regarding CSS is that it can be performed only on newly-constructed buildings, which is not the case. The key is to know when the building was placed into service by the taxpayer/property owner, not when the building was built originally. Therefore, a CSS can be performed on a recently purchased building even if the building was built in 1965. Theoretically, a CSS can be performed on any building placed into service since January 1, 1987, as long as it is being held for commercial or investment purposes. However, the CSS should be completed in or near the year that the building is placed into service for maximum benefits from accelerated depreciation derived from the study.

When a CSS is conducted for a building placed into service in a prior tax year, the property owner has the ability to claim catch up on the depreciation that should have been taken in previous years. The difference can be taken all at once in the year of the study without amending the prior tax return(s) by filing Form 3115, Application for Change in Accounting Method, prior to filing the current year tax return. Then, when the current year return is being filed, a copy of this form should be attached.

CSS can be a powerful estate planning tool as well (see Case Study #2). In the state of Texas, ordinarily, when a spouse dies, community property held by a married couple receives a step-up in basis. The same property could conceivably keep depreciating on an accelerated basis over and over without triggering any gains or recapture.

All in all, careful consideration must be given in assessing the feasibility of utilizing a CSS. Property owners should consult with their tax advisor, then carefully select a cost segregation provider that conducts CSS in accordance with the IRS Cost Segregation Audit Techniques Guide. CSS is gaining its popularity for a good reason — if implemented correctly under the right circumstances, it could be a very powerful tax-saving strategy.

Masahiko Kamata is a cost segregation consultant with Quality Cost Segregation Group, LLC in San Antonio.

1 Internal Revenue Code (IRC) Section 1245 property having a 5- or 7-year recovery period.

2 IRC Section 1250 property having a 15-year recovery period.

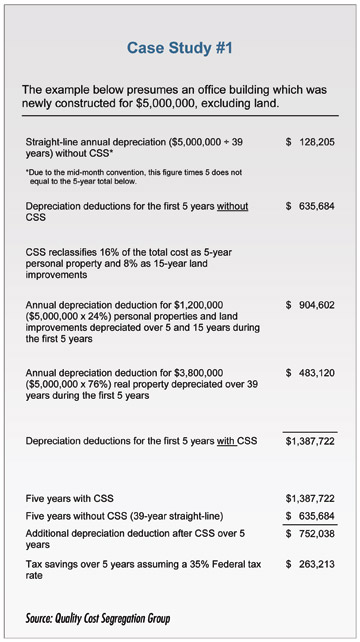

Case Study #1

Let us assume (see illustration) that an office building was constructed for $5 million. Without having a CSS performed on the building, the building would be depreciated over 39 years based on a 39-year, mid-month convention method of depreciation. This equates to $635,684 of depreciation deduction over the first 5 years, beginning when the building was placed into service. After having a CSS performed by a team of accountants and engineers, 16 percent of the building components is identified as 5-year personal property, and 8 percent is identified as land improvements, which is depreciated over 15 years. Depreciation derived from those reclassified assets for the first 5 years results in $904,602 in depreciation deduction. The remaining 76 percent will be depreciated over 39 years instead of 100 percent being depreciated over 39 years. The CSS justifies an additional $752,038 in depreciation deduction for the first 5 years. Assuming a tax rate of 35 percent, the tax savings, or additional cash flow, for the additional depreciation deduction would be $263,213.

Case Study #2

An investor purchases a shopping center for $1 million, excluding land. He utilizes a CSS, and it identifies 18 percent of the acquisition cost as a 5-year property and 10 percent as a 15-year property. The center gets depreciated for 5 years on an accelerated basis per the CSS. Assuming a 35 percent tax rate, approximately $60,000 of tax savings could be achieved during the 5-year period due to $299,000 in depreciation deduction with CSS versus $127,000 without CSS. Then, his spouse passes away. On the date of death, the fair market value of the center (excluding land) is now $1.5 million. The shopping center receives a step-up in basis to $1.5 million from the adjusted basis of $701,000 (the $1 million cost minus the $299,000 depreciation taken) without any gain or recapture. Another CSS is performed and the center is depreciated based on an accelerated basis. The remaining spouse passes away after 5 years. During this 5-year period, approximately $90,000 of tax savings could be achieved due to $448,000 in depreciation deduction with CSS versus $191,000 without CSS. Now, the center is inherited by the investor’s heir. Again, the center receives a step-up in basis to the fair market value as of the date of death without triggering gain or recapture. The heir utilizes a CSS and starts to depreciate the building again on an accelerated basis. This scenario assumes that the taxpayers have the income to offset the additional depreciation expense.

|

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|