| FEATURE ARTICLE, OCTOBER 2007

MEDICAL OFFICE TAKES OFF

Oaks Development Group brings a hybrid ownership structure to the medical market in Texas.

Kerry Angus

The graying of America is generating some serious green for a specific segment of the commercial real estate industry. The growing number of medical office building projects marks a healthy investment for developers with their fingers on the pulse of the changing commercial market place. Texas, especially San Antonio, is tapped into, and benefiting from, the trend.

With the population of 55 or older growing to 15 million during the next decade, savvy investors are catering to aging Americans. The concept of what amounts to one-stop shopping for those consumers is part of what’s fueling the trend to nest medical professionals in high-end, easily accessible developments with plenty of parking near major medical centers.

This is not a new trend; people have been talking about medical office buildings since the 1990s, and Oaks Development Group has been specializing its ownership hybrid for more than 15 years. It is just an idea that has finally hit the collective consciousness and, as a result, interest in this genre is growing rapidly.

According to a recent report by Marcus & Millichap Real Estate Investment Services, total medical office space in the U.S. is projected to increase by 14.5 million square feet this year alone. The Southwest and Midwest are the hottest locations for medical office building growth. The regions are expanding space by 6.9 million square feet, according to the report.

San Antonio, with its three different hospital systems and flourishing medical research community, is a prime example of the trend’s momentum. With about 5.3 million square feet of finished space, at least four major developments are either breaking or have recently broken ground that will increase the city’s medical office space by more than 400,000 square feet.

|

Oaks Development Group has closed on 8 acres near the South Texas Medical Center in San Antonio where it will break ground on a 105,000-square-foot project (early rendering above).

|

|

Oaks Development Group recently closed on 8 acres near the South Texas Medical Center where it will be breaking ground on a 105,000-square-foot project. The group is one of several investing in medical office buildings in and around the Alamo City.

San Antonio is the ideal site for this kind of project with its strong economy, a vibrant community and cutting-edge medical services. “We couldn’t find a better location for our first development in the Lone Star State,” says Max Oaks, chairman of Oaks Development Group.

The project at the corner of Hamilton Wolfe and Floyd Curl is the first foray into Texas for Oaks Development Group, but hardly the first such development for the company. The company has more than 40 medical office buildings and more than 300 partners within various medical professions across the country, mostly in the Southeast. Since the mid 1980s, Oaks Development Group has specialized in providing Class A facilities for medical professionals and its clients.

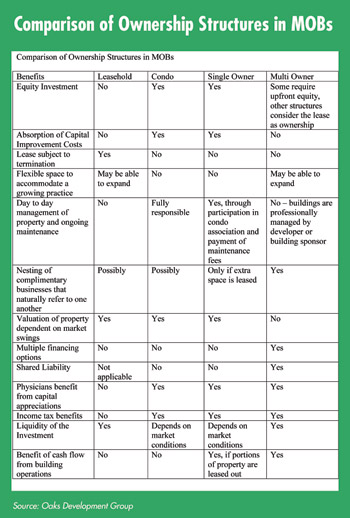

The company’s unique perspective and ownership formula drive the success and popularity of the private equity-funded investment group’s properties, according to Oaks.

“Our business philosophy is what sets us apart,” Oaks says. “We truly believe that the developer, the equity investor and the tenant should all have an ownership stake in the building. As a result, we have a lower risk profile, a wide range of exit strategies, better rates of return and a turnkey setup.”

Oaks Development Group offers a hybrid ownership structure that is set up as a single-purpose limited liability company (LLC), Oaks says. Tenant partners split ownership interest of 50 percent of the LLC based on how much space they occupy. There’s no capital outlay required for pro rata ownerships, and tenant partners have first right of refusal to acquire an additional 25 percent through an equity investment. The company keeps the last 25 percent of ownership and maintains the professional development and asset management long term. Tenant partners receive distributions of operations profits and any profits from refinancing.

“Our concept relieves doctors of having to take time away from their patients to manage their property, but they still enjoy the tax benefits and investment income,” Oaks says. “When medical professionals are freed up to do what they do best, the real value of our asset is created.”

With each new project, Oaks Development Group has refined its operating structure to cut costs and increase profits. The company only begins a project after at least half the space is pre-leased. At least five parking spaces are included for every 1,000 square feet of the building. Complimentary professionals are clustered together so that they can refer patients within the project. The design of each building focuses on patient care and convenience.

It’s a system that has really worked out well for us, our partner tenants and their clients. Doctors are watching their profit margins shrink as managed healthcare costs grow. This is a great way for them to make a sound investment directly related to their profession.

Oaks Development Group’s first medical office building project in Texas will not be the last, Oaks says.

“This is just the beginning for us. We’re committed to meeting the needs of investors, professionals and patients throughout the state. We already have our eyes set on the Austin market and will soon be turning to Houston as the demand for world-class facilities continues to grow.”

Kerry Angus is a partner with Cary, North Carolina-based Oaks Development Group, which also has an office in Austin, Texas.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|