| COVER STORY, NOVEMBER 2009

TOOLS OF DEVELOPMENT

Two Texas economic development organizations are utilizing a well-known state law to attract more business to their cities.

By Coleman Wood

Economic development is a big deal in Texas, and it is not just because of the number of cities and towns here. It has more to do with a law passed 30 years ago. The Development Corporation Act of 1979 allowed cities to create economic development corporations to attract business and spur growth. The law has been amended several times since then, most notably in 1989 when a provision was added that allowed cities to institute a sales tax specifically to fund economic development (oftentimes a half-cent tax) and for these corporations to administer the revenue from this tax. The provision allows all cities in a county with a total population of less than 500,000 to form what is now known as a 4A economic development corporation. Later amendments to the Development Corporation Act expanded what types of projects funds could be used for, but the act primarily targets industrial companies and projects. Funds can be used in a variety of ways to provide assistance, including tax abatements, relocation and job training assistance, cash grants, and assistance in procuring land for new facilities.

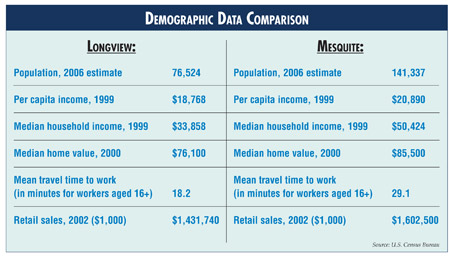

One example of a 4A corporation is the city of Longview. Located in the pine forests of northeast Texas, Longview benefits from a couple of geographic factors. It is situated on Interstate 20, which has made the town a less expensive alternative to the Dallas/Fort Worth Metroplex for distributors and other industrial users.

In fact, last year Sysco Corp. opened a 350,000-square-foot distribution center in the city, one of the reasons being that a Longview location allowed it to reach customers in Arkansas, Louisiana, Oklahoma and Texas in a single day. A few years prior, Neiman Marcus saw the same benefits and opened its 470,000-square-foot national distribution center in the city. In addition to distribution, Longview is also known for manufacturing, healthcare and the energy industry.

“We’re lucky, because we have a lot of diversity. We’re not just stuck on one thing,” says Susan Mazarakes, new business investment group director with the Longview Economic Development Corporation.

It is the energy industry that may lead to a boom time in Longview. The city is located near several large oil and natural gas deposits, most notably the Haynesville Shale. This natural gas formation is believed to total 3 million acres and stretches from northwestern Louisiana into northeast Texas. While drilling has just begun on the formation, it is already being touted as the largest natural gas field in the continental United States.

This is attracting many energy companies to the region and causing those already there to consider expansion. Flanders Electric is a company that manufacturs mining equipment and has been located in Longview since 1997. The company recently embarked on a $4 million expansion of its facility, and the Longview EDC is assisting in the project. As part of its incentive package, the city is providing a $400,000 grant to assist with the project. The Longview EDC attached conditional benchmarks to the funds, including that Flanders completes the expansion and it holds to its commitment to hire 25 new employees over the next 4 years.

In addition, energy giant Halliburton is making its move into the city by renovating a vacant 100,000-square-foot building the company already controlled. The Longview EDC again chose to offer a conditional cash grant and is providing $1.2 million for the $51 million project. Halliburton will receive $600,000 based on its commitment to complete $3 million in renovations by the end of this year, and it will reeive $100,000 per year for the next 6 years by holding to its commitment to hire 10 new employees each year during that period.

Another tool at the city’s disposal is its ability to offer space at its 483-acre business park. The park currently has four buildings already constructed, with between 150 and 200 acres left to build out. The city isn’t stopping there, though. It has already commenced development for a new business park that will total 705 acres. The infrastructure for the project will be in place by spring 2010.

“A lot of people would ask why you’re building a business park when your other business park is not full yet, and that is just us planning for the future, so that we’re ready. We’re trying to be proactive,” Mazarakes says.

The other main type of economic development entity is a 4B corporation, which was created in a 1991 amendment to the Development Corporation Act and expanded several times since. All cities in Texas are eligible to create a 4B corporation regardless of size and they still have the ability to create an economic development sales tax. A later amendment expanded the types of projects that tax revenue could fund.

“We have many of the same resources available to use. The primary difference [between 4A and 4B corporations] is a 4A corporation has a greater flexibility with the half-cent sales tax revenue stream,” says Tom Palmer, manager of economic development with the city of Mesquite, which operates a 4B corporation.

For example, a company that is looking to open a new location in a city with a 4A corporation can receive a variety of economic incentives. The city can use sales tax revenue to give the company land to build a new facility, offer cash grants and tax abatements, and can provide money for relocation costs. A 4B corporation is limited primarily to tax abatements as an incentive.

“The 4A corporations were established because the legislature at the time — and it is still valid, to a degree — thought that smaller towns in Texas could not compete against the big cities for the attraction of these companies,” Palmer says. That has been a big boost for those smaller communities and more rural areas. What’s happened, though, is as the Metroplex, Houston and San Antonio have grown, those 4A corporations are no longer so small and so rural. They are in our back yard.”

The city of Mesquite is not fretting too much over this. The city benefits from a prime location in the southeast Dallas suburbs that features access to I-20 and the Union Pacific rail line, including one of the railroad’s largest intermodal facilities. It also receives plenty of attention from companies looking at real estate opportunities in the Metroplex. One of these is Capstar Commercial Real Estate Services, which recently acquired a 680,000-square-foot building that it plans to convert into a multi-tenant data center. Built in 1970 for Western Electric, the building had been vacant for several years before Capstar came along.

“I was concerned that building would be a white elephant for a long, long time, because it is an old building, it’s an exceptionally large building, and it was a specially built building that was not going to be easily reused for just anyone coming in,” Palmer says.

Capstar had been looking at the Dallas/Fort Worth area as a potential location due to its reputation as a national data center hotspot. The company sees a sea change in how information is stored, and it wants to be at the crest of the wave.

“There is a growing need across the United States for data centers, because everything we experience in our daily lives, whether it is in business, how we communicate and send files, and even social networking, involves data. Data is growing in every part of our lives,” says John Patterson, principal with Capstar and one of the project leads for the Mesquite development.

Named 3000 Skyline Dallas, the new project will consist of four quadrants of 170,000 square feet each that can be subdivided even further to 42,500-square-foot pods if a tenant needs it. The building also contains a 100 MVA electrical substation. Though the project will not be complete until the first quarter of 2010, Capstar has already looked at future expansion. Approximately 40 of the property’s 91 acres can be used for an additional building and another 100 MVA substation. On top of attracting Capstar to Mesquite, the city also has an incentive package designed to attract tenants to the speculative project, which includes a 10-year, 50-percent tax abatement for property improvements and personal property.

“The city of Mesquite has come to the table 100 percent to help this project, through economic incentives to the planning process,” Patterson says.

While Mesquite may have fewer resources to entice companies than a city with a 4A corporation, development is still strong. For one, larger cities such as Mesquite often attract different tenants than smaller Texas towns, and 4A and 4B corporations do not often compete for business like one would think.

“We have averaged about 1 million square feet of new industrial projects per year. I would put that up against pretty much anybody in the state over the past 10 years,” Palmer says.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|