| TEXAS SNAPSHOT, NOVEMBER 2008

Austin Multifamily Market

Employment growth and healthy apartment fundamentals are helping Austin’s multifamily market weather the national capital markets crisis. By August 2008, Austin added approximately 18,000 jobs and experienced an unemployment rate of 4.5 percent, the lowest in 4 years. Other driving factors that keep Austin on investors’ radar screens include phenomenal demographics and the fact that Austin remains, on a whole, unscathed by current economic trends plaguing other parts of the country.

Fostered by an environment of education, technology and government, Austin continues to thrive as one of the most desirable cities for corporate relocation and new business expansion. National companies like Dell, Whole Foods and Samsung have chosen to call Austin home.

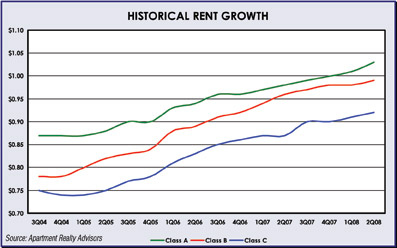

Employment and population growth are the foundation for a healthy multifamily market. Austin is experiencing the highest rents since the tech employment boom of 2001. The Austin MSA experienced 98 percent occupancy and $0.99 per square foot (psf) average rental rates. The ensuing tech bust of 2003 drove occupancy down to 88 percent and rental rates to $0.82 psf. Fast forward to the second quarter of 2008, and occupancy has reached 91.6 percent and rental rates are $0.98 psf, according to Austin Investor Interest. Rental rates rose for the 13th consecutive quarter with a $.01 psf increase across all product classes. The Austin MSA annual rent growth was an impressive 4.3 percent. With nearly half (46 percent) of the metro’s working age between 18 and 44, Austin is a prime market for apartments. Approximately 55 percent of Austin’s residences are renter-occupied and with rising interest rates and tightened standards on mortgage loans, Austin’s renter population is only expected to increase.

Austin remains a popular destination for institutional and private multifamily investors. Although the number of offers being received on multifamily dispositions has decreased, it is still common to receive five to 10 offers for an Austin asset. In 2006 and 2007, multifamily investors included tenant-in-common, high leveraged private investors, REITs, and pension fund advisors. In 2008, due to the death of the CMBS debt market, tenant-in-common and high leverage investors are no longer in the market. Additionally, most pension fund advisors are on the sidelines due to capital market turbulence. Offers today are coming from well-capitalized, low-leverage private investors, as well as public and private REITs.

Core Class A cap rates have increased from an average of 4.75 percent pre-credit crunch to 6 percent post-credit crunch. Unique locations and value-add opportunities are still garnering a lot of attention and driving cap rates down to sub-6 percent levels. Class B product has recently traded at a 6.5 percent cap rate, and Class C product is trading around a 7.5 percent cap rate. The highest conventional apartment sales prices have occurred in and around the central business district (CBD), where garden-style, Class A product is trading in the $180,000 per unit range. Suburban, Class A, garden-style product is trading in the $95,000 to $115,000 per unit range. Class B product has traded in the $55,000 to $65,000 range, while Class C apartments have averaged $35,000 to $45,000 per unit.

The most popular investment trend in Austin today is in the value-add category. Investors are targeting 1980s- and ‘90s-vintage properties and conducting kitchen and bath upgrade programs. The investments range from $3,000 to $10,000 per unit and may include new appliances, resurfaced countertops, a lighting and hardware package, 2-inch wood blinds, faux wood floors or upgraded carpet, and the addition of washers and dryers to units. In some cases, investors are upgrading the clubhouse and amenities at an additional cost. The post-rehab average monthly increase being received in Austin today is $75. Despite the capital market uncertainty, a recently listed mid-‘80s vintage value-add property received more than 10 offers.

There are roughly 14,000 conventional apartments in the construction pipeline. These are expected to deliver over a 24-month period. Due to Austin’s rapid growth and congested traffic, it is not possible to make blanket assumptions about how supply will affect the entire MSA. It is important to dissect the city by submarket to note the effect supply will have on a particular area. The top three submarkets for supply are Round Rock, South Austin and the Far North. The three submarkets with the least supply are Cedar Park / Leander, Far Northwest and the North. Financing for new multifamily construction is scarce, and, as a result, multifamily construction permits have fallen from 6,700 units in 2007 to less then 3,000 units in 2008. It is likely that any project not already under construction will get its financing pulled and/or not receive financing for the foreseeable future.

Austin’s downtown landscape is undergoing a dramatic transformation. High-rise buildings are scraping over 50 stories high with ground-floor retail and rooftop pools. Mayor Will Wynn has pushed to ease zoning restrictions in the CBD, in an effort to have 25,000 people living downtown by 2015 (currently 5,800 people reside in the CBD). Downtown has over 800 condominium units delivering in 2008 and roughly 765 more units planned in 2009/2010. Due to the current capital market turmoil, condominium construction debt and equity has come to a halt. Future projects that have been announced but have not broken ground appear to be on hold for the foreseeable future.

Existing condominium sales have been brisk. The 360 Tower is sold out, The Shore is 98 percent sold, Bridges on the Park and Sabine on 5th are exceeding 60 percent sold. Projects under construction and just initiating presales are the Four Seasons Residences, the W Hotel & Residences, and the Austonian. These high-end projects are marrying luxury living with the Sixth Street music scene and the outdoor environment of Town Lake and Zilker Park. The Austonian, located on Second and Congress, is a $200 million, 55-story building that will contain first-floor retail with residential units above, ranging in price from $500,000 to $3.8 million.

High-rise apartment living, something new to Austin, is garnering the highest rents in the city. The new wave of tower construction is bringing AMLI on 2nd, Altavida, Gables Park Plaza, Legacy Town Lake and The Monarch to downtown Austin. These projects total 1,275 units. AMLI and Monarch are currently leasing at rates that range from $2.25 psf to $2.75 psf. Altavida and Legacy Town Lake do not deliver until 2009, followed by Gables Park Plaza in 2010.

Mid-Rise development in downtown accounts for roughly 733 units in the pipeline. Red River Flats, 300 South Lamar and Crescent are currently in lease up. 2009 deliveries include 5th Street Commons and Gables at Pressler. Mid-rise rental rates range from $1.70 psf to $2.10 psf. Young professionals, empty nesters, University of Texas alums, and movie stars are driving the downtown rental rates to new highs.

— Patton Jones is Managing Director of the Austin office of Apartment Realty Advisors.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|