| COVER STORY, NOVEMBER 2007

OFFICE UPDATE

Experts weigh in on the office markets in Dallas/Fort Worth, Austin, Houston and San Antonio.

Lindsey Walker

With healthy job growth and a strong economy, Texas’ real estate fundamentals have improved across the board in 2007. The office sector, in particular, has benefited from these factors, producing robust leasing numbers in the major Texas markets, according to Jason Mattox, executive vice president with Behringer Harvard. “Companies have expanded their workforces and have leased space at a fairly rapid pace to meet that demand,” Mattox says. “Absorption has been positive for these markets.”

These markets — Dallas/Fort Worth, Houston, Austin and San Antonio — are seeing the continued tightening of lease space, as occupancies generally are still increasing and rental rates are still rising, Mattox says.

Walter Foster, senior vice president with KBS Realty Advisors, agrees. “For the last 18 months, we have seen rising rents in all markets,” Foster says. “In some submarkets, rents are up 50 percent in 18 months. In Austin, office rents have increased from $12 to $18 per square foot, and in Dallas’ Uptown area, rental rates are up by $3 or $4 per square foot.”

While office sales aren’t quite as strong as leasing, these major cities have enjoyed an active year in the office market and, looking toward 2008, things will only get better.

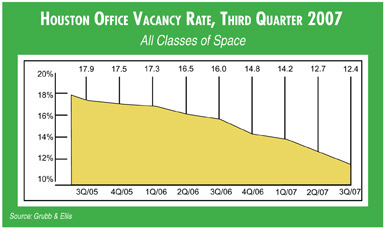

HOUSTON

The Houston office market remains very strong, seeing positive absorption in every submarket, according to Chip Colvill, president of Colvill Office Properties. “The major core submarkets of the CBD, Galleria, Westchase and Energy Corridor are very tight on space,” Colvill says. “Pent-up demand remains and, as a result, many new office developments are on the drawing boards.”

In addition, there are continued increases in rental rates in Class A and B office buildings citywide, says Griff Bandy, senior associate at NAI Houston. According to Colvill, development costs have increased, pushing the rents in many new building to more than $22 per square foot net in the suburbs and $28 to $32 net in the CBD. “As a result, landlords of existing buildings are continuing to push rents up to get closer to rents in these new developments,” Colvill says.

Landlords have the upper hand over tenants when it comes to negotiating leases in Houston’s office market, especially in Class A and B buildings with 85 percent and above occupancy, Bandy says.

The energy businesses and their ancillaries are driving office activity in Houston. “Unlike past up-cycles in the energy markets, this positive cycle seemingly has no end in sight as world oil demand continues to be strong,” Colvill says. “The price of oil being at record highs is benefiting the Houston economy significantly; as a result, energy tenants will continue to take on additional space.”

The energy companies, as well as major energy-related companies, continue to lease large blocks of space on the west side, according to Colvill. “These tenants are looking for buildings with excellent amenities and well-located buildings to assist in attracting employees,” he says.

They also are looking for efficient floor plans, Bandy adds. “Parking availability and cost is another big factor to consider today as well as most, if not all, Class A office buildings are charging for both reserved and non-reserved parking spaces,” Bandy says.

Bandy also notes Houston’s strong economic benefits of the robust energy market. “The local economy is doing very well,” he says. “As an example, residential home sales locally continue to be strong in the closer-in sections of town. Redevelopment efforts with numberous mixed-use developments are underway across town in older, more established areas, and in suburban areas, master-planned, mixed-use development continues to be hot.”

Houston’s strong, energy-fueled economy makes it a safe haven for investment groups seeking office product. “This is unlike the East and West Coasts at the moment, which seem to be in flux based upon turmoil in the lending markets,” Colvill says. “Many California and New York investment groups are in the market looking for acquisitions. All asset types are being sought out with record sales prices continuing to be reached.”

What’s more, these record prices in Houston are simply good buys when compared to pricing in the rest of the nation — particularly the coasts, Colvill adds. “This phenomenon continues to attract buyers,” he says.

This investment activity is happening at a more rapid rate than 3 to 5 years ago, according to Bandy, who notes that smaller, neighborhood buildings also are trading more often today than in the past. “Locally owned buildings are attracting more institutional and 1031 exchange buyers due to lower cap rates for highly leased, multi-tenanted office buildings,” he says.

Unlike in the past, all of Houston’s major submarkets are doing well right now. “Both [urban and suburban office space] seem to be equal,” Bandy says.

Looking to 2008, Houston’s office market should continue its strong activity. “The Houston economy is more diversified than it was during the last energy boom,” Bandy says. “This is more of a controlled boom period.”

— Lindsey Walker

DALLAS/FORT WORTH

According to Bernard Deaton, executive vice president and managing partner with Bradford Companies/CORFAC International, the Dallas Metroplex has seen a continued positive trend in absorption through the second quarter and all indications are that it will continue through the third quarter and beyond.

Currently, tenants are seeking quality product and are willing to pay a premium for efficiency and amenities — many tenants are even looking at their office location as a way to assist them in employee retention and recruiting, says Kathy Permenter, senior vice president with CB Richard Ellis. “Going green also is becoming a major consideration, much more than 12 months ago,” she says.

For example, LEED-certified buildings are garnering more interest than in the past, with several notable projects leading the way. Intellicenter-Dallas (see Intellicenter-Dallas and One Victory Park Raise the Bar for Green Office Design in Texas), which is a development of Koll Development Company, and McKinney Green Building, developed by HDR, are two facilities that have been delivered with much success in the Dallas/Fort Worth market during the past year. Another green project, One Victory Park (also see sidebar), is generating buzz and is expected to bring a new level of office product to the Uptown/Downtown areas of Dallas when it is completed by Hillwood.

Driving this office activity in Dallas/Fort Worth is a solid job market, which attracts new companies to the area as well as supports local business growth. According to Permenter, Dallas/Fort Worth has a lower unemployment rate than Texas and the rest of the nation. “The U.S. Bureau of Labor Statistics recently announced North Texas has added 91,000 jobs in the 12-month period ending in July,” Permenter says.

Another driving factor in the strong office activity is that the Metroplex boasts a housing market that has not seen the same value loss as other cities. “The financial activities sector, which has struggled with the housing turndown in other major metro areas, is expected to expand by more than 5 percent by year-end,” says Tim Speck, first vice president/regional manager of the Dallas office of Marcus & Millichap Real Estate Investment Services.

According to Deaton, the core businesses for the Dallas area are in finance, communications and technology, which are the firms that Dallas/Fort Worth has seen expand into more space. Following those businesses are the companies that support those firms, such as CPAs, lawyers and the credit industry. Within Dallas/Fort Worth, the core companies and their derivatives are seeking office product in good locations, with access to an employee base and flexible type. “What has changed is the vacancy in Class A is limited, so companies are having to change their space requirements to Class B and/or Class A- space. Rate and availability are driving those changes,” he says.

While Class A vacancy is limited, vacancy is Dallas’ central business district (CBD) is open; however, there are positive trends in the downtown market. “Most of the financial companies are staying in the CBD, and word on the street is that some of the law firms are looking at putting satellite offices in outer areas while keeping their headquarters in the Dallas CBD,” Deaton says. “A major insurance company that is currently located in the suburbs has chosen to relocate downtown.”

Dallas/Fort Worth’s suburban submarkets continue to perform well, as most of the technology and service firms still prefer these areas due to factors such as location, workforce and rental rates, according to Deaton.

The Frisco/North Plano submarket is an example of a suburban area that is seeing substantial activity and is therefore driving other markets. “Recently, a 100,000-square-foot deal was announced, and competing for that same space were two other companies looking for 50,000 square feet each,” Deaton says. “Both of those deals were picked up in competing buildings. As soon as the original 100,000-square-foot deal was signed, the competing buildings increased their rates by $4. Due to this, Frisco/North Plano changed overnight.”

Similar deals are starting to happen in other markets, and concessions are slowly being tweaked downward, Deaton says. “All of the economic indicators are positive and our leasing office market is improving quarter by quarter,” he says. “2008 should be a banner year for Dallas office.”

On the investment side, activity within Dallas/Fort Worth remains strong even though there is more diligent underwriting taking place, Permenter says. “Trades are definitely continuing, but they are shifting more from the entrepreneurial investor to mainly institutional,” Permenter says. “Investors are looking for prime locations and prime properties that are weathering the storm. Buyers are not paying for vacancy as they had been 6 to 12 months ago.”

In Dallas — where construction is up to $290 per square foot — existing office buildings are attractive to investors as they can be acquired for much cheaper at $175 to $200 per square foot, according to Foster. “Current high construction costs are raising the allowable ceiling for acquisition costs by investors,” he says.

Out-of-state investors and pension funds have been very active in the market, supporting a 5.7 percent increase in the Metroplex’s transaction velocity, Speck says, who predicts that investors from around the country will continue to target assets here. Local buyers, which haven’t played as large of role in recent years, according to Speck, are starting to accelerate their activity, focusing on well-located Class B assets for value-add plays. “As conditions tighten, demand for these properties will increase, as local employers are looking to maintain costs and stay in centralized locations.”

— Lindsey Walker

Intellicenter-Dallas and One Victory Park Raise the Bar for Green Office Design in Texas

Two important office projects — one that opened this year and another set to open in late 2008 — are setting a high standard for green design in Texas.

Completed last March, Intellicenter-Dallas is a two-story, 200,000-square-foot facility located at the intersection of Interstate 635 and Belt Line Road in the Regent Center Business Park in Irving. The building is part of a national, branded, high-performance speculative building program that Koll Development Company (KDC) launched in 2005.

“Intellicenter buildings are LEED-certified in accordance with the U.S. Green Building Council’s rating system for green building and sustainable design,” says Jake Ragusa, senior vice president and partner with KDC. “KDC has already seen much success since the first Intellicenter was introduced in 2005; currently, Intellicenters are complete in Atlanta, Dallas and Houston with three more under development in California, Florida and North Carolina.”

Intellicenter-Dallas features green components such as raised access flooring to provide easy access to route electrical, phone and data cabling; large, efficient floor plates that allow for under-floor distribution; and 25 percent to 50 percent more parking than conventional office buildings, according to Ragusa.

These elements aren’t just friendly to the environment, they also comprise the amenities that today’s corporate workforce demands. “Before developing Intellicenter, we surveyed many of our clients and brokerage partners to assess the needs of Corporate America,” Ragusa says. “The response was a desire for environmentally friendly workspaces with more sustainable design.”

One Victory Park, an office building underway at 3090 Olive Street in downtown Dallas, is meeting the new standards of Corporate America as well.

“Companies have recently realized that [green construction] is a differentiating factor that can be a part of their corporate values and can help attract and retain top employee talent,” says Bill Brokaw, vice president of Hillwood, the developer of One Victory Park. “Besides being constructed using environmentally friendly practices, One Victory Park offers modern technology that results in reduced energy consumption, improved air quality and more efficient use of space by companies.”

One Victory Park, which will house tenants such as Haynes & Boone, Ernst & Young and Plains Capital Bank when it opens roughly a year from now, will have 455,000 square feet of Class A office space as well as 10,000 square feet of first-floor retail. The building’s tenants will have access to a number of amenities, from the DART Rail at Victory Station to a number of restaurants, hotels and entertainment venues.

“These companies and future tenants want to be a part of a neighborhood that’s designed to be a modernized, urban environment for which Dallas has longed and now has become a reality,” Brokaw says. “They are pleased to take part in the efficient, green development within Victory Park.”

— Lindsey Walker

AUSTIN

Pent-up demand for Austin’s office space will support stable occupancy levels and impressive rent growth, despite an influx of speculative construction coming on line in the near term. Although the economy is cooling nationwide, job growth in the metro will remain well above the national rate, which, when combined with the first significant increase in stock since the beginning of the year, is prompting many employers to expand into new space. In addition, several other employers have signed leases to occupy much of the new space scheduled to come on line in the coming months. Rising operating costs in some coastal metros and the highly educated and rapidly growing local work force make Austin a reasonable alternative for companies seeking bottom-line relief in a slowing economy. As such, conditions are forecast to remain tight this year, and metrowide rents will advance nearly 9 percent above the rates posted at the end of 2006.

Employers are on pace to add 23,500 positions in the Austin metro this year, a 3.2 percent increase. Office-using employment will grow at a more modest rate, expanding 1.7 percent with the addition of 2,800 jobs. Next year, job growth will slow modestly.

Over the past 12 months, builders have delivered 1.4 million square feet of office space in the Austin metro, representing a 3.9 percent increase in office stock. Currently 3.2 million square feet of new office space is under construction, a 37 percent jump from the same period 1 year ago. Another 3.2 million square feet is in the various planning stages, 51 percent more than during the third quarter of last year. The Southwest submarket, home to many of Austin’s corporate campuses, is receiving much of the new construction this year. Currently, 1.5 million square feet of space in under way in the area, though the planning pipeline has dwindled to 230,000 square feet. Developers are expected to deliver 1.9 million square feet of new office space in 2007, increasing local office inventory 5.4 percent. In 2008, builders are forecast to surpass this year’s construction.

The metrowide vacancy rate is on track to finish the year at 13.2 percent, down 150 basis points from the end of 2006. Next year, speculative space will put upward pressure on vacancy.

Early estimates indicate that asking rents reached $23.72 per square foot in the third quarter, a 9.3 percent increase from 1 year ago. During the same period, effective rents climbed 11 percent to $20.78 per square foot as owners trimmed concessions. Due to premiums paid for new space, third quarter Class A asking rents increased 9.6 percent year-over-year to $27.22 per square foot, while rents in the lower tiers improved 7 percent to $18.88 per square foot. In the wake of significant rent gains and higher occupancy levels, owners have enjoyed a 12.2 percent increase in revenue over the past 12 months.

During the previous period, revenue growth was recorded at 18 percent. The metro’s tight conditions will enable owners to raise asking rents 8.8 percent this year to $24 per square foot. Concessions will continue to decline, as effective rents are forecast to reach $21.15 per square foot, up 11.2 percent from the end of 2006.

Supported by an influx of out-of-state buyers and institutions targeting the metro’s newer assets, transaction velocity has climbed 12 percent over the last year. Year-over-year, the median sales price has increased 41 percent to $183 per square foot as investors have focused on prime infill assets. As the number of these listings becomes limited, buyer focus will shift to suburban assets. Average cap rates have declined 30 basis points into the mid-6 percent range in the past 12 months, though lending issues are expected to put upward pressure on cap rates in the coming months. Austin’s bright economic outlook will attract investors to the metro in the coming months, especially in the wake of a slowing national economy. Further improvement in fundamentals is expected to support price appreciation into 2008.

— Bradley Bailey is the regional manager of the Austin office of Marcus & Millichap Real Estate Investment Services.

SAN ANTONIO

San Antonio office market fundamentals will remain strong throughout the second half of the year. An influx of speculative office space will be offset by strong demand, keeping vacancy hovering in the high-14 percent range and enabling impressive rent growth. Much of the new Class A space is coming on line in the popular Northwest submarket, home to many of the metro’s major employers. Vacancy in the submarket is expected to inch higher until the current building boom is complete in the middle of next year. In the Class B/C sector, demand for space will remain strong due to San Antonio’s business-friendly climate. Much higher rents in other metros around the country and the city’s centralized location are attracting businesses looking to relocate their back-office positions. As such, employment growth in the metro will double the national average this year. Additionally, development of the long-overlooked southern half of the metro is expected to further support demand in the area.

On the investment side, the metro’s healthy economic and demographic outlook is attracting both Texas-based and out-of-state investors. Average yields in the mid- to low-7 percent range are providing ample debt-service coverage for highly leveraged private buyers, while the area’s relatively low prices are conducive to securing a lower loan-to-value ratio.

Employers in San Antonio are on pace to add 19,700 positions this year, increasing total employment 2.4 percent, well above the national forecast of 1.3 percent. Office-using employment is expected to advance 3.1 percent with the creation of 5,900 jobs. Next year, payrolls are projected to expand at a slightly faster rate.

Over the past 12 months, developers have delivered 680,000 square feet of new office space, expanding stock 2.6 percent. Only 60 percent of the year’s projected deliveries have come on line thus far. Approximately 1.5 million square feet of office space is under construction in the metro, relatively unchanged from the same time in 2006. The planning pipeline, however, has declined 45 percent over the last year to 850,000 square feet. The Northwest submarket, the metro’s largest, is receiving the most attention from developers this year. Year-to-date, 600,000 square feet of new office space has been constructed, increasing area stock 7.8 percent. After completing only 37,000 square feet of space last year, developers are on track to add 1.1 million square feet of new office space to the market in 2007, expanding inventory 4.4 percent. In 2008, the pace of new construction is expected to slow to less than 500,000 square feet.

Vacancy in San Antonio finished the third quarter at an estimated 14.5 percent, a 90 basis point decline from one year ago. Over the past 6 months, the delivery of new space slowed improvement in vacancy to 20 basis points. Robust demand for the limited amount of top-tier space has pushed Class A vacancy down 70 basis points year-over-year to 11.3 percent. The introduction of new stock, however, has limited improvement in the sector to 20 basis points over the past 6 months. In the lower tiers, leasing activity from employers with back-office positions has declined vacancy by 90 basis points to 16.5 percent over the past year. The metrowide vacancy rate is expected to finish the year at 14.7 percent, a 10 basis point improvement from year-end 2006. Vacancy will likely continue to inch lower in 2008.

Year over year, asking rents finished the third quarter at an estimated $18.50 per square foot, a 4.5 percent gain due to tighter conditions. During the same period, owners were able to withdraw concessions and raise effective rents 5.4 percent to $15.71 per square foot. In the Class A sector, asking rents have climbed 3.2 percent year-over-year to $21.32 per square foot. Asking rents in the lower-tiers have advanced 4.5 percent to $16.73 per square foot in the wake of higher occupancy levels generated by the spillover demand from the top tier. Impressive rent and occupancy gains have led to a 6.5 percent increase in revenue over the last year. During the previous 12-month period, owners enjoyed revenue growth of 8.2 percent. Tighter conditions will generate above-average rent growth and fewer concessions for local office owners. Asking rents are forecast to reach $18.66 per square foot by year end, while effective rents will climb to $15.87 per square foot, respective gains of 4.3 percent and 4.8 percent.

For properties valued over $5 million, transaction velocity in the San Antonio metro has soared an impressive 56 percent over the past 12 months, as local and out-of-state buyers have increased their stakes. Despite the increase in transaction velocity, the median price, at $118 per square foot, is relatively unchanged over the past year. Average cap rates have compressed 20 basis points into the low- to mid-7 percent range over the last year. Much of the decline can be attributed to buyers seeking assets in higher tiers, where vacancy is lower. Investment activity will remain elevated this year as institutions and REITs focus on assets in growing markets. As such, some downward pressure on cap rates in Class A properties is expected to offset the increase in spreads.

Private investors can find some value-add deals in prime locations near major transportation arteries due to the tight Class A conditions in the metro, especially in the northern submarkets, though the threat of overbuilding will loom in the area until 2009. The few Class A listings west of the city center, where several corporate campuses are located, will be targeted by institutions and REITs with longer holding periods. Finally, a market for sale-leasebacks is beginning to emerge in San Antonio after several employers have decided to construct their own buildings in recent years.

— Bradley Bailey is the regional manager of the San Antonio office of Marcus & Millichap Real Estate Investment Services.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|