| FEATURE ARTICLE, NOVEMBER 2006

OFFICE MARKET UPDATE

The office market in Texas is robust with development and leasing activity taking place on all fronts. In this month’s issue of Texas Real Estate Business, we spoke with professionals in San Antonio, Dallas, Austin, El Paso and Houston to get the latest market trends in each city’s office sector.

San Antonio

|

Kim Gatley,

REOC Partners

|

|

Topping investment news in the third quarter in San Antonio, locally based Brass Real Estate, backed by CapMark Services, purchased the 26-building Centerview Crossing complex (1.1 million square feet, formerly known as Koger Center). The transaction is just the latest in a growing list of significant office property sales that demonstrate the increased level of investor interest in the San Antonio office market.

In August, San Francisco-based Maier Siebel Baber closed on two buildings — The Pyramid Building (206,392 square feet) and Oak Park (160,000 square feet) — adding to its portfolio of North Central Class A properties, which also includes Pacific Plaza (100,455 square feet) purchased earlier this year and Nowlin Tower (235,978 square feet) purchased in 2003. Third quarter activity also included the purchase of 8401 Datapoint (153,272 square feet) by Charlotte, North Carolina-based Allegiance Realty Corporation as well as the acquisition of the Titan Building (102,079 square feet) by California-based Chase Merritt.

“Investment activity has increased significantly over the course of the last 12 months with institutional investors leading the activity and local investors largely left on the sidelines as sales prices continue to rise,” says Brian Harris, CCIM, senior vice president/partner with REOC Partners. Improving market conditions supported by an expanding economy and projected job growth have attracted office property investors to the San Antonio market.

According to the survey of more than 23.5 million square feet of multi-tenant office space conducted by REOC Partners, the office market experienced more than 300,000 square feet of positive net absorption in the third quarter. Class B properties led the market with 258,434 square feet of net gain in occupied space and Class A properties tallied less than 52,000 square feet while Class C properties registered negative absorption of nearly 8,200 square feet.

Overall, third quarter activity raised the year-to-date absorption total to 692,882 square feet of positive net gain throughout the market. As a result, the citywide direct vacancy rate improved to 14 percent, down from 16.3 percent recorded last year at this time. Pent-up demand tightened both direct vacancy as well as the amount of sublease space available in the market. At this time last year, the overall citywide vacancy rate including sublease space stood at 17.3 percent but has since dramatically improved to 14.9 percent currently.

The downtown market experienced nearly 39,000 square feet of positive net absorption in the third quarter, although the sector continues to lag with higher vacancy rates — currently 19.4 percent. The central business district (CBD), softened initially in 2003 by the space consolidations of AT&T, lost another tenant to the suburbs this quarter when Tinsman & Sciano vacated 15,200 square feet at One Riverwalk Place to occupy the former Brake Check headquarters building on US Highway 281, which they recently purchased. The CBD Class A vacancy now stands at 17.1 percent, up from 16.8 percent recorded a year ago, but improved compared to 18.7 percent recorded last quarter, mainly as the result of gains reported at Weston Centre and Bank of America Plaza. Activity in those two largest downtown buildings generated more than 31,000 square feet of positive net absorption this quarter. Still, double-digit vacancy continues to plague the downtown market.

The suburban market again outperformed the CBD and generated more than 263,000 square feet of positive net absorption in the third quarter. Class B properties in the Northwest submarket led the way with the lease of 4300 Centerview, the 93,299-square-foot building previously left vacant by Providian. Tenant expansions continue to be a significant contributor to positive absorption, including the 12,000-square-foot expansion by AACOG at Petroleum Towers and the 15,400-square-foot expansion by Pape Dawson Consulting Engineers at McAllister Plaza.

Activity in new projects also contributed to absorption gains this quarter, including Miner Corporation, which leased 16,200 square feet at North Park Corporate Center Phase II. Two office/retail projects reached completion this quarter, adding upper-level office space to the market. Ventura Plaza, a three-building complex located along Loop 1604 in the Far North submarket, added 36,623 square feet while Warren’s Corner, located on Broadway just outside of Loop 410, added 20,700 square feet. Both buildings came on line with a portion of the space pre-leased. Ventura Plaza will be occupied by Land America Title (7,174 square feet) along with Broom Realty, Countywide Home Loans and Liberty Mutual. Warren’s Corner leased 4,955 square feet to Charles Schwab.

Year-to-date, the suburban market experienced a total of 717,181 square feet of positive net absorption, which improved the vacancy rate to 12.5 percent, down from 15.5 percent last year at this time. The vacancy rate among suburban Class A properties dropped to 7.6 percent compared to 11.5 percent a year ago while the suburban Class B vacancy rate improved to 12.6 percent, down from 16 percent. Meanwhile, the vacancy rate among older suburban Class C office buildings remained at a much softer 20.2 percent.

An over-the-year comparison reveals that the vacancy rates declined in all suburban submarkets except the South. A return of space previously held off the market at Security Tower boosted vacancy in the South to 9.5 percent, up from 5 percent a year ago. The Northwest submarket outperformed the rest in terms of absorption this quarter and showed the greatest improvement over the year with a current vacancy rate of 13.8 percent, down from 17.7 percent. The North Central submarket now stands at 12.2 percent compared to 14.7 percent a year ago and the Northeast vacancy rate improved to 9.3 percent compared to 11.9 percent.

In response to declining vacancy, the citywide average quoted rental rate climbed to $18.48 per square foot annually on a full-service basis. The over-the-year increase of $0.57 represents a healthy annual growth rate of 3.2 percent. Despite the advancing trend, the cost of San Antonio office space still compares favorably to most other major metropolitans. For the past several years, lower rents and concessions available in the marketplace have created opportunities for tenants to upgrade their location or effectively reduce their overall operating costs — or both. But, those opportunities become limited as market conditions begin to favor the landlord. Tenants currently faced with renewal or relocation decisions are more likely to experience sticker shock as quoted rates have increased for all building classes. The average quoted rental rate for Class A space rose to $21.40 — up $0.74 or 3.6 percent compared to a year ago. Asking rents for Class B space climbed $0.58 or 3.4 percent to $17.64 and the average cost of Class C space now stands at $15.58 — up $0.45 compared to last year at this time. The North Central submarket enjoys the highest average asking rental rate at $19.13, which is up $0.63 or 3.4 percent compared to a year ago. The Northwest submarket, however, showed the greatest over-the-year gain this quarter climbing $0.84 to $17.88 — an increase of 4.9 percent. The Northeast submarket experienced less than 1 percent growth with a current average of $18.42 while the South submarket reflected a gain of 3.6 percent or $0.55 to an average of $15.67 per square foot.

“Improvement in market fundamentals is the catalyst for increased speculative development,” says Todd Gold, CCIM, president of REOC Partners. New projects provide greater opportunities to attract incoming businesses and accommodate expanding tenants. In addition to the variety of medical office and smaller buildings being added to the market, nearly half a million square feet of speculative office space is currently under construction. The major projects underway include Union Square II (131,000 square feet), La Arcata Office Building (97,490 square feet), Heritage Oaks at Inwood (84,000 square feet) and the upper level of two buildings at the Legacy (52,505 square feet) — all of which have reported pre-leasing activity. Less than 100,000 square feet is expected to reach completion by the end of this year with the rest spilling over into 2007. Looking ahead, another half million square feet of projects is ready to get underway including 4500 Lockhill-Selma (99,098 square feet), Concord Park Two (120,000 square feet) and Heritage Oaks II (84,000 square feet).

New development is being delivered in response to the increased demand for space fueled by San Antonio’s expanding economy and steady job growth. Expect vacancy to tighten and rents to climb through the end of the year, but watch for vacancy to fluctuate as several new projects are delivered in 2007. Overall, the forecast for the San Antonio office market is very bright, which is why investors are positioning themselves in the market.

— Kim Gatley is director of research for REOC Partners in San Antonio.

Dallas

|

Zaya Younan,

Younan Properties

|

|

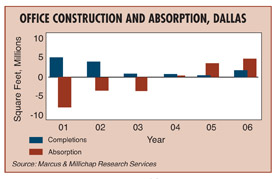

In the past 12 months, there has been a significant change in leasing fundamentals in Dallas’ office market, with consistent positive absorption and increasing demand for office space in all submarkets. With no major new construction in sight, a continuing drop in vacancy rates and increased rental rates, the recovery is expected to continue for the next 1 to 2 years. Current net absorption now far exceeds the square footage of new inventory coming into the market.

Investment activity has increased substantially, and, in the last 12 months, the total transaction volume beat the previous year by 40 percent. In anticipation of continued recovery, there is a lot of institutional investment and fresh capital from global investors moving into the market. Class A high-rise office buildings have garnered the most attention, with improvement spilling over into Class B, and expected to extend into Class C assets in the next 6 to 8 months. All indications are that the market is continuing to recover, with investment activity by both private and institutional investors. Keep in mind that actual rent in place today is less than what it was 15 years ago, so there is a long way to go for improvement in rental rates.

Last year, 85,000 new jobs were created in Dallas, reflecting the general health of the economy and driving a strong recovery, especially in Class A assets. Corporate Am-erica continues to migrate into Dallas because of its affordable cost of living and central location in the U.S. There are now 18 Fortune 500 headquarters in Dallas, contributing to its reputation as one of America’s top cities for business. In addition, high population growth and the migration of Corporate America into the region will sustain the growth for years to come.

In Class A office buildings in Dallas, average occupancy has improved from 82 percent to 86 percent during the past 12 months. Vacancy has stabilized at 14 percent in all submarkets. In Class B assets, average occupancy has improved from 78 percent to 82 percent. Class C has seen an improvement from 72 percent to 74 percent during the last year. The fundamentals have been strongest in suburban markets, and the gap is closing between suburban and urban markets due to a large economic gap in rental rates.

Due to the ongoing recovery, the office market has changed and is in transition. Six months ago, tenants had the upper hand. Now, situations differ from market to market. Six months from now, landlords should be more in charge of lease negotiations than tenants, when vacancy in the market approaches 10 percent.

There is a significant migration of the banking and manufacturing industries into Dallas. The gas and oil industries also continue to grow in the city because of an infrastructure in place to service market needs. In addition, a highly educated workforce and favorable labor costs have created a significant migration of all industries into Dallas.

These industries that are migrating into Dallas are looking for all products in key submarkets. As the market is recovering, there’s been a focus on Class A assets, which are nearing 90 percent occupancy. As those assets have filled up, an increasing focus on Class B office buildings is taking place, and that will spill over into Class C properties in the next 12 months. The current trend shows that Class A assets are still in high demand, but we predict that will change as vacancy drops and rates go up.

In Dallas, the interest has always been highest in suburban office space, where average rental rates are $4 per square foot higher than urban rental rates. As the gap continues to increase between urban and suburban rental rates, the market will see a migration back to urban office space in Dallas.

A number of significant office leases have been signed in the last 12 months in Dallas. At Lakeside Square, oil and natural gas company EXCO Resources expanded into 47,860 square feet to occupy the entire 16th and 17th floors of this Class A building in north suburban Dallas. Other recent Lakeside Square transactions include a new lease with high-profile law firm Loewinsohn Flegle LLP for 14,956 square feet and a renewal and expansion by prominent engineering firm CH2M HILL for 32,074 square feet.

At 9400 NCX Plaza, corporate wellness company WinningHabits almost tripled its space, expanding from 9,136 square feet to new offices occupying the entire 25,136-square-foot seventh floor of this 16-story tower on Dallas’ North Central Expressway. Also at 9400 NCX Plaza, CPA firm Smith, Jackson, Boyer & Bovard PLLC relocated from 9,070-square-foot offices to expanded space totaling 11,993 square feet.

At Four Forest, two prominent national firms renewed leases — Paramount Pictures for 7,843 square feet and Time, Inc. for 6,722 square feet.

At 8080 North Central Expressway, shopping center developer Regency Centers will become a new tenant occupying 17,811 square feet. Compass Bank is expanding into 16,127-square-foot offices.

At North Central Plaza, an architectural landmark at Dallas second busiest intersection (at the corner of the LBJ Freeway and North Central Expressway), AIG Auto Insurance is expanding to occupy 16,303 square feet.

At Graystone Center, Meridian Business Centers renewed its commitment for 20,676 square feet. Also, at KPMG Centre, a 900,000-square-foot skyscraper in downtown Dallas’ high-rent Arts District, respected law firm Middleberg Riddle & Gianna renewed its lease for 50,622 square feet.

Overall, the recovery in Dallas has been strong in Class A office properties, where the average vacancy has dropped into the low teens. There’s been a significant spike in rental rates in this sector, sustaining the beginning of a recovery for Dallas and all of Texas. Leasing is predicted to remain strong in 2007, which will be the beginning of a long recovery road in Dallas’ office market.

— Zaya Younan is chairman and CEO of Younan Properties.

Austin

In the Austin, Texas, office market, landlords are becoming proud, according to Diana Holford, president of Staubach’s Central Texas region. “As companies expand, occupancy increases and rents continue to rise,” Holford says. “The market has tightened with an 85 percent occupancy rate — with the Northwest and Southwest submarkets being the tightest.”

Businesses in Austin are becoming more confident in their future, and, consequently, they are hiring. “It is job growth that is driving the current market activity,” Holford says.

For example, 13 buildings sold in the first two quarters of 2006. Then, in the third quarter, Frost Bank Tower sold for $188 million — or $354 per square foot — setting an Austin office record, Holford says.

The overall vacancy rate for Austin’s office market currently rests at 15 percent. When broken out by class, Class A and B vacancy rates for the central business district (CBD) and suburban submarkets are 20 percent and 14 percent, respectively, according to Holford. “Separately, the overall Class A vacancy rate is 14 percent, Class B is 16 percent, and Class C is 7 percent,” she says.

Who has the upperhand in lease negotiations for Austin office space depends on the space. “It is a case of supply and demand,” Holford says. “There is a dearth of very large spaces as well as 5,000-square-foot spaces. In these areas, the landlord has the advantage. There are many spaces in the 10,000-square-foot to 20,000-square-foot area, including a number of sublease opportunities. Consequently, in this field, the tenant has an advantage.” Who has the upperhand in lease negotiations for Austin office space depends on the space. “It is a case of supply and demand,” Holford says. “There is a dearth of very large spaces as well as 5,000-square-foot spaces. In these areas, the landlord has the advantage. There are many spaces in the 10,000-square-foot to 20,000-square-foot area, including a number of sublease opportunities. Consequently, in this field, the tenant has an advantage.”

Emerging growth companies seem to be the companies most aggressively seeking office space in the Austin area, mostly in the Northwest and Southwest submarkets. “Once again healthcare, semiconductor and high-tech companies are also seeking space,” Holford says.

Another product in high demand is bulk warehouse. “If a company needs 100,000 square feet of bulk space — good luck,” Holford says. “The good news is this product type is easily constructed, so new product should assuage this situation soon.”

As indicated by how many companies are seeking out space in these areas, the Northwest and Southwest submarkets are the most desired locations in Austin. At the same time, downtown activity also has increased and recorded three straight quarters of positive absorption, Holford says. Contributing to this was Silicon Labs, which recently purchased and occupied the former CSC building downtown, relocating from the Southwest market sector.

Overall, the future looks strong for the Austin market. “In effect, the Austin office market has recovered drastically from the tech bust in 2000,” Holford says. “Rental rates are increasing, and new construction is in progress across the city. This trend should carry well over into 2007. Many developers have predicted the same outcome, as nearly 1 million square feet of office space is expected to deliver in 2007.”

— Diana Holford is president of Staubach’s Central Texas region.

El Paso

After several years of a stable market with very limited growth, the office market now is steadily improving in El Paso, Texas. Across all submarkets there is increased activity in leasing, absorption of space and development of many new office buildings. Although there has been very little speculative office development during the last decade, the city is seeing many new smaller projects that range from 5,000 to 30,000 square feet, many of which are medical related. There are no plans, currently made public, for any major speculative office park or building development in the area.

Many local businesses have elected to acquire existing buildings becoming owner/users or construct new facilities as investments with their businesses are the primary tenants. Across the board, all types of office properties are seeing renewed investment activity from local and a few institutional investors from outside our market area.

The economic drivers that are increasing activity throughout the El Paso community include a strong economy, both in El Paso and the border city of Juarez, Mexico. The recent announcements of the relocation of 25,000 to 30,000 military personnel and their families will generate $2 to $3 billion in investment by the U.S. government in new facilities and infrastructure to support the expansion.

Service industries that include defense, high-tech, medical, engineering and construction are ramping up operations in El Paso to support this military growth and potential expansion of the army’s future combat operations. A strong demand for housing in the El Paso and Southern New Mexico region, with the combined expanding economy and growing retirement community, will further bring a positive impact to the service industries that will require more office and retail space.

It is estimated that the overall market vacancy is approximately 17 percent to 20 percent with a substantial amount of space in the central business district (CBD). The suburban office markets have performed much better during the last few years and their occupancy rates are estimated at 87 to 92 percent, depending on the submarket.

The CBD market has experienced a resurgence during the last 24 months and occupancy rates and lease rates have improved. Furthermore, with a strong interest in a solid downtown redevelopment plan, more local businesses as well as larger regional or corporate entities are taking an interest in locating there. Recent acquisitions of large downtown assets represent investor interest in the area with plans, within the next 24 months, to bring more Class A office space to the market.

Currently, it appears that landlords throughout the market are gaining slightly more leverage on lease transactions as vacancies decrease and overall activity improves. Overall, tenants and landlords are typically ending up with mutually satisfactory terms, but advantages for tenants still exist in some markets.

Service industries, supporting the growth in El Paso are seeking new space in Class A and B facilities in all submarkets. They include engineering companies, defense contractors, medical related facilities, construction and support services. El Paso continues to be a preferred location for call center or solution center operations and the market also is seeing increased demand for call center space, medical space and general use offices. Numerous positive factors include an available and talented labor pool, bilingual population, mountain time zone, affordable living and a very good climate that is relatively disaster free.

Greater interest has been shown in both urban and suburban office space during the past year. Suburban office space has done fairly well in the past few years as the CBD declined. In the last 2 years, however, the demand for downtown CBD space is steadily growing and absorption is very positive.

The most recent major office leases signed include a 25,000-square-foot solutions center expansion for EDS and 60,000 square feet for a solutions center operation for ADP.

There are no current major office developments underway in El Paso, with the exception of a large redevelopment of a 100,000-square-foot vacant office building expected to be completed in the next 24 months.

In 2006, with all submarkets steadily improving, El Paso has experienced improvement. Within the next 2 years there will be new speculative office development and more CBD office space will become available. Several large existing downtown buildings should bring in excess of 250,000 square feet to the market. To accommodate the growing economy in West Texas, Southern New Mexico and Juarez, Mexico, the office market is expected to grow substantially in the next 3 to 5 years.

— Will Brown is principal with Sonny Brown Associates in El Paso, Texas.

Houston

|

Kathryn Koepke, O’Connor & Associates

|

|

Class A trophy properties in the central business district (CBD) have been popular among investors recently despite elevated vacancies. Even as the downtown Houston office market continues to struggle, investors are eager to snap up properties. Several trophy office properties in Houston’s CBD have traded in 2006, including EPCO’s purchase of 1100 Louisiana from Hines; Wells Real Estate Funds’s purchase of 5 Houston Center from Crescent Real Estate Equities Company; and Goddard Investment Group’s purchase of Heritage Plaza from ING Clarion. These acquisitions presented leasing challenges for their new owners, as many tenants announced plans to vacate in the near future. Their bets are likely to pay off though as many more leases and expansions have been signed than move-outs.

Wells Real Estate Funds paid $286 per square foot for 5 Houston Center, the highest price per square foot ever paid for a Houston office building. Institutional investors from outside of Texas have generally been active in Houston, despite soft office stats since 2001.

Strong employment growth, particularly in the energy and energy-related services sectors, is the major trend in Houston’s office market. Last year’s employment numbers were revised upward to reflect a gain of 3.2 percent or 74,700 jobs, which is considerably better than the originally reported 2005 year-end gain of 1.8 percent or 42,500 jobs. Job growth was across the board as all sectors experienced gains. A high percentage of the gains can be attributed to the energy sector, which made a comeback in a big way in 2005. Year-end growth in energy-dependent employment in 2005 was 14,000 jobs or 4.7 percent, the highest annual gain since pre-1988.

Occupancy bottomed out 2 years ago at 81.99 percent and has since risen to 84.24 percent in the second quarter of 2006. The Class A market posted the highest occupancy levels, averaging 87.02 percent, while occupancies for Class B, C and D space ranges from 79 percent to 82 percent.

The downtown office market clung to 20 percent vacancies through 2005, but have picked up in 2006 due to large increases in Class A occupancy.

Power is shifting back to landlords as concessions and generous TI allowances are waning. Tenants were upgrading space due to low rents in recent years — a trend that is likely to continue to decline as rents pick up over all classes.

Energy-related businesses are scooping up large blocks of space, primarily Class A+ space in prime downtown and West Houston locations. Many energy companies such as British Petroleum and Shell are also developing LEED certified office buildings, which appear to be increasing in demand in Houston. In addition, medical office and single tenant Class A space (particularly for energy companies) are actively being developed in suburban markets such in Southwest and West Houston. Overall, there appears to higher interest in downtown space and markets around the Beltway or further out, but less interest in markets in the middle.

Numerous large lease transactions have closed recently in Houston, boosting the market’s occupancy rates. ChevronTexaco leased 465,000 square feet in Continental Center I downtown; EOG Resources leased 200,000 square feet in Heritage Plaza, also downtown; and Mustang Engineering pre-leased 200,000 square feet in the currently under construction Ten West Corporate Center II in West Houston. Notable lease expansions include that of Kinder Morgan, which renewed and expanded its lease by 55,000 square feet to total 214,000 square feet in One Allen Center downtown, and Occidental Oil & Gas, which renewed and expanded its lease by 30,000 square feet to a total of 383,000 square feet in the Greenway Plaza submarket.

West Houston areas including the Houston Energy Corridor, which is where several major oil and gas companies including BP, Shell and ConocoPhillips have offices, currently has 640,000 square feet of proposed office space. The proposed projects include the Energy Center, a 315,000-square-foot multi-tenant office building by the Trammell Crow Company and Energy Tower II, a 325,000-square-foot multi-tenant office building by Mac Haik Enterprises. Another major energy related office development is Jacobs Engineering’s new 300,000-square-foot office building. BP has announced plans for a 390,000-square-foot LEED building in the Houston Energy Corridor, while plans for Shell’s 170,000-square-foot LEED certified building in the Energy Corridor are already underway.

Overall, the market has improved in 2006, much to the relief of landlords. Rent growth, occupancy and absorption have all been positive. Next year will likely continue to strengthen, assuming construction of multi-tenant space remains limited and manageable. Rents are picking up, particularly in Class A, which will prompt increases in other classes.

— Kathryn Koepke is manager, research & consulting, for O’Connor & Associates in Houston.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|