| COVER STORY, MAY 2006

TEXAS RETAIL UPDATE

Brokers provide an in-depth look at how the retail market is performing across the state.

Interviews by Lindsey Walker

This month, brokers from across the state of Texas provide an in-depth, market-by-market look at the retail sector. From lifestyle centers in the Metroplex to mixed-use, urban developments in Central Texas, strong retail developments are fueling economic growth in the Lone Star State.

Interviewees included: Tom Salanty, Cushman & Wakefield of Texas; Cynthia Ellison, Grubb & Ellis; Henry S. Miller, IV, Henry S. Miller Commercial; Jerry Goldstein, Marcus & Millichap; Sherry Naquin Sanchez, Dean Janeff, Travis Waldrop and Monica Moore, NAI Commercial Industrial Properties Company; Edward Page, Page Partners; Todd Wallace, Staubach Retail; Sherman Hinkebein, The Retail Connection; and Darrell Hernandez, United Commercial Realty.

TREB: How would you characterize retail development activity in your area this year?

Page: Development in Houston can be characterized as very active in suburban and inner-city markets.

Wallace: We are experiencing the largest retail growth ever in the Austin MSA. Last year saw the largest retail growth Austin had ever experienced, with approximately 1.89 million square feet of retail built. In 2006, we now have nearly 5.83 million square feet of retail under construction with an additional 4.29 million square feet in the planning stage, according to Capitol Market Research.

Salanty: With the addition of Firewheel Town Center and numerous other power center projects across the Dallas/Fort Worth Metroplex, retail development activity has been brisk. Tenant demand for the Texas retail sales dollar is stronger than in most regions of the country. It is probably one of the top five markets in the U.S. in terms of population growth and retail development.

Sanchez, Janeff, Waldrop and Moore: The Central Texas retail market is very robust. The market has been underserved for a number of years and new development is taking off at a record-setting pace.

Goldstein: The Houston market is active, but it is slower than last year because of major retailers’ expansion programs that are nearly complete. Kroger and HEB, for example, only opened one store this year in Houston.

Hinkebein: Retail development activity in San Antonio, Corpus Christi, Laredo and the Rio Grande Valley should be very strong through 2008.

Ellison: With the expanding job market and buoyant consumer confidence, San Antonio’s retail market has accelerated its rate of growth into 2006. The city's population has grown by 7.5 percent since 2000 in addition to the median household income surging 16.3 percent, fueling consumer spending.

TREB: How would you characterize retail leasing activity in your area so far this year?

Page: Retail leasing is extremely active in Houston, with low vacancy across the spectrum of community centers, lifestyle centers, grocery-anchored centers, anchored power centers and unanchored strip centers.

Hinkebein: Retail leasing activity is outstanding for quality centers in San Antonio.

Goldstein: It is healthy based on a growing economy and population in Houston. The expansion plans of regional and national tenants are taking advantage of this.

Sanchez, Janeff, Waldrop and Moore: The leasing market is very active with high competition for premier spaces. This is particularly evident in the new lifestyle centers that are under construction in the market.

Ellison: Consumer de-mand and the dizzying expansion of retailers chasing market share fueled robust retail construction and leasing activity, boosting rents modestly during the past 12 months. With vacancy slipping below 10 percent and lofty demand, rents advanced more than $1 per square foot to close 2005, marking the first time that the retail sector has broken the $15 NNN barrier. New retail centers will soon require $22 to $25 per square foot NNN in order to maintain profit margins depending on the area of town.

Wallace: Even with all the growth, the Austin MSA is still holding a 93.2 percent occupancy rate (as of De-cember 2005, according to Capitol Market Research), which shows how strong the leasing activity in Austin has been and should remain for some time.

Hernandez: Leasing activity as a whole continues to be strong in the North Texas market. Some of the suburban markets that are seeing a tremendous amount of retail growth may take a little longer to get to full occupancy, but ultimately — if it is a good growth market and a good retail site — it will get to full occupancy levels.

TREB: How would you describe the investment sales activity in your area?

Hinkebein: We are seeing above asking prices for prime locations in the San Antonio area.

Salanty: Demand is strong along all property types. For Class A properties, there is unlimited demand for product throughout Texas. For the smaller properties (less than $3 million), the Texas single-tenant tax-free trade market is incredibly strong. And for the traditional, neighborhood center, the demand is also strong. In fact, there seems to be a California feeding frenzy for the smaller property types. It does not appear to be slowing down.

Sanchez, Janeff, Waldrop and Moore: Investment activity remains highly competitive with out-of-state investors focusing in on the strength of the Central Texas market.

Ellison: Retail properties arguably have benefited more than other property types in the hot investment market of the past few years.

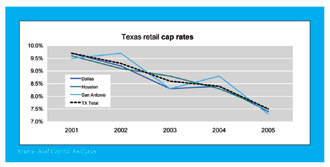

Wallace: Even with the rising interest rates, we are still seeing cap rates between 5 percent and 7.5 percent for retail centers in Austin.

Goldstein: Houston’s investment sales market is vibrant, even considering the rise in interest rates. Houston represents an opportunity to purchase shopping centers at higher returns than those on either coast.

Page: When compared to other markets, Houston’s cap rates are slightly higher versus other major metropolitan markets attracting buyer interest.

TREB: What retail markets — or submarkets — have grown in the past year and which markets are poised for growth in 2006? Why?

Wallace: The submarkets of Georgetown, Buda and South Austin have experienced the largest retail growth in the Austin area during the past year. In 2006, North Round Rock will host a tremendous amount of growth at FM 1431 and IH-35 with the new IKEA- and JC Penney-anchored development, along with Chelsea Outlet Mall and the proposed HEB. For the first time, the eastern corridor of the Austin MSA will see big box retailers land along SH-130 to service all the growth that will be propelled by the new highway. With the addition of SH-130, the face of Central Texas will change completely with a majority of the new developments shifting to the east side of IH-35.

Ellison: San Antonio has experienced explosive growth in the north central area outside Loop 1604. That growth will be shifting from the far north central to the far northwest.

Miller: In the Dallas/Fort Worth Metroplex, Northwest Frisco, Little Elm, Uptown, Wylie, Sachse, Highland Village and Flower Mound are the growing markets. New home growth and job growth are what continue to drive retail demand in these submarkets — this coupled with the consumer demand for a new and better shopping experience.

Page: This past year in Houston, we have seen growth in the 290 corridor, The Woodlands, Katy, Pearland, Sugar Land, Atascocita and Missouri City. The areas we feel are poised for growth are The Woodlands (West), Conroe and Rosenburg. The growth follows the residential growth and residential growth in these areas is extremely strong.

Hinkebein: In San Antonio, Loop 1604 (from IH-35 to Potranco) is growing. Development is following population/housing.

Sanchez: Central Texas has experienced a population explosion with a high-income demographic. This trend is complemented by the largest new road construction project in the country, SH 130, which is scheduled to open the first phase of construction this year. This road system will make it easier for commuters and deliveries to get to their destinations without sitting in traffic. The land surrounding these new roads is still very affordable and thousands of new single-family homes are planned, approved, permitted or under construction as a result. Retail naturally will be developed in these areas to provide these homeowners with goods and services in their neighborhoods. This trend is expected to continue through 2006 and beyond, particularly in submarkets such as Bastrop, Buda, Cedar Park, Georgetown, Hutto, Kyle, Leander, Pflugerville and Round Rock.

In addition, the southwest and west submarkets of Austin will continue to grow to meet the increasing population in these areas. Housing prices in the area have reached the point where residential development makes economic sense, and retail must follow to meet the demand. Several large retail projects are planned for these submarkets during the next 24 months.

Goldstein: Consistent with the macro trend in the Houston metropolitan area, growth markets have continued to be dominated by areas that center on planned communities such as Sugar Land (First Colony, New Territory), The Woodlands and West Houston (Cinco Ranch), as well as in-fill development in the city of Houston. The planned communities in the suburban markets have developed infrastructures that not only provide the country club lifestyle, but also some have a commercial side that allows people to work and play in those areas. Development in the city of Houston is in response to some areas being under-retailed because of the growth in housing that is mostly driven by upscale apartments and townhouses.

Salanty: Dallas has continued to grow to the north, with the submarkets of McKinney, Frisco and Garland (with the Firewheel Town Center project) gaining the most interest. Southlake, to the west/northwest is booming in retail growth. In fact, the northeast Tarrant County submarket that includes Southlake is reaching near build-out. Growth markets in the region this year will include the communities of Cedar Hill, DeSoto, Burleson, Denton and North Fort Worth.

TREB: What retail markets or submarkets are struggling? Why?

Miller: As a whole, the Dallas/Fort Worth market is very strong from a retail point of view. There are no submarkets that come to mind the show any signs of a struggle; however, there are pockets throughout this market that struggle because of poor design or location or an over-saturation of retail in a particular area.

Hernandez: The ones that might be struggling are areas where you have had a tremendous amount of growth surpassing the residential base and it is just a timing game. The commercial and retail growth may have gotten ahead of the residential growth, thus some retailers may struggle as the market builds up and becomes more dense. But, the residential base is going to eventually catch up.

Wallace: The only markets struggling are some of the smaller suburban markets outside of the MSA. These are smaller, rural markets that typically have lower median household income combined with sparse population, which equate to lower retail sales and less growth.

Ellison: The Walzem Road corridor has been struggling, primarily due to the fleeing of tenants from Windsor Park Mall. Many retailers left Walzem when the Forum Shopping Center opened at Loop 1604/IH-35. The Forum is serving the residents of northeast San Antonio, which also contributed to some of the vacancy on Walzem Road.

Page: Some pockets in Southwest Houston and downtown are struggling due to road construction and the relocation of tenants to more affluent areas.

Moore: North Central Austin and parts of Far Northwest Austin are seeing moderate drops in occupancy as retailers in B- and C-grade shopping centers are making the flight to quality in new A-grade shopping centers.

Goldstein: Some parts of West and Northwest Harris County, as well as other selected areas, are struggling because of small shopping center overbuilding. No major properties seem to be involved. These areas are struggling because of the availability of too many land tracts that could be developed into shopping centers and not enough population to support them.

TREB: What types of retail properties are the hottest in Texas? Why?

Salanty: The smaller credit, single-tenant deals, lifestyle centers and traditional big box power centers in the suburban, family-oriented markets are the hottest retail properties in Texas. Retailers love the large families with disposable income that live in these areas.

Janeff: Anchored shopping centers and mixed-use urban developments are continuing to see the highest rates and lowest vacancy. Retailers are attracted to the traffic that national credit anchors generate, as well as increased demand in urban areas created by the return of the population to urban mixed-use projects.

Hinkebein: Power centers and well-located shadow anchored strip centers are hot in San Antonio right now.

Goldstein: Grocery-anchored shopping centers and Wal-Mart-related properties are hot. The neighborhood shopping center, which is anchored by the grocers that are in favor, have always been at the top of investor lists and particularly the REITS because of stability and the potential for rental growth. For smaller investors, properties near Wal-Mart Supercenters are hot.

Page: Lifestyle centers, town centers and strip centers are hot in Texas. Unanchored strip centers are also hot properties in Texas. The lifestyle and town centers offer a new shopping experience for the consumer. Un-anchored strip centers are hot due to the availability of land and strong capital markets.

Hernandez: In Dallas/Fort Worth, the types of retail properties that are hot are mixed-use/hybrid developments. It is becoming more and more difficult to create a true lifestyle center because, with so many major malls in the market, a number of the retailers desired in these lifestyle centers are already in the malls — making it more difficult to create a true lifestyle center. Therefore, you are seeing a smaller mix of lifestyle centers incorporated into this mixed-use development, creating a hybrid, which seems to be the hot retail property being built right now.

Wallace: The hottest retail properties are ground leases. Banks and drug stores are at the top of most group’s lists.

TREB: What types of retail properties are struggling in Texas right now?

Moore: Unanchored centers are struggling. The smaller tenants are dependant on the advertising dollars and foot traffic generators that anchors provide.

Page: B and C malls are struggling in Texas, as well as grocery-anchored centers when the grocer is closed. Class B and C malls are experiencing a change in demographics and customers are leaving because there are superior shopping experiences available outside of the mall. Malls, in general, could experience some struggles with the consolidation and closure of some of the major department stores. Grocery-anchored centers are struggling due to the consolidation and exodus of certain grocers from the market.

Salanty: Older regional malls located within neighborhoods and not on freeways are the retail property types that are struggling in Texas. Those particular properties are being out-positioned by power centers and regional mall hubs at major freeway intersections.

Wallace: Unanchored strip centers in the smaller markets of Central Texas are struggling a bit, especially in the neighborhoods. As new anchored retail on primary intersections become available in these markets, retailers are relocating into these larger centers for better visibility, access and co-tenancy.

TREB: What retailers are most sought after?

Page: The most sought after retailers are Target, Wal-Mart, grocers and soft goods. Those retailers bring frequency in traffic, and they attract the female shopper and bring in other retailers and allow owners to achieve higher rents in side shops and pads.

Wallace: These anchor retailers help land junior anchors and other retailers to ensure the success of a development.

Hinkebein: In San Antonio and South Texas, traffic generators and credit tenants are the retailers being sought after.

Salanty: Target, Old Navy, Wal-Mart, Kohl’s and JC Penney, those types of retailers are most sought after because they are delivering the products and services that today’s consumer wants in an easy-to-use format that today’s busy shopper can easily get in and out of.

Miller: I do not think this really ever changes; it is just whatever mix of tenants you can put together to generate the most traffic through your shopping center. Retailers like Barnes & Noble, Starbucks Coffee, Borders, strong grocers and distinctive restaurants are ones that come to mind.

Janeff: National credit anchors are a must for any new development to generate leasing activity in these new lifestyle centers. Additionally, locally owned and well-established tenants, restaurants in particular, help urban in-fill centers maintain a local flavor that keeps long-time area residents coming back for more.

TREB: What do you think needs to happen in order for the market to improve in 2006 and 2007?

Salanty: Continued job and housing growth are necessary for market improvement.

Wallace: Austin’s retail market is so strong at this point that it will be difficult to improve the growth rate that the Austin MSA is experiencing. However, to continue growing at this rate, Austin’s population will need to continue growing exponentially as it has been for the past several years.

Sanchez: In order for the market to improve or continue to remain as vibrant as it is today, interest rates will need to remain fairly low to continue spurring development. In addition, continued positive economic trends to boost consumer spending and more population growth will need to occur.

Page: We would need to see a stabilization of interest rates, and continued increase in job growth and residential growth.

TREB: What retail trends do you think will emerge in the near future?

Page: Trends that will emerge will be development of new retail concepts and the consolidation of retailers in order to keep up with the changing demographics of their customers. More retailers will emerge that cater to the baby boomers and the booming teen and Hispanic markets. We will also see a continued proliferation of lifestyle centers.

Salanty: The public and the investor will continue to see solid returns from the shopping center industry.

Goldstein: There will be more of a realization in the Houston market that certain retail properties have excellent locations but are really just worth land value and major redevelopment, in earnest rather than cosmetic changes, will realize real value.

Waldrop: One of the more immediate trends that is taking place is the need for tenants to modify their space plans and product lines in order to accommodate the smaller spaces of lifestyle centers and mixed-use centers, as well as climbing rental and construction rates, as these centers will continue to be the preferred destination for consumers.

Another trend that is emerging in retail is the redevelopment of infill projects. As the population spreads out, and commutes get longer, people are reconsidering the suburban life and moving back into the city. The continued success of several downtown mixed-use projects is evidence of this trend, and retailers are pushing to take advantage of the increasing density.

Wallace: In 2006, we are going to see more power centers being built more like lifestyle/mixed-use centers. Developers are taking larger tracts of land and adding condos, office, amphitheaters, parks and other amenities around the development to steer away from the old strip center look. This creates more of a work, live and shop atmosphere in these large developments. These types of centers appeal to a vast array of consumers.

Hinkebein: California buyers are purchasing more and more product in Texas.

TREB: What are your predictions for Texas retail?

Hernandez: Texas retail will continue to go through a solid growth time, although I do think there will be more caution as to the amount of developments. If interest rates continue to rise, some of the oxygen may be taken out of the investment community. A majority of these projects are being built to be sold because Texas is high on the list for retail investment buyers. If the buyers slow down, I think there will be a slow down in the amount of retail built.

Janeff: Rents are expected to remain stable and new retail projects and re-developments are expected to continue in urban markets. Retail acquisitions and developments are also expected to remain strong as the population continues to grow and spur more demand.

Wallace: Central Texas is going to continue to experience residential growth, which in turn will open up the doors for additional retail growth. In 1990, the Austin MSA had approximately 18 million square feet of retail. Today, the Austin MSA has more than 30 million square feet (per Capitol Market Research), with more than 5 million square feet under construction. There are no signs that this will change in the near future.

Hinkebein: Texas will continue to have an excellent climate for retail.

Salanty: I predict that there will be continued growth in supply but a setback in absorption with the pending exit of Albertsons from the area.

Page: Retail in Texas will remain strong. We will continue to see well-measured growth with a slowing of building of unanchored strips due to the rising cost of construction.

TREB: How would you describe the lending environment for retail properties in Texas?

Goldstein: Aggressive.

Ellison: Investors and developers have enjoyed easy access to money.

Salanty: For leased properties there is an unlimited supply of capital. Actually, there is so much money chasing product today that there is money for anything.

Wallace: Lenders have been very favorable to lending in the Austin MSA for retail projects and developments with the continuation of the strong population growth in the Austin MSA. Lenders will continue to have an appetite for this market.

Miller: It is very competitive; there are lenders lined up to look at deals.

Waldrop: The lending environment in Texas is very aggressive due to the competition between lenders for the abundance of out-of-state investors flowing into the state.

TREB: How do you think interest rates will affect real estate in Texas?

Waldrop: Residential markets could be impacted to a higher degree by higher interest rates by increasing consumers’ housing costs. In turn, this would affect retail markets by lowering consumers’ disposable income leading to lower retail sales and curtailed expansion of retail locations. However, retail developers may accelerate construction timelines to lock in lower rates on their permanent financing.

Salanty: For high-leveraged buyers, an increase in interest rates will lead to a softening in cap rates and we expect there to be somewhat of a disconnect between buyer and seller expectations as interest rates rise.

Miller: I do not see a big effect on this market. The Metroplex is still very affordable when compared to the majority of other major markets.

Wallace: For the last 2 years, interest rates have risen and everyone thought it would affect the cap rates. So far that has not been the case, and, if anything, cap rates have dropped. Eventually, the rise in interest rates will cause cap rates to rise, but with the market as it stands today, cap rates will remain low and developers will continue to build.

Goldstein: There is some downside pressure, but it will be in relationship to the proportion of the change.

TREB: Are there any additional comments you’d like to make regarding Texas’ retail market?

Goldstein: The retail business will remain an excellent business to be in, but, as in the past, new projects will have to be thought out carefully .

Page: With the continued job growth in Houston (more than 75,000 new jobs in 2005) the market is well-positioned for solid and steady residential and retail growth. Currently, most projects are well-leased prior to completion.

Sanchez, Janeff, Waldrop and Moore: The Central Texas market is expected to continue to lead the state to meet the demand of the increasing population.

LACENTERRA AT CINCO RANCH BRINGS NEW RETAIL TO KATY, TEXAS

|

Amstar Group and Vista Equities are developing LaCenterra at Cinco Ranch, a 240,000-square-foot lifestyle center in Katy, Texas.

|

|

Katy, Texas, is growing, and a new retail development currently underway will satisfy the demand for a new shopping destination. Denver-based Amstar Group and Houston-based Vista Equities have formed a joint venture to develop LaCenterra at Cinco Ranch, a 240,000-square-foot lifestyle center located at Cinco Ranch Boulevard and Grand Parkway within the 7,000-acre, master-planned community of Cinco Ranch. The project, which broke ground in January, is set to be a success.

“Population growth around LaCenterra is projected to outpace population growth in the greater Houston area by a wide margin, and the people moving to the area tend to be affluent and well educated,” says Doug Wiley, executive director of Amstar Group. “Also, LaCenterra is very easy to get to via the Grand Parkway, and the site’s parking and street design make this center easy to get in and out of, without compromising the shopping, dining and working experiences.”

The development, which comprises 18 acres, includes 160,000 square feet of retail and 80,000 square feet of second-floor Class A office space. Talbot’s and Cold Stone Creamery have already signed on to the project, and several other retail tenants are in the advanced stages of finalizing leases. Houston-based Hermes Architects is providing architectural services, and Hoar Construction is serving as the general contractor.

For the community, it is an exciting new development. “Local residents, the Katy Economic Development Council and Katy’s civic leaders have all been in active dialogue with us as LaCenterra has come together, and we are grateful to have such interest and support from the community,” Wiley says.

The planned grand opening of the project is March 2007.

— Leah Sanders |

CONSTRUCTION OF PARK NORTH PLAZA UNDERWAY IN SAN ANTONIO

|

Construction on the 1.2 million-square-foot Park North Plaza in San Antonio is underway.

|

|

In San Antonio, a retail development that will bring more than 1 million square feet of retail space to the area is underway. Park North Plaza, which is owned by PN Plaza Investments and is being developed by Hill-Granados Retail Partners, is located at San Antonio’s busiest intersection — Loop 410 and San Pedro Avenue opposite North Star Mall.

In addition to an enviable location, the 1.2 million-square-foot project has several aspects that will add to its success. Special features at the development include sky bridges and covered walkways that connect the buildings in order to protect pedestrians from inclement weather.

With Park North Plaza, Hill-Granados wanted to offer a good mix of entertainment for the entire family, providing for the retail needs of a diverse trade area that stretches from Loop 1604 to downtown, according to Mark Granados, managing partner of Hill-Granados. “After many years of having a ‘dead area,’ the community is excited to know the shopping center will include a department store, a super discounter, a health club, entertainment including a movie theater and restaurants, junior anchors and many other local, regional and national tenants,” Granados says. Retailers in the initial phase of the development in-clude Mattress Firm, Cingular, the Lion and Rose Pub, Jim’s Restaurant, Cold Stone Creamery and Oodles. Park North Plaza is also located within a desirable retail area with neighboring retailers such as Best Buy, Office Depot, Barnes & Noble and DSW.

“Park North Plaza is like nothing you’ve seen in San Antonio,” Granados says. “Tenants both national and regional have expressed interest in the project because of its uniqueness and prime location.”

Construction on Park North Plaza commenced last year and is scheduled for completion in 2008.

— Leah Sanders |

NORTHPARK CENTER COMPLETES RENOVATION

This month, Dallas is welcoming the expansion of NorthPark Center, a regional center and local tradition since 1965. The expansion, which was announced in December 2004, brings NorthPark Center to nearly 2.4 million square feet and includes a 1.4-acre garden space.

“This expansion is all about bringing the best of the best to Dallas — the best retail in all categories and the best amenities from dining and entertainment to guest services,” says Christine Szalay, director of marketing and tourism for NorthPark Center.

Through the expansion, NorthPark is able to offer a special collection of retailers in a unique way. More than 70 stores are opening this spring, including Miss Sixty, Metropark, Babystyle and Klinger Advanced Aesthetics, and some stores — such as Juicy Couture, Custo Barcelona, Ted Baker London and H Hilfiger — are flagship Texas locations. The retailers are grouped in categories, allowing shoppers access to multiple retailers of one type within the same area. The center is also now shaped in a quadrangle around a 1.4-acre open-air area called Center Park. Shoppers are able to move through the mall continuously, without the inconvenience of side halls, and also enjoy this new green space.

The expansion includes new entertainment and dining options as well. AMC NorthPark 15, opening with the expansion in May, has two of the largest screens in United States. Kona Grill and Luna De Noche are two of six new restaurants, and NorthPark Café offers 10 counter-service options for casual dining and indoor and patio seating.

The older parts of NorthPark will also be renovated upon completion of the expansion.

— Leah Sanders |

THE HOT WORLD OF LIFESTYLE CENTER DEVELOPMENT

|

Stonebriar Commons on Legacy in Frisco, Texas, includes a 108,000-square-foot retail portion, office space, condominiums and hotels.

|

|

Filled with upscale shopping and a social ambiance, lifestyle centers are a hot item in the retail development world. Like the rest of America, Texans are enjoying these new shopping destinations and are helping to make the lifestyle center development business even more successful. Lifestyle centers have changed the atmosphere of shopping, giving the shopper the sense of convenience and community.

“Lifestyle centers offer a mix of well-known and unique retailers that create a destination, not just a shopping center,” says Herbert Weitzman, chairman and CEO of Dallas-based The Weitzman Group. “Their popularity stems from the fact that people respond to them, partly because of the success of lifestyle retailers and partly because the centers themselves offer a sense of place.’” Weitzman also says that shoppers respond to typical lifestyle design features — such as town-center style architecture and pedestrian-friendly design in a sophisticated, fun setting — because they offer a community experience.

The Triangle, which is bordered by Lamar, Guadalupe and 45th streets in Austin, is one such lifestyle center that blends shopping and community. Cencor Urban, a division of Dallas-based Cencor Realty Services, is developing the new phase of the retail component of the project, which is scheduled to open in spring 2007. The Weitzman Group is hand-ling the retail leasing. Upon completion, The Triangle will feature 125,000 square feet of retail space (approximately 10,000 square feet have opened in this year), in addition to a multifamily component. The design includes varied storefronts, brick colors and materials to create a “Main Street” feel. Area residents have been involved in the project, a fact that exemplifies a common desire for community-oriented retail centers.

|

In Austin, Texas, Wolf Ranch, a project of Simon Property Group, offers more than 700,000 square feet retail and restaurant space.

|

|

“The Triangle worked with neighborhood groups for several years before its final design was selected,” Weitzman says. “As a result, the community sees The Triangle as ‘its center.’ The project’s retailer line-up is very Austin-centric, which is important to the Austin community. This urban development is one of the best examples of New Urbanism in the state.”

While they have typical elements (such as appeal to an affluent customer base and success in areas of urban density), lifestyle centers are successful in part because of their flexibility, according to Weitzman. The aspects and features of lifestyle centers are moldable.

Wolf Ranch and Stonebriar Commons on Legacy, which are both being leased by The Weitzman Group, demonstrate the diversity potential of lifestyle centers. Wolf Ranch, which is a development of Indianapolis-based Simon Property Group, offers more than 700,000 square feet of retail and restaurant space in Austin, and combines life-style and power center elements. In contrast, Stonebriar Commons on Legacy, which is being developed by Dallas-based Windmill Development at the northwest corner of SH-121 and Legacy Drive in Frisco, Texas, offers 108,000 square feet of retail space as part of a large mixed-use development with office space, residential condominiums and hotels. The project’s first phase of retail opened recently and is drawing a number of specialty retailers and restaurants.

|

Cencor Urban is developing The Triangle, which will feature 125,000 square feet of retail space, in Austin, Texas.

|

|

Another project, Firewheel Market, brings a strong line-up of specialty retailers and restaurants to the area, according to Weitzman. “More than that, though, it offers traditional ‘Main Street’ architecture that appears to have evolved during the years,” he says. “Based on the success of the new project, the trade area responds to both its tenant mix and its true sense of place.” The 106,600-square-foot specialty life-style retail center, which is located at the northeast quadrant of SH-190 and SH-78 in Garland, Texas, completed construction in February.

“Lifestyle centers, by their very nature, are unique,” Weitzman says. “You can’t take a cookie-cutter approach. A concept that works in one market may not work in another. And as their popularity grows, we’ll see them evolve with new components in terms of retailers and layout, as well as better retailer concepts.”

— Leah Sanders |

Trademark Property Company attracts new, upscale tenants to Market Street

|

Market Street will feature 400,000 square feet of retail and restaurant space, 100,000 square feet of Class A office space and possibly a hotel upon completion.

|

|

Market Street, a pedestrian-friendly, mixed-use development located in The Woodlands, Texas, has upped its momentum as a one-of-a-kind shopping and entertainment destination with the recent announcements of several upscale tenants, many of which are opening locations in the Houston area for the first time. Market Street’s developer, Trademark Property Company, hopes that these new retailers — J. Crew, Lilly Pulitzer, Just Add Water, Orvis and Forth & Towne — will not only increase the drawing power of customers but also help to attract even more national specialty retailers to the project. These new retailers add to an already powerful mix including Tommy Bahama, Smith and Hawken, Borders, Sur La Table and a collection of some of the best restaurants in the region.

“Today’s specialty retailers are attracted to places that connect emotionally with customers in addition to being a part of a fantastic collection of stores,” says Tommy Miller, principal of Trademark Property Company. “Market Street delivers just such an experience. The entire project is designed as a place for people to gather, celebrate and be part of the community.”

|

New additions, such as J.Crew, Lilly Pulitzer, Just Add Water, Orvis and Forth & Towne, will add to the center’s appeal.

|

|

Surrounded by the Cynthia Woods Mitchell Pavilion, a major convention center hotel, one of the community’s largest churches, a new town park, an ice skating rink and the area’s library community center, Market Street’s unique location draws a variety of customers. According to Miller, the development’s primary target customer is the affluent/educated woman, her family and the merchants that cater to them. “By day, Market Street caters to the stay-at-home mom and her children,” Miller says. “At night, Market Street becomes a great place for adults.”

The project, which has opened in phases since last summer, will feature 400,000 square feet of retail and restaurant space, 100,000 square feet of Class A office space and possibly a hotel upon its completion. “There is approximately 35,000 square feet of retail space remaining to be built and the potential for a boutique hotel,” Miller says.

As the first truly pedestrian scale, mixed-use environment in the Houston suburbs, Market Street hopes to be a destination for today’s customers as well as those in the future. “We tried to build something that will be better 10 to 20 years from now,” Miller says. “Market Street was built to age and to last.”

— Lindsey Walker |

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|