| COVER STORY, MAY 2005

TEXAS RETAIL UPDATE

Brokerage firms share the latest stats and development news about the retail markets in Texas.

Retail is doing very well in Texas this year. Lifestyle centers are particularly hot — consumers and retailers can’t get enough of them and developers are building quickly to support the demand.

Texas Real Estate Business asked several Texas brokers to report on the state of the retail market in their areas:

• Houston

• Rio Grande Valley

• San Antonio

• Central Texas

• Dallas/Fort Worth

HOUSTON

All retail markets in Texas are buoyed by the strong economy. In southeast Texas, the retail markets that have grown most significantly in the past year include The Woodlands, northwest Houston (SH 290 and Spring Cypress) and South Freeway (SH 288 and FM 518). In the next year, we expect to see significant retail growth in the west Houston (Cinco Ranch) area. These are all high residential growth areas where new customer bases are being created.

Lifestyle and town center projects are the hottest retail property types in Texas because customers have a growing affection for these open-air, community-related projects. That being said, the number of this type of project that can be built in a metropolitan area is limited by the stringent demographic criteria necessary to support them. Tenants most frequently seen anchoring these projects include theaters, bookstores, restaurants, home furnishings stores — Z Gallerie, Pottery Barn, Williams Sonoma and Bombay — and specialty women’s apparel — Chico’s, Talbots and White House/Black Market.

Power center development is also very active in Texas. Anchors most actively pursued for these centers include discount department stores like Target and Wal-Mart; home improvement big boxes like The Home Depot and Lowe’s Home Improvement Warehouse; housewares big boxes like Bed Bath & Beyond and Linens ‘n Things; family clothing discounters like T. J. Maxx, Marshalls and Ross Dress For Less; and pet store big boxes such as PetsMart.

C-grade, enclosed malls are struggling more than any other retail center concept because they have been out-positioned and out-tenanted by better malls or other, more viable retail concepts.

Some of the more significant retail projects being started or finished this year in the Houston area are Market Street at the Woodlands by Trademark Property Company, the redevelopment of Town & Country Mall by The Midway Companies, and the redevelopment and “de-malling” of Northline Mall by Fidelis Realty Partners.

Other active retail developers in the area include The Ainbinder Company, Crosswell Greenwood Properties and New Quest Properties.

New retailers or retail concepts to the market in 2004 and 2005 are Gander Mountain, Lifetime Fitness, L.A. Fitness, Sears Grand, JC Penney’s freestanding stores and MW Cleaners (a new concept being rolled out first in Houston by Men’s Wearhouse).

In 2005 and into 2006, continued residential growth, historically low interest rates and low cap rates should keep the retail development market active. — Edward F. Page, manager of Page Partners in Houston

Greater Houston

The Greater Houston retail market is quite healthy and continuing to experience moderate growth. Approximately 3 million square feet of new retail space will be added in 2005, which is minimally down from last year. Leasing activity is active and steady. Occupancy and rental rates are expected to increase slightly in 2005 with occupancy rates achieving 87 percent and the overall rental rate average exceeding $18.50 per square foot annually, according to O’Connor & Associates.

Investment sales probably won’t reach the same level as 2004. Interest is strong and money is abundant, but there are only a limited number of properties available.

As always, residential growth drives retail growth, especially in four very active Houston submarkets: southwest Houston/Richmond/Sugarland; north Houston/Woodlands; the Highway 290 Corridor (northwest); and south Houston/Pearland. However, increased interest rates will probably cause some slowdown in new housing developments, which should reduce the need for additional retail developments. Also contributing to a slowdown in retail development in 2005 will be increasing construction costs and land costs, which can significantly affect the economics of projects. More and more development activity will focus on substantial rehabilitation of existing centers.

As market saturation becomes apparent in 2005 and 2006, there will be a slowdown in the continued aggressive expansion by some major retailers, most of whom are already in the Houston marketplace. At the moment, though, development is quite active. And certain tenants are expanding more than others. Of the 3 million square feet of retail space that will be added to the market this year, more than 40 percent will belong to the large super discount centers and home improvement stores.

Developers are intrigued with the new 100,000-square-foot JC Penney and Sears concepts and the 120,000-square-foot H-E-B format. In addition, the continued expansion of Whole Foods, Best Buy, Walgreens and CVS/pharmacy will fuel new development activities and projects. The emphasis will be on lifestyle/town centers, expanded major regional malls with added lifestyle components, community centers anchored by super discount stores, free-standing stores, and remodeled/redeveloped projects.

As for struggling retail, older and smaller regional centers with two or three department store anchors are “soft,” as are community centers with large, vacant anchors. Additionally, there are some closed former supermarkets and obsolete big box spaces in older neighborhoods, which are creating challenges in certain markets.

Overall, though, continued broad-based job and population growth will allow the Greater Houston retail market to remain vibrant and continue to improve in all sectors during the next year, albeit moderately.

— Ed Wulfe, president of Wulfe & Company in Houston

The Rio Grande Valley

The Rio Grande Valley — which includes Cameron, Hidalgo, Starr and Willacy counties — is a strong retail market in Texas. Town centers and lifestyle centers are most in demand. They cater to families and upscale shoppers who like the quality of these types of projects without the hassles of a mall. Developers and center owners seek retailers that really draw consumers, including Crate & Barrel, Restoration Hardware and Pottery Barn. Big box retailers have grown quickly in the past year and are poised for growth. In the Rio Grande Valley, the most popular big box retailers are The Home Depot, Lowe’s Home Improvement Warehouse, H-E-B, Marshalls, Bealls, Hobby Lobby and PetsMart.

In the Valley, we are doing well economically. 2005 should be a very good year, barring difficulties between the United States and Mexico.

McAllen (Hidalgo County)

|

Developer AmREIT and owner El Pistolon II Ltd. are planning Las Fuentes, a 30-acre project at 10th and Dove streets — a prime retail corner in McAllen. El Pistolon II Ltd. owns the land; AmREIT will manage the development, construction and leasing of the project, which will be an estimated 400,000 square feet. Las Fuentes will break ground in January 2006 with the opening planned for fall of 2006.

|

|

Simon Property Group is developing Palms Crossing, a 70-acre project located on Highway 83 between Ware Road and 29th Street in front of the new $50 million dollar McAllen Convention Center. The project is scheduled to open in spring of 2006. Targeted big box prospects include Circuit City, Oshmans, Office Depot, Cost Plus World Market, Babies “R” Us, Borders Books & Music, Ross Dress For Less, Old Navy, Linens ‘n Things, Petco, Bealls and Marshalls. The site has nine pad site locations on Expressway 83 frontage road. Simon picked this location for Palms Crossing because the company knows the purchasing power of the Mexican national customer. The company also knew that another developer would develop this land if it did not — and Simon wanted to protect its investment at La Plaza.

In McAllen, La Plaza remains one of Simon Property Group’s highest grossing retail malls (per square foot) in the United States, boasting average sales of more than $650 per square foot. The mall is anchored by Dillard’s, Sears, JC Penney, Foley’s, Foley’s Home Store and Joe Brand. Initially the Mexican national shopper contributed as much as 60 percent of the sales for La Plaza. Today this number is closer to 35 percent. This is not due to loss of market share, but to the growth of the local shopper base on the U.S. side of the border.

Once completed, the Anzalduas International Bridge will bring more Mexican national customers into the market more often due to the reduction of travel time from Monterrey, Mexico.

Brownsville (Cameron County)

Brownsville has several retail projects underway or announced. These include Paseo de la Resaca’s ambitious 550,000-square-foot proposed power center, located at FM 802/Ruben Torres and Parades Line Road, and Sunrise Palms, an 82,000-square-foot strip center and office complex by Hope Property Group, located in line with Circuit City at the north end of Sunrise Commons and Sunrise Mall. Morrison Crossing, a project of POB Montgomery, has announced the city’s second Home Depot and other big box stores. Wal-Mart is developing a new Supercenter at FM 802 and Highway 48 on the extreme eastern side of Brownsville. A Wal-Mart Supercenter is almost completed in Port Isabel, about 30 miles northeast of Brownsville.

Harlingen (Cameron County)

Harlingen is about 25 miles north of Brownsville and 35 miles east of McAllen. Valle Vista Mall, a Simon Property Group mall located in Harlingen, is struggling for business. Many Harlingen shoppers go to McAllen or Brownsville for a better selection. However, Bridge Realty has announced a proposed power center to the west of Pep Boys on Expressway 83 and Dixieland Road in Harlingen.

— Michael J. Blum, Roger Stolley and Larry Crow, NAI Rio Grande Valley

DALLAS/FT. WORTH

Affordability, quality of life and a good business environment keeps Dallas/Fort Worth a winning market for retail. The three-county, 4 million-resident area dubbed the “Dallas/ Forth Worth Metroplex” continues to break records for new single-family home and apartment deliveries. This, in turn, helped the Dallas/Fort Worth retail sector absorb a total 4.73 million square feet in 2004.

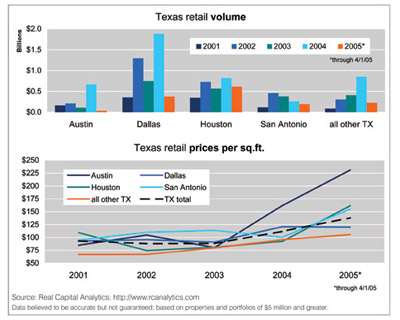

Current retail occupancy in Dallas is a solid 91 percent and it is only slightly lower in Fort Worth at 89.5 percent. The average sale price for retail space in the metro area is $122 per square foot, though good properties in solid submarkets and newly constructed centers can reach $200 per square foot.

Though Dallas and Fort Worth are only 40 miles apart and, in reality, create one major metro area, Fort Worth has more room for development expansion than Dallas and will likely become much larger than Dallas in the years to come.

Living the Lifestyle

A significant trend occurring in Dallas/Fort Worth is the growing popularity of lifestyle centers — properties that combine a main retail component with other elements such as office, restaurant, service and multifamily.

Developed by Cooper & Stebbins, Southlake Town Square, between Dallas and Forth Worth to the north of the Dallas/Fort Worth airport, was one of the first lifestyle centers in the metro area. When the first phase of the 130-acre open-air project came on line in 1999, locals questioned its viability, but the center has continued to thrive through multiple expansion phases to include 14 restaurants, 58 offices — including government uses — and 67 local and national brand stores. Southlake Town Square is entering its final phase with almost 47,000 square feet of retail and office space and plans for a theater, a hotel and a multifamily component.

In North Richland Hills, at State Highway 26 and the Northeast Loop 820, the 26-year-old, 500,000-square-foot vacant North Hills Mall is being demolished to build Citywalk at Calloway Creek. When completed in early 2008, this will be a 900,000-square-foot lifestyle center with entertainment and retail tenants, an amphitheater and trails, and 160,000 square feet of medical office space.

A similar $42 million renovation will turn Town Center Mall — one of the first malls in Fort Worth — into La Grande Plaza. The renovation will be accompanied by construction of a new 250,000-square-foot retail center called Plaza de las Americas.

On W. Seventh Street northeast of Fort Worth, Dallas-based Weber & Company and Kimco Realty are redeveloping a 1928-built Montgomery Ward building into a 45-acre project called Montgomery Plaza. A 170,000-square-foot Super Target will anchor the project. Other confirmed tenants include Pier 1 Imports, Marshalls, PetsMart, Linens ‘n Things and Ross Dress For Less.

South of Dallas/Fort Worth in the heavily retailed Interstate 20 corridor of Arlington, Arlington Highlands has been announced. The $100 million project is being built by Dallas-based Retail Connection and will include 900,000 square feet of retail space.

Big Boxed In

While some major retailers like Target, Wal-Mart and The Home Depot continue to expand in the area, most have tapped out in Dallas/Fort Worth, leaving little to conquer and feeding the opinion that we’re heading for a slowdown on the big box front.

Dollar Tree, Family Dollar and Dollar General have orchestrated aggressive expansions here over the last 5 years. The large electronics retailers also continue to battle it out locally. An example is the expansion of the Conn’s appliance/electronics group, which is making a push into the Metroplex with eight new stores while Ultimate Electronics closes 10 Dallas/Fort Worth locations after filing bankruptcy in early 2005.

Opportunities for major retail players may still exist in smaller markets like Weatherford, Granbury and Burleson near Fort Worth, and towns like Sachse and Rowlett near Dallas. There is also great promise in infill properties, though they’re becoming harder to come by.

Filling In the Gaps

Renovated in the late 1990s, University Park Village is a very successful infill retail center in the Colonial Country Club/Texas Christian University area. It includes restaurants and retail tenants such as Barnes & Noble, Gap, Williams-Sonoma, Harold’s and Pottery Barn. Rents average up to $30 (plus NNN) per square foot, which is significantly higher than the $12 per square foot (plus NNN) average in the overall Dallas/Fort Worth retail market.

The Seventh Street corridor in Forth Worth is another good area to watch. It has blocks of land for potential development and benefits from the barbell effect, anchored on one end by downtown Fort Worth and the other by the cultural district and high demographic neighborhoods. Though this corridor has been somewhat overlooked in recent years, people are returning.

— James Blake, CCIM, senior advisor for Sperry Van Ness in Fort Worth

Central Texas

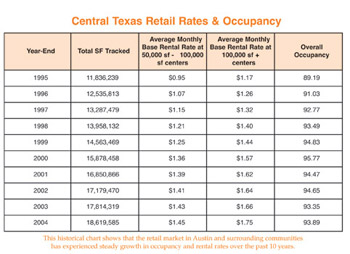

The Central Texas retail market, comprised of Austin and the surrounding communities, is strong by any standard of comparison, with an overall market occupancy rate of approximately 94 percent. The overall retail occupancy rate has been above 93 percent for the past 6 years in a row.

Average retail rental rates have also shown gravity-defying strength throughout the economic downturn that has softened rental rates in other segments of the Central Texas commercial real estate market. Average rental rates for multi-tenant shopping centers between 50,000 square feet and 100,000 square feet were $1.45 per square foot, per month plus NNN at year-end 2004 and centers over 100,000 square feet reported average rates of $1.75 per square foot, per month plus NNN.

The retail strip center market is still being driven by brand name retailers such as H-E-B, Target, The Home Depot, Kohl’s, Wal-Mart, Walgreens, and the junior anchors and small shops that like to follow them. Fast, casual dining restaurants are also a hot segment of the market as Americans look for quick and healthy options for their busy lifestyles. Simon Property Group is still the dominant player in the local mall and lifestyle markets, but other well-capitalized local, regional and national developers such as Trammell Crow Company, Endeavor Real Estate Group, Catellus Development Corporation and Cencor Realty Services are working hard to stake their claim in the Central Texas market.

Lifestyle centers, as well as traditional neighborhood and New Urban developments, are the trend for new retail development. There are several lifestyle centers, or some variation thereof, in the works in the Central Texas area. Cencor Realty Services is currently developing the long awaited Triangle project in north central Austin with a mix of residential above small shop retail. We are also seeing a couple of significant developments start to turn dirt. Simon Property Group and Catellus Development Corporation are beginning two of the higher profile mixed-use developments in the region. Simon Property Group’s Domain project will be anchored by Neiman Marcus. Catellus Development Corporations’s Robert Mueller Municipal Airport redevelopment project will be anchored by Seton’s Children’s Medical Center of Central Texas. Looking out on the horizon, there is a wave of retail development that will be locating at the intersections of new and established roadways. Central Texas has a number of major roadway projects currently underway, such as SH-45 and SH-130, which will influence the traffic patterns for years to come. Housing development has already occurred near many of these future roadways, which is the perfect scenario for retail growth. Look for continued retail interest in such areas as Buda, Kyle, Cedar Park, Round Rock, Hutto, Bastrop and Georgetown. Some examples of this trend are Simon Property Group’s Wolf Ranch project in Georgetown, on IH-35 at SH-29 and anchored by Target, Kohl’s and T.J. Maxx; Cabela’s on IH-35 at Loop 4 in Buda, which is drawing a host of retail activity such as Wal-Mart; Endeavor Real Estate Group’s SouthPark Meadows project on South IH-35 at Slaughter Lane with Phase I anchored by Wal-Mart and PetsMart.

Central Texas is maturing as a retail market. This is evidenced by the proliferation of developers, retailers and city officials now focusing on enhanced design standards. It is also noticeable by the recent announcement of retailers such as Crate & Barrel and Neiman Marcus. This trend is being promoted by community interest and a multitude of developers intent on creating projects that reflect the quality of life that makes Austin and the surrounding communities such an attractive place to live.

— Eric DeJernett, CCIM, principal; Bryan McMurrey; Dean Janeff; and Sherry Naquin,NAI Commercial Industrial Properties Company

San Antonio

San Antonio has firmly established itself as a major Texas city. From advances in its biotechnology services fields to the manufacturing industry with the Toyota plant construction to the explosion of retail projects, San Antonio has seen positive growth as a result of its diversified economy.

San Antonio has seen 11 consecutive quarters of positive growth. The job market has expanded rapidly with more than 12,000 new jobs added in 2004 alone — and economic forecasters anticipate an additional 18,500 jobs for 2005. In mid-April, San Antonio received another boost to its current economic trend with the announcement that the National Security Agency (NSA) has leased the former Sony chip plant on the west side, and will bring in 1,500 white-collar jobs while simultaneously attracting more military contractors and suppliers to the area as well.

Residential growth is driving retail growth in San Antonio. Records continue to be broken as housing starts surpass those from 2003 by 12 percent. During 2004, 12,700 starts were recorded and the projection for 2005 is expected to increase by 5 percent.

Thanks to this housing boom, 180,000 new residents are expected in west San Antonio in the next decade. The north-northeast and northwest areas are experiencing major growth as well. San Antonio’s superb cost of living is fueled by the healthy demand in the housing market as well as competitive pricing due to the many new builders entering the market including California-based Standard Pacific Corporation, which recently opened an office in San Antonio.

Commercial real estate values have also taken an upward turn. Retail development is brisk and the leasing activity is extraordinary. With the demand so high and the supply relatively low, rental rates are increasing. At the end of the fourth quarter of 2004, the average rate per retail square foot was $14.75.

The San Antonio retail market will continue to be strong in 2005 and 2006, but it will be sensitive to the interest rate. As interest rates rise, so will cap rates, and building activity will slow some. However, there is currently a lot of money available in the lending and equity markets. As long as it does not get too expensive, the financing environment will continue to be strong.

One shadow on the retail market in San Antonio is the Walzem Road/East area. The area is struggling with enormous vacancy, including Windsor Park, a dead mall.

All types of retail projects are doing well, especially big box and lifestyle centers. SuperTarget, H-E-B and Wal-Mart Supercenter are the most sought-after retailers in part because they attract other tenants.

The submarkets currently reflecting the most intense development and growth are found in the north-northeast and northwest areas. Berndt Interests Inc., Birnbaum Property Company, General Growth and many other developers are working on major retail projects in these areas. The highly anticipated Shops at La Cantera will debut high-end retailers such as Neiman Marcus, Nordstrom, and Tiffany & Company into the San Antonio market beginning in September. More than 4 million square feet of retail space is proposed at the intersection of IH-10 and Loop 1604. The planned developments at U.S. 281 and Loop 1604 and Potranco Road and Loop 1604 have put San Antonio on the list of top Texas cities for retailers to consider.

— Tom Sineni, president of United Commercial Realty – San Antonio, and Jeanne M. Peterson, project marketing director of United Commercial Realty.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|