| FEATURE ARTICLE, MARCH 2012

ALMOST THERE

Texas is on the last leg of distressed asset lifecycle for retail properties — sale of distressed properties.

Nick Tarantino

The distressed asset lifecycle that real estate brokers, property owners, attorneys, lenders, architects, engineers and developers have been moving through since 2008, appears to be in its last phase — the sale of distressed assets. The cycle started out in the early 2000s with a booming and active economy with uncontrolled underwriting, overbuilding and aggressive lending techniques.

In 2008, when the Great Recession began, the distress in the commercial real estate sector was evident. Huge funds began to form, stockpiling cash to buy distressed assets as many expected a repeat of the Resolution Trust Corportation (RTC) days of the 1980s where properties were sold quickly at huge discounts.

In 2009, as the economy worsened, performing commercial real estate loans were turning delinquent and becoming distressed faster than the system was set up to handle them. These distressed loans funneled into bank’s REO departments and for the loans that had been securitized, they went to special servicing firms. During the first quarter of 2008, according to Real Capital Analytics, about $6 billion dollars worth of assets became distressed in the U.S. During the second quarter of 2009, the number of distressed assets added for that quarter jumped to nearly $45 billion dollars. That’s a 650 percent increase in just over 1 year.

While the nation was losing jobs at an increasing rate, the servicers were hiring. In many cases, the same people that worked on the loan originations and securitizations were hired on and became asset managers and loan workout coordinators tasked with having to deal with all of this troubled real estate that was coming to them at an increasing rate. And with little or no money into the deal, the owners of the real estate with non-recourse debt simply handed over the keys and walked away in many cases (not without taking the last month’s rent and security deposits, of course). The lenders scrambled to find property managers, receivers and leasing agents to take control of the operations of these assets and preserve the value. In Austin, Tarantino Properties, Inc., took control of six foreclosed commercial properties in a 3-month period, even though Austin was considered a “recession proof” city.

Trying to better understand the value of the assets the lenders controlled, brokers were inundated with broker’s opinion of value requests (BOVs). In many cases, the loans were made based upon projected NOI growth that never came to fruition, and thus the current market value of the assets were well below the original loan amounts.

In 2010, as the amount of distressed assets continued to mount, potential real estate investors continued to gear up preparing to buy, but were not seeing the deals they had anticipated. Much to the dismay of the funds stockpiling cash to buy distressed assets at pennies on the dollar through “fire sales”, banks and special servicers this time employed a different strategy — they held. Phrases like “extend and pretend,” and “a rolling loan collects no loss” describes the technique used by many lenders doing short term extensions on loans rather than foreclose.

On the properties where they did foreclose or had them given back by the borrower, the strategy was to wait it out, hold and operate the asset and do whatever they could to increase the value. The plan was to operate the property better than the previous owner and to let the economy improve before selling the collateral and writing it off at a huge loss. On one property, Tarantino Properties did nine lease renewals on more than 40 percent of the shopping center’s net rentable area (NRA) in one 12-month period. On another, Tarantino leased the property from less than 50 percent occupancy to 100 percent and with a better NOI or net operating income than at the time of the initial acquisition.

However, lenders are not typically long-term owners of real estate — they aren’t set up for it. It takes a tremendous amount of people, communication and time to own and operate real estate via a lender, which uses a team of attorneys, asset managers and agents, and requires a credit committee’s approval to make decisions. Once lenders have held the real estate long enough to gain control of the asset, understand what it is that they own and do their best to improve the NOI, they sell. And that is what we saw really start to happen in 2011.

In 2011, the economy improved, corporate profits were trending upward and lenders were lending again. The assets in foreclosure and receivership have been under lenders’ control for anywhere from 6 months to 3 years. The local managers and leasing agents have done what they can to help restore NOI. The BOV’s pipeline and the foreclosures decreased and the sale of commercial real estate increased. In the second quarter of 2009, less than $1 billion dollars worth of distressed assets were sold. In the fourth quarter of 2011, more than $10 billion dollars worth of distressed assets were sold, and since the fourth quarter of 2010, more than $45 billion dollars worth of distressed assets have been sold.

The banks and special servicers were selling, and it appears that their strategy worked. They extended the distressed asset lifecycle out by not making immediate write downs and sell offs. They held and worked the assets through the REO departments and special servicing and preserved as much value as possible.

And, just because the deals aren’t coming out at pennies on the dollar like anticipated, for investors, the opportunities are still great. Many of the distressed assets have had lease renewals or new leases done recently at current market rental rates, which can be dramatically down from rates 5 years ago. That means the opportunity is for the new buyer to come into the property at the right basis, and ride the market to increased occupancy and with increasing rental rates as conditions continue to improve and more efficient ownership structures make long-term decisions. Additionally, while the lending requirements are much more restrictive, the interest rates are at record lows, making for extremely attractive leveraged returns.

That is what has me so excited as we come to the end of the distressed asset lifecycle. New owners, making investments, have the capital to put into the assets, which mean they spend money on attorneys, architects, engineers and contractors to do work and improvements.

Recently, at a CCIM breakfast in Austin, Dr. Mark Dotzour, chief economist at the Real Estate Center at Texas A&M, described the U.S. economy as a “jack in the box.” What he is describing in this analogy is the growth and activity in the economy is like the jack in the box before it pops out. The trigger holding the jack in is the uncertainty that remains with investors and consumers.

The data is showing that companies are making profits and households and consumers are spending again; that’s the activity inside the box. But the uncertainties holding us back are the unpredictability of the laws, policies and decisions of our government, combined with concerns for the global economy. As the future becomes clearer, the trigger may release and we could be booming once again.

It should be noted that with more than $1 trillion worth of commercial real estate loans coming due during the next 5 years, many questions remain unanswered. For the most part, loans have been able to be worked out or refinanced. The lending environment is much more favorable than it was just 2 years ago.

However, with NOIs down due to market rental rate decreases and concessions offered during the past several years, this distressed asset lifecycle looks to be in its last phase for a lengthy period of time.

— Nick Tarantino, CCIM, vice president of Austin-based Tarantino Properties

|

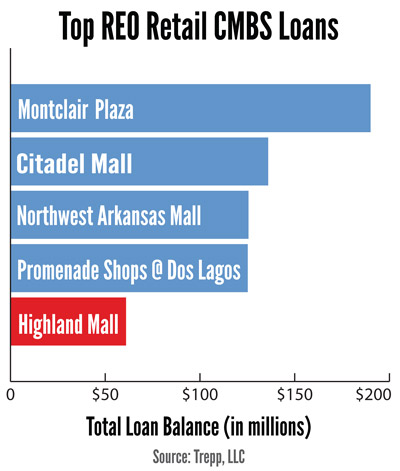

Highland Mall is located in Austin and has a balance of approximately $61 million. Montclair Plaza is located in Montclair, Calif.; Citadel Mall is located in Colorado Springs, Colo.; Northwest Arkansas Mall is located in Fayetteville, Ark.; and The Promenade Shops at Dos Lagos is located in Corona, Calif. |

|

©2012 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|