| TEXAS SNAPSHOT, MARCH 2007

San Antonio Industrial Market

San Antonio’s warehouse market appears to be in great shape with another year of positive absorption under its belt. The vacancy rate dropped again in 2006, and the market’s future looks bright due in large part to the national exposure that Toyota has brought to the city, according to Ryan Smith, vice president and partner of San Antonio-based Cross & Company. With that in mind, San Antonio’s industrial market is experiencing two big trends as 2007 gets underway — continued speculative development and more functional warehouse design.

In 2005 alone, 1.7 million square feet of Class A speculative space was added to the marketplace, followed by 1.2 million square feet in 2006 and 1.5 million square feet that is presently under construction or planned in 2007. “All of this activity is significant when you consider that the San Antonio distribution warehouse market is only approximately 33.72 million square feet, according to the local office of Grubb & Ellis,” Smith says.

Additionally, these newly constructed warehouses have been designed to be more functional. “Specifically, San Antonio’s newest warehouses have taller ceiling clear heights, deeper truck courts and more vehicle parking spaces, which in many cases are separated from the truck court for safety,” Smith says. “All of these physical characteristics help explain why the newly constructed warehouses have been leasing so well, despite the fact that only three of the 21 tier-one Toyota suppliers elected to locate their facilities away from the Toyota plant, which opened in late 2006.”

The newly constructed warehouses have been leased by distribution companies — some that are new to the market and many that were already here but were previously occupying older warehouses without many of the physical characteristics previously mentioned. “The reason, in my opinion, has been that companies are recognizing the cost saving benefits of higher ceilings,” Smith says. For example, if a company elects to relocate into a new 30,000-square-foot warehouse with a 32-foot high ceiling, as opposed to its previous 30,000-square-foot warehouse that may have only had a 24-foot high ceiling, then it gains approximately 60,000 square feet of additional racking space by being able to add two more levels to its warehouse racks, according to Smith. “This translates into higher productivity relative to its occupancy costs, which is appealing to every growing distribution company,” he says. “Therefore, our market appears to have been experiencing the benefits of pent-up demand for these more modern and functional warehouses.”

There are primarily three active industrial parks in San Antonio where much of the city’s speculative development is taking place (or, where there’s potential for significant development): Port San Antonio (formerly Kelly USA), Tri-County Industrial Park in Schertz and Cornerstone Industrial Park on the east side of San Antonio.

“Port San Antonio is the wild card — its location in southwest San Antonio off of Highway 90 handicaps it by being so far off of IH-35, but it is the nearest industrial park to Toyota and, more significantly, it has 1,880 acres with a development potential for up to 8.2 million square feet of warehouse space,” Smith says. “Furthermore, it has the potential to become an inland port since it possesses an 11,500 foot-long runway, rail service, and 65 existing tenants, many of which are in the aerospace industry. Port San Antonio has the potential to have the most significant economic impact on the San Antonio industrial market’s future, but it has yet to gain any real critical mass in the general warehouse market.”

Another property in San Antonio with significant activity is Cornerstone Industrial Park. Developed in the late 1980s by San Antonio Savings & Loan, this 270-acre industrial park became the focus of new construction activity with a speculative 188,000-square-foot warehouse completed in 2005 combined with another 400,000 square feet of warehouse space scheduled for completion this year, according to Smith. Cornerstone is located on the east side of San Antonio in the northeast corner of Interstate 10 and Loop 410. “It is effectively positioned at the cross roads of all truck traffic from Mexico (NAFTA) and the IH-10 traffic from California to Florida,” Smith says. “Incentives available to companies considering Cornerstone include a Foreign Exchange Zone and a Triple Freeport Zone (county, city and school district).”

The third significant industrial park is the Tri-County Industrial Park, located just off IH-35 in the city of Schertz. The originally 280-acre park was developed in the late 1980s and is now virtually built out with more than 2 million square feet of distribution warehouse space, so several developers have taken large land positions to expand this thriving industrial area, Smith says. “A significant reason for the park’s success has been due to Schertz’s quick building permit issuance and tax incentives that keep the operating expenses lower than competing properties,” he says. “Tri-County is also a Double Freeport Zone (county and city only), which provides companies an exemption of up to 100 percent of personal property taxes on goods-in-transit or inventories in manufacturing process that are moved outside of the state of Texas within 175 days.” The park presently has 470,000 square feet of just completed or under construction warehouse space.

With Tri-County Industrial Park generating so much activity, the majority of the current industrial activity in San Antonio is found in Schertz, a city that consistently demonstrates an extremely pro-business civic government and benefits from an excellent location for those companies interested in the Austin/San Antonio corridor, according to Smith.

The active industrial developers in San Antonio continue to be ProLogis, Verde Corporate Realty Services, Titan Development and Cross & Company. The newest developer to the market is EastGroup Properties, which entered the market in 2005 by making several key acquisitions on their way to creating a 975,000-square-foot local portfolio, Smith says. “In 2006, they constructed two buildings totaling 106,000 square feet and they have two more buildings totaling 222,000 square feet planned for 2007,” he says.

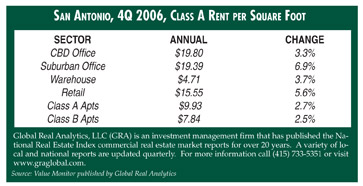

According to the Grubb & Ellis Industrial Market Trends San Antonio Fourth Quarter 2006 report, warehouse rental rates averaged $3.81 per square foot through the fourth quarter of 2006, but that is an average of all deals signed, including newly constructed warehouses as well as new leases signed in existing older facilities, Smith says. “Therefore, it is important to note that the modern more functional warehouses have quoted rental rates from $4.35 to $4.50 per square foot,” he says.

According to the Grubb & Ellis report, the citywide vacancy rate for distribution warehouse space is 10.8 percent with 3.9 million square feet of space absorbed in 2006. “However, 2 million square feet of that was attributable to the opening of the Toyota manufacturing plant,” Smith says. “Furthermore, many of the vacant properties are antiquated by virtue of having low ceiling clear height and/or shorter truck courts, which is the primary reason for the significant increase in new construction.”

Overall, San Antonio appears to be in the early stages of an enormous growth cycle that will allow us to look back and say that we were fortunate to have been in the right place at the right time, according to Smith. “Furthermore, if the U.S. and Mexico are ever successful in negotiating a cross border trucking accord, then San Antonio’s geographic location at the intersection of IH-35 going to Canada from Mexico and IH-10 from California to Florida will finally provide San Antonio with much greater and long anticipated benefits of NAFTA,” he says.

— Ryan S. Smith is vice president and partner with San Antonio-based Cross & Company.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|