| TEXAS SNAPSHOT , MARCH 2005

San Antonio Multifamily

Market

The San Antonio multifamily market continues to be strong. According to the San Antonio Multi-Family Trends Report by Austin Investor Interests, the San Antonio market saw 1,636 new conventional units completed last year, a net gain of 1,300 conventional units in the market. Despite the increase in number of units, Austin Investor Interests also reports that the average multifamily occupancy rate in San Antonio has remained steady and is at 91.01 percent.

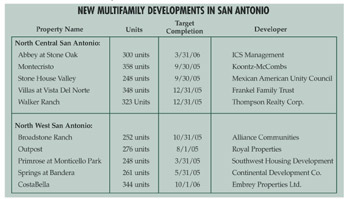

Since the market has been so robust in the last 2 years, the trend here has been to continue to build more units. The majority of this new multifamily construction has occurred in two geographical areas: the north central quadrant and the northwest quadrant. Perhaps the strongest, the north central quadrant is located along Highway 281 and north of Loop 410. The second area is the northwest quadrant, along IH 10 and north to Loop 1604 and beyond. In north central San Antonio during 2004 and 2005, ICS, Alliance Communities, Frankel Family Trust, Koontz-McCombs, Mexican American Unity Council Inc., Housing 2000 and Thompson Realty Corporation will develop almost 3,000 units total. In the northwest part of town, developers such as Alliance Communities, Busick Properties Inc., Royal Properties, Southwest Housing Development, Continental Development Company, Embrey Properties Ltd., Hogan Real Estate Services, Franklin Development Corporation, Duke Residential Development, Samuel Kobrinsky, Flournoy Development Company, Trademark Property Company and Housing 2000 will bring almost 5,000 units on line in the near future.

Sperry Van Ness expects the north central and northwest areas of San Antonio to continue to be strong because of their proximity to the medical and research clusters as well as The University of Texas at San Antonio.

New developments are looking to attract upper- and middle-class professionals; thus, the newer product will boast larger units and more amenities, such as garages, fitness centers, business centers, movie theaters and car washes.

According to Austin Investor Interests, rental rates have increased slowly and will likely continue to do so. Austin Investor Interests reports that the current Class A rate averages 95 cents per square foot, the Class B rate averages 82 cents and the Class C rate averages 71 cents. The average rent per unit in San Antonio is currently $639. Approximately 70 percent of the market is still offering concessions. Multifamily sales have begun to taper off, and, consequently, cap rates are down.

San Antonio has always maintained a steady, but slow, growth economy. It has never experienced the “boom or bust” economic roller coaster that other cities experience. This is due largely to the fact that San Antonio’s economy is influenced by the stable healthcare, construction and tourism sectors. Local companies added some 16,000 new jobs to the San Antonio economy in 2004 and more companies are moving to San Antonio. Toyota is planning an $800 million dollar production facility on the south side of San Antonio. The company is expected to begin hiring in 2005. Xenotope Diagnostics recently relocated from San Francisco to San Antonio. The company chose San Antonio because it is a “biotech breeding ground.” Strategal, an information technology company, recently chose San Antonio for its relocation, citing the low cost of living, quality of life, and talent base.

— Rex Jones is a senior advisor with Sperry Van Ness. He is active in the San Antonio and Austin markets.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|