| TEXAS SNAPSHOT, JUNE 2009

Dallas/Fort Worth Office Market

|

Riner |

|

The Dallas Fort Worth (D/FW) office market has gone through another successful quarter. First quarter 2009 ended with a positive net absorption of 1.2 million square feet and a vacancy rate of 16 percent. Fortunately, the first decline in D/FW job growth was not felt until January 2009. These two major trends have set D/FW up for the “last in, first out” model of recovery. This is a much different trend than experienced during the last two major recessions, and this time D/FW is the right market to be in to ride out the recession. One of the major factors that has put D/FW in this positive light, as compared to the rest of the other major office markets across the country, is the pre-leasing of 241,500 square feet of the 965,387 square feet of new construction that came online in the first quarter.

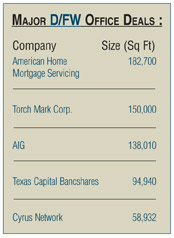

The D/FW office market as a whole has experienced positive net absorption for the last 6 years. The following are a few of the large deals that contributed to this. Torch Mark Corporation took 150,000 square feet at Stonebridge Ranch; AIG leased 138,010 square feet at South Tower; Texas Capital Bancshares. Inc signed on for 94,940 square feet at Texas Capital Bank Building; American Home Mortgage Servicing took 182,700 square feet at Point West I; and Cyrus Network leased up 58,932 square feet at convergence in Lewisville. There are still a handful of large transactions that are on the horizon for the remainder of 2009, which, if signed, will continue to lessen the blow of the national recession.

Construction deliveries at the end of first quarter 2009 totaled approximately 4 million square feet, and 1.3 million square feet is slated to come online at the end of second quarter 2009, with 390,000 square feet of that being pre-leased. In the third quarter of this year, 900,000 square feet is expected to come out of the ground with 350,000 square feet already pre-leased. For the fourth quarter, a delivery of just over 400,000 square feet is expected with 360,000 square feet of that space pre-leased. Lastly, the 1 million-square-foot Blue Cross Blue Shield building in the Richardson/Plano submarket is set for completion first quarter 2010. This building is 100 percent pre-leased. Once again, the pre-leasing of future space will lessen the blow of the national recession on the D/FW office market.

First quarter 2009 sublease space ended at 2.27 million square feet, a decrease of 230,000 square feet from fourth quarter 2008. This number is expected to increase by at least 12 percent during the second and third quarter of this year. This is due to the lag effect of D/FW being one the last markets to truly enter the recession. However, now that job growth will trend into the negative area, sublease activity will increase. The lack of capital in the liquidity markets will act as a governor for future speculative development, helping the market to continue to outshine the rest of the other major office markets across the country. Asking rents for Class A space has fallen 0.09 percent from quarter over quarter, and Class B space remained the same. Class B rates are expected to further trend downward and Class A space will continue to move downward throughout the year. New deliveries, sublease competition and declining jobs will all contribute to the slow down in leasing.

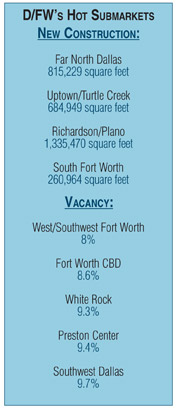

Some office submarkets are experiencing construction activity. Far North Dallas is slated for 815,229 square feet and uptown Turtle Creek is expected to bring 684,949 square feet online. Richardson/ Plano has 1,335,470, square feet slated for completion, but once you remove The Blue Cross Blue Shield building it equals to only 335,470 square feet. Lastly, South Fort Worth is set for 260,964 square feet, and the rest of the submarkets are expected to bring less than 200,000 square feet to the marketplace.

The healthiest submarkets with a base of 4 million square feet or more with single digit vacancy rank in the following order: West Southwest Fort Worth (13.7 million square feet) has a vacancy rate of 8 percent, Fort Worth central business district (11 million square feet) has a vacancy rate of 8.6 percent, White Rock (6 million square feet) has a vacancy rate of 9.3 percent, Preston Center (5 million square feet) has a vacancy rate of 9.4 percent and Southwest Dallas (4.6 million) has a 9.7 percent vacancy. Uptown Turtle Creek has historically had the highest asking rents and is expected to remain a consonant hotspot for years to come. The current asking rent is $30.15 per square foot.

When you start to break down each space by submarket, it becomes clearer what opportunities lie ahead. For example, subleasing on the negative side will pick up as the recession goes through its cycle, Class B and C space will blend to extend, and landlords will offer more tenant improvements and more concessions. But remember, a day lost of rent is lost forever. For corporate America, at least a few of the bold and brave, it will mean a time to bargain hunt and consolidate facilities or just simply upgrade office space. Class B and C properties will be the hunting ground if there is an A space nearby. From the owner and asset management side, it is time to get into the relationship business. From a developer side, it is also time to get into a relationship business. Therein lies the source — The Broker! You get my point. I hope to see you on the playing field soon!

— Rob Riner is a principal with Lee & Associates in Fort Worth, Texas.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|