| TEXAS SNAPSHOT, JUNE 2007

Dallas Multifamily Market

Dallas/Fort Worth is an active multifamily market with conversions, new development and significant deals all benefiting from strong area fundamentals, according to Brian O’Boyle, principal with Apartment Realty Advisors (ARA) Dallas. Several former office towers in the central business district (CBD) currently are being converted to apartments, such as the Mosaic project located at North Akard and Pacific, which Hamilton Properties is converting into a 440-unit residential tower. Other examples include the Gables Republic Tower, a 36-story tower that is being refurbished into 229 residential units and the Mercantile Block redevelopment, an entire city block that is being redeveloped by Forest City Enterprises.

The majority of multifamily activity is taking place intown, with 1,900 units targeted for delivery in the first quarter of 2008. “Las Colinas/Valley Ranch, Oak Lawn, West Plano and Allen/McKinney are other areas of town seeing multifamily development, and Lewisville has delivered over 1,400 units in the last 12 months,” O’Boyle says.

Several areas of town have big projects in the works and are good places to watch for future growth. In the area off Spring Valley/Brookhaven Club Drive and Marsh in Addison, UDRT has acquired several projects and is planning a major redevelopment. From Meadow Road to Royal Lane and Greenville Avenue to Central Expressway, approximately 2,500 units are being demolished and will be redeveloped by Balencia Capital Management into condominiums, townhomes and upscale apartments. In addition, in the Lovers Lane/Greenville Avenue submarket, three projects — Signature Pointe, Amesbury Townhomes and The Plaza on Lovers Lane — will be redeveloped into upscale multifamily units.

In Las Colinas, a large employment base is driving sales and new development. For example, SCI Real Estate Investments just purchased the 367-unit Mandalay on the Lake community, and 800 units currently are being built around Lake Carolyn. “In the La Villita sector of Las Colinas, AMLI is developing 288 units and Lincoln Property Company has Lincoln at Lakeside under construction,” says O’Boyle.

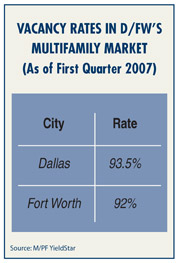

In the second half of 2007, occupancy will continue to improve and the Dallas multifamily market will see a gradual burn off of concessions. “Last year saw a record sales level in Dallas County for projects of more than 100 units, and of those 117 transactions, 41 were Class A deals,” O’Boyle says. “A limited amount of Class A and B product is on the market right now, but the amount of available product for sale will increase in the second half of 2007.”

According to O’Boyle, the D/FW metropolitan area will continue to produce significant job formations that will, in turn, create demand for additional residential units. The Metroplex boasts a lower cost of living index compared to other major metro areas and will continue to see more companies relocating their operations to the area — creating the need for more housing, especially multifamily. “Looking at the numbers, between 20 percent and 30 percent of the first-time home buyers cannot qualify for a mortgage today due to stricter underwriting guidelines,” O’Boyle says. “This will put more people back into apartments.”

— Brian O’Boyle is a principal with Apartment Realty Advisors (ARA) Dallas.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|