| COVER STORY, JULY 2011

INDUSTRIAL ROUNDUP

As Texas recovers faster than other parts of the nation, how are its industrial markets faring mid year?

HOUSTON

Houston, the energy capital of the world, is tied to the demand for energy and local oil and gas companies appear to be standing strong in the midst of the nation’s recovery from the Great Recession. An increase in oil exploration, along with strong oil prices, should bode well for the energy sector’s employment potential. Loans will continue to be subject to strict criteria in Houston’s industrial commercial real estate market, but the area has regained two-thirds of its job lost during the recession — significantly outpacing the nation. However, the goods producing sector of mining, construction and manufacturing has not fared as well as other Houston sectors, having regained only 22,400 jobs or 27.6 percent of the jobs lost during the recession.

According to CB Richard Ellis, the vacancy rate for the Houston industrial market dropped in the second quarter of 2011 from 6.5 to 6 percent in part due to Jacobson Warehouse signing a deal to lease the 436,410-square-foot Building Two at InterPort Distribution Center in Pasadena, Texas. That represents the largest lease in the Port of Houston area and it has consumed close to 10 percent of the vacant industrial space in the southeast submarket.

“The lease signifies a breakthrough for a submarket which has recently recorded double-digit vacancy rates, while other Houston markets are in the mid-single digits,” said John Talhelm, vice president of Jones Lang LaSalle. “InterPort Distribution Center is an attractive location for tenants like Jacobson Warehouse with requirements for storage and distribution efficiency as well as quality construction and stable ownership. The InterPort site offers a secure location in a controlled and well maintained environment with excellent accommodations for tractor trailer rigs and proximity to two container terminals.”

Talhelm, along with Will Swanson and Kevin Erck of Jones Lang LaSalle, represented the landlord, FR/CAL Interport, L.P., a property owned by the California State Teachers Retirement System (CalSTRS), in the 436,410-square-foot industrial lease transaction with Jacobson Warehouse. Located in the southeast submarket serving the Port of Houston’s container terminals, InterPort Distribution Center was part of an accelerated development trend that resulted in an overbuilt market. At its peak, vacancy rates in the submarket averaged more than 18 percent with minimal lease activity.

After Jacobson Warehouse’s more than 400,000-square-foot lease, Packwell, Inc. checked in with 136,928 square feet at Wallisville Industrial Park in the northeast inner loop submarket; Federal International at 100,000 square feet at 7611 Railhead Lane in the Northwest Highway 290/Tomball Parkway submarket; Sercel at 99,000 square feet at Techway Southwest Business Park in the southwest Sugar Land submarket; and Berlin Packaging at 80,200 square feet at Duke Realty’s Westland II in the west outer loop submarket.

“Berlin Packaging is experiencing tremendous growth,” said Sonny Atkinson, operations manager for Berlin Packaging in Houston. “We looked at several different facilities in the Houston area and the Westland II building provided all the features we were looking for. Relocating to a larger facility allows us to maintain the highest level of inventory management services for the Houston market.”

Westland II is a 300,000-square-foot, cross-dock industrial building that is more than 73 percent leased with Berlin Packaging’s lease of 80,200 square feet. Berlin expanded and relocated there in June. It is Duke Realty’s second building within Westland Business Park, located just south of Highway 290 at the West Road and Eldridge Parkway exit, approximately 2 miles west of the Sam Houston Tollway. Duke Realty began development of the speculative building in October 2010 when another tenant outgrew its space in Westland I. Jeff Venghaus of Jones Lang LaSalle’s Houston office and Chris Watts of its Chicago office represented Berlin Packaging, a distributor of rigid packaging including glass, metal, and plastic bottles, jars, cans and other containers, while Cory Driskill represented Duke Realty in house.

“Berlin Packaging knew specifically what they wanted in their new Houston warehouse and distribution center,” said David Hudson, senior vice president of Duke Realty’s Houston operations. “This new facility provides the space they need in an easily accessible and visible location and incorporates state-of-the-art features that will enable them to maximize their storage capabilities.”

Construction also picked up in the Houston industrial market during the first half of 2011. In the north, 500,000 square feet of pre-leased construction continues at Clay Development’s Kennedy Greens Business Park, while in the southwest, Ben E. Keith Foods broke ground in March for its 475,000-square-foot distribution center on 82 acres in Missouri City, Texas.

— Daniel Beaird

DALLAS/FORT WORTH

Smaller tenants have been the primary contributors to the Dallas/Fort Worth industrial market’s influx of leasing activity. The market continues on the road to recovery and key market indicators have experienced moderate improvement since the end of last year. Net absorption has increased and vacancy rates have decreased for the third consecutive quarter. Like its Texas brethren, Dallas/Fort Worth is expected to see better growth in the transportation, warehouse, manufacturing and wholesale trade industries than the rest of the nation during the next 5 years as Dallas/Fort Worth currently tops the nation in overall job growth.

In Dallas/Fort Worth’s industrial market, vacancy rates still have a substantial climb ahead of them, and construction activity is still almost non-existent and not expected to pick up pace until 2012. There are currently four projects underway in the Metroplex totaling more than 611,000 square feet. Construction began on one new industrial project in the second quarter, a distribution building that will be part of Traxxas’ future Craig Ranch office campus.

Most notably, the more than 1 million-square-foot Whirlpool distribution center in Wilmer was delivered in the second quarter of 2011. Duke Realty developed the center for Whirlpool as a consolidation of several smaller warehouses in North Texas. A partnership set up by CB Richard Ellis Realty Trust bought the distribution center for more than $40 million in the second quarter of 2011.

— Daniel Beaird

EL PASO

Industrial real estate activity is up in the El Paso/Juarez metro area, indicating that the recession-driven slump, which had been intensified by reported violence on the border, has not deterred companies from making long-term commitments to the region. The increase in industrial leasing and sales, as well as improved employment statistics and increasing commercial truck crossing data are all positive signs for the future of the local industrial economy.

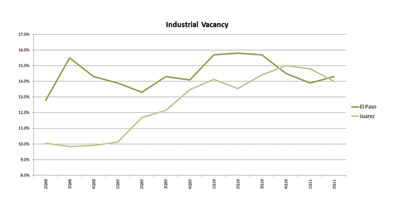

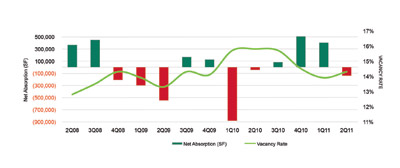

The industrial market in El Paso and Juarez totals a 115 million square feet split between two countries and is an intersection of international manufacturing firms, global supply chains and the local economy. During the past 3 years both the global recession and security situation in Mexico have reverberated across the industrial market. However, industrial leasing and sale activity is up on both sides of the border with Juarez leading the way at 658,000 square feet of net absorption during the first 6 months of the year and El Paso recording 264,000 square feet. However, El Paso was the first city to start the rebound in 2010 with almost 600,000 square feet of net industrial absorption in the second half of the year. Both markets have seen industrial vacancy levels recede from all time highs in 2010 as shown in the accompanying chart.

|

El Paso, Texas and Juarez, Mexico Industrial Vacancy Rates. Source: CB Richard Ellis

|

|

In El Paso demand has continued to be focused on the East side of town driven by companies wanting to be close to the Zaragoza International Bridge. There remains a fair amount of vacancy in this part of town but it is concentrated in a small handful of large distribution buildings that were vacated during the recession. Activity in Juarez has been across the city with the common factor in new absorption being companies expanding or relocating within the same submarket.

|

Net Absorption versus Industrial Vacancy Rates for El Paso, Texas.

Source: CB Richard Ellis

|

|

These statistics are reflective of growing industrial sector activity nationally as indicated in the Federal Reserve Bank of Dallas’ April 2011 Economic Update for El Paso. Increases in activity for March hovered around 10 percent annualized. In turn, Cd. Juarez maquiladoras payroll rose by an almost seven percent annualized rate during the same month, the benefits of which should be seen in the El Paso economy in the coming months.

In addition to the statistics pointing to an improving situation on both sides of the border, anecdotal evidence is also largely positive. Starting in the summer of 2010, CBRE’s industrial team began to see an increasing demand from warehouse and Third Party Logistics (3PL) firms. We have always seen activity from this sector as a leading indicator of market conditions as it often reflects increasing industrial production levels. Contrary to the start of the last cycle in 2004, we saw activity in El Paso pick up before activity in Juarez. We believe this is a result of both revised logistics models and continued security concerns in Juarez.

Another positive indicator of renewed interest in Juarez is the number of manufacturing plants purchased in 2010 and 2011. Data shows 580,000 square feet of vacant second generation manufacturing plants were purchased by users in Juarez during the last eighteen months. These were all expansions coming from the existing industrial base and do not include the 365,000 square feet of investment sales during the same time frame. We expect to see more user purchases in the second half of 2011.

Finally, one of the main components of area growth that has been missing during the past 3 years is high profile investment announcements. This changed rapidly in 2011 with announcements of increased production capacity in Juarez from Foxconn, Electrolux, Automotive Lighting, Plexus and Via Systems Group. These projects are expected to generate more than 1,400 new jobs and represent some of the largest manufacturing employers in the region.

— Christian Perez Giese of CBRE El Paso

©2011 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|