| TEXAS SNAPSHOT, JULY 2006

Houston Multifamily Market

Currently, developers are increasing density on in-fill multifamily product in order to absorb the rapidly increasing land prices in Houston’s most desirable Inner Loop submarkets, according to Craig LaFollette, senior vice president of CB Richard Ellis (CBRE) in Houston. “We are seeing more mid-rise and high-rise residential,” LaFollette says.

Several new residential projects are underway or in the planning stages in the Houston market. The Finger Companies, for example, has recently announced a 37-story luxury high-rise in downtown Houston consisting of 347 units. “This is the first high-rise rental community built in downtown in more than 40 years,” says Todd Marix, also a senior vice president in CBRE’s Houston office. “The plans for the project include 27,000 square feet of retail space at street level that will most likely be leased to a specialty grocery, wine merchant and a restaurant — bringing a true urban residential lifestyle experience to Houston.”

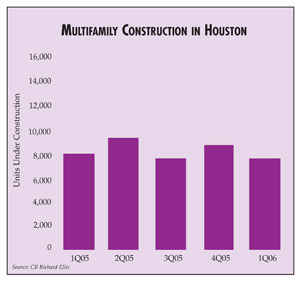

The majority of multifamily development primarily is taking place in the Inner Loop, West and Nortwest submarkets, according to LaFollette. “Of the approximately 10,000 units currently under construction, 90 percent of that activity is occurring in the Central, Southwest, and Northwest sectors,” he says.

New builders to the Houston market include ZOM, Wood Partners, Davis Development, Grayco Partners and Guefen Development.

In Houston, multifamily product type tends to hinge on location and corresponding land prices. “Suburban product has the more traditional 25 to 30 units per acre for density,” Marix says. “Closer in locations have more dense product — 50 to 60 units per acre — for mid-rise and even higher for high-rise.”

The overall average rental rate in Houston for multifamily product sits at 76.8 cents per square foot per month. The Class A average is 97.5, while the Class B average is 71.8. Class C product is averaging at 64.6, and Class D sits at 46.

Vacancies are improving throughout the market with the overall average occupancy at 90.4 percent. Class A and B products are seeing 90.6 occupancy, while Class C is averaging 91.2 percent. Class D is the lowest, with occupancy sitting at 85.8 percent.

In the near future, there should be increased activity along the Energy Corridor as oil and gas companies create demand and continue to hire. The best news for the Houston market is the continued strengthening of the Houston economy, specifically 75,000 jobs created in 2005 and projections of another 79,000 jobs for 2006, according to Marix. “This is welcome news for a market that has struggled with demand during the past few years,” he says.

In addition, the Hurricane Katrina effect created a spike in absorption and moved occupancy from the 80s to 90s. “The market faces a new challenge with the expiration of units rented by the City of Houston under the FEMA voucher program,” LaFollette says. “Escalating operating costs are a challenge for all operators in Houston, coming in the form of rising insurance premiums, rising utilities and increases in assessments from appraisal districts, which should be somewhat offset by a reduction in real property tax rates by new state legislation.”

— Craig LaFollette and Todd Marix are senior vice presidents in CB Richard Ellis’ Houston office.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|