| TEXAS SNAPSHOT, JANUARY 2009

San Antonio Industrial Market

Terry Warth, SIOR and vice president of CB Richard Ellis|Brokerage Services – Industrial Properties in San Antonio, recently answered a few of our questions about the local industrial market. Read below for what he has to say.

TREB: What major trends are affecting your area?

Warth: As we work through the days and months to come, the current national and worldwide economic conditions will affect us. The good news is that greater San Antonio is and continues to be an excellent place to do business and in which to live. That said, the reality is that 2009 is expected to bring new challenges and opportunities, as we move forward through a down market the likes of which we have not expeerienced in the past three down cycles in Texas — dating to the 1970s. I continue to believe we are extremely fortunate to be in Texas at this time.

TREB: What recent transactions (sales or leases) have impacted your market? Why? Are there any transactions in the works that will have a major impact?

Warth: The story is the lack of recent major transactions, thanks largely to the current market. A large number of transactions have been affected, many of which are now on hold or postponed indefinitely.

TREB: Are there any major projects (planned, completed or under way) affecting the market?

Warth: The Union Pacific Railroad Intermodal facility is one of San Antonio’s most significant projects and a huge step in turning the city into a regional transportation hub. It is expected to become the catalyst for a major industrial/business neighborhood located in the southwest sector of town.

Also, the recently completed Microsoft San Antonio Data Center, located in Westover Hills in the city’s northwest sector, is a major transaction. A 477,000-square-foot data center facility by a world-class user, the project affirms San Antonio as a viable location for the nation’s corporate data center operations and users, with draws such as infrastructure, base-line competitive cost of power and a location with minimal potential for natural disasters.

TREB: What are your thoughts on the current state of the market? What about going forward for the next year?

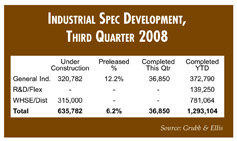

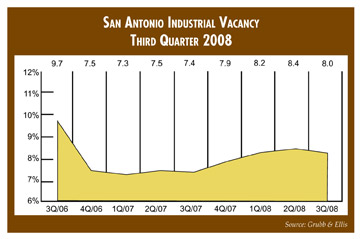

Warth: As for the current state of the market, San Antonio is not overbuilt in new industrial product, as possibly is the case in other market sectors. Market absorption for 2008 will end up in an expected 30 percent range, a decrease from that of 2007, with leasing activity for the most part slowing in the last half of year.

Going forward for 2009, absorption will continue to trend lower, but there is the opportunity to see a handful of significant transactions executed in the market, which will lhopefully end 2009 on a positive note. The market for 2009 is expected to see competition among landlords for tenants, existing or new, at a higher level than normal, with the determinate at the end of the day not only price or incentives to sign a deal, but also the features of the property to match the needs of the tenant/user. For the most part, Class A product will continue to be the preference, even as competition for each deal extends into a greater portion of the vacant inventory in the overall industrial market.

TREB: What submarket or area is a hotspot for activity or development in your market? Why?

Warth: There are several hotspots for industrial development in San Antonio. The IH-35 corridor in Northeast San Antonio — extending up the 1604 NE Loop and to Schertz — is one primary area. Also, the IH-10 East/410 NE Loop is hot, with the potential of future access to the IH-130 toll road once it’s completed. Lastly, there is growing interest in the south side initiative market sector by the city and county.

— Terry Warth is SIOR and vice president of CB Richard Ellis|Brokerage Services - Industrial Properties in San Antonio.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|