| COVER STORY, FEBRUARY 2012

FINANCIAL UPDATE

Where, oh where have all the CMBS defaults gone?

By Ann Hambly

|

Hambly |

|

From January 2009 through 2010, the CMBS default curve resembled a steep climb up Mount Everest with an approximate 90-degree incline. The default rate reached a peak of more than 12 percent of all outstanding CMBS debt — or over $80 billion — before starting a slight decline during the middle of 2011.

Amid the slight ebb in loan defaults, there was widespread speculation in the industry that maybe all the defaults were behind us and that this was a sign of a gradual recovery.

As it turns out, that perception was actually an illusion. Throughout 2009 and 2010, CMBS defaults were increasing at a fast and furious pace with virtually no resolutions or recoveries. The reason there were no resolutions is that no one knew when real estate values would increase again.

The majority of people took the wait-and-see approach, including most special servicers. We referred to this hesitation in the CMBS industry as a period of “kicking the can further down the road” or “delay and pray.”

When it became clear by early 2011 that valuations were not going to increase significantly anytime in the near future, the approach changed from kicking the can further down the road to figuring out a real resolution for the problem.

The default curve leveled off during the middle of 2011 because there were finally some real resolutions occurring, offsetting the continued increase in defaults.

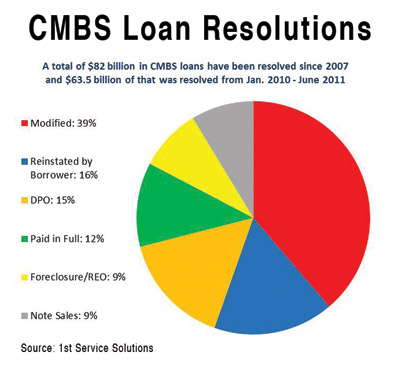

From 2007 through the middle of 2011, a total of $82 billion of CMBS loans were resolved in one way or another.

More than 75 percent of those resolutions ($63.5 billion) took place between the middle of 2010 and mid-2011. The resolution pace is now just as fast and furious as the defaults.

Since there are very few real estate owned (REO) properties tied to troubled CMBS loans, what is happening to all these defaults?

The good news is that the largest percentage of defaulted CMBS loans — about $25 billion — has been modified. That is because modified loans historically have provided a higher level of recovery for bondholders than loan foreclosures or note sales. Modifications are more likely to be the appropriate resolution in the following scenarios:

The borrower has new capital to contribute at the time of the modification.

There is sufficient term left on the loan to allow the value of the real estate to recover.

The borrower submits a realistic proposal in a format that is acceptable to the special servicer (that is where a borrower advocate comes into play).

Here are the other ways the $63.5 billion in CMBS loans have been resolved to date:

Borrowers have reinstated about $10 billion, either because the cash flow on the properties increased to a level that could support the existing debt, or because borrowers decided that the pain of paying out of pocket to cover payments was less than the pain of continuing with a modification and all the associated costs.

Another $9.5 billion was paid off at a discount. Although the discount amount is really a derivative of the actual current value of the real estate, the average loss severity on discounted payoffs is 50 percent.

About $7.5 billion was paid in full. The vast majority of these payoffs were likely maturity defaults that eventually got refinanced.

Only about $5.5 billion in CMBS loans were foreclosed and sold as REO properties. Foreclosure and REO sales on average resulted in the highest loss severity. Why? During the entire time that a loan is going through foreclosure and all the way through the eventual sale of the REO property, the bondholders have to be kept current, which significantly drives up the cost of this option.

The remaining $6 billion was sold through note sales. Although note sales resulted in significant discounts to the principal balance of CMBS loans, the loss severity was actually less than foreclosure because the transactions were done swiftly. In the CMBS world, time equals money.

The actual loss severity is really dependent on the property, market, vintage of the securitization and other variables.

Still, when a loan is modified, the average loss severity is less than when the special servicer goes through a foreclosure and ultimately sells the asset as a REO property and here’s why that is so important.

The special servicer for the CMBS pool is the party charged with making the decision about the ultimate resolution such as foreclosure or loan modification. When a new CMBS pool is formed and a special servicer is appointed, the special servicer signs up for what is referred to as the “servicing standard.”

The servicing standard requires the special servicer to take the course of action on a loan that will ultimately result in the least amount of losses to all classes of bond holders, regardless of the special servicer’s own bond position at the time.

When the special servicer is determining the appropriate course of action on a particular loan, he must perform a mathematical calculation of the potential net recovery to the bondholders for each scenario, and then do a net present value calculation of each scenario to determine which course of action will result in the highest recovery — or the least amount of loss — to the bondholders.

Remember that the bondholders have to be kept current the entire time the loan is being foreclosed on and ultimately sold as an REO. That means that the net recovery is severely impacted the longer there are no payments being made by the borrower.

That is why it is almost always better to modify the loan than to foreclose. Of course, there are many other factors that must be considered, but this definitely explains why more loans are modified than foreclosed. Mathematically it is a better outcome for the bondholders.

And now that we know where the defaults have gone, here’s the burning question: Are we really at the peak of the mountain, or is there still climbing to do?

The answer is that we actually have just completed our first ascent and have a long way to go to get to the top of the mountain. There are more steep climbs still ahead of us.

— Ann Hambly is founder and co-CEO of 1st Service Solutions, a borrower advocacy firm based in Grapevine, Texas. To date, 1st Service Solutions has restructured more than $6 billion of CMBS loans on behalf of borrowers.

©2012 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|