| FEATURE ARTICLE, DECEMBER 2008

BROKER OUTLOOK 2009

Brokers weigh in on their markets’ performances in 2008 and discuss the forecast for the coming year.

Compiled by Lindsey Walker

San Antonio: Resilient and Optimistic

The San Antonio commercial real estate market has remained resilient and has fared much better than the national economy during the past year. Grubb & Ellis maintains a relatively optimistic outlook for 2009.

That said, the market currently is experiencing significant reductions in sales, and the gap between buyers and sellers is wider than at any time in the past 4 years, as a result of the turmoil in the credit markets and the challenges confronting the national economy.

Rapid growth in 2006 and 2007 sparked many new developments that were approved prior to the onset of the credit crisis. As a result, San Antonio is experiencing higher delivery of office and retail product than the market can absorb. The current wave of activity and the projected quick turnaround are due to the positive aspects of the local economy.

San Antonio remains a popular business destination due to its southern climate; central location; ample, relatively inexpensive land for expansion; low barriers to entry/growth; expansion-minded city government; BRAC relocations; affordable utilities; and positive job and population growth. In response to the current changes in the market, occupancies and effective rental rates for office and retail properties are falling temporarily. As the nation begins to recover and new trade routes through Port San Antonio and Mexico get up and running, San Antonio will be well positioned to resume a healthy pace of growth in the industrial market as well.

Another factor that positively impacts San Antonio is the quantity and quality of the medical field, which creates some 3,500 high-paying jobs every year. In addition, due to the large number of military retirees who have significant technical experience and high security-level clearance, San Antonio is a big beneficiary of the National Security Administration. All of these will aid in a quick market recovery for the San Antonio commercial real estate market.

— Ernest Brown is executive vice president and managing director for Grubb & Ellis Company in San Antonio.

Abilene: Growth Industries Bolster Activity

The Abilene commercial real estate market has been very active in 2008 due to several growth industries locating to the area. For example, multiple companies have developed thousands of wind turbines in a 50- to 75-mile radius of the city, resulting in many support companies choosing Abilene for their facilities. This has caused more than 1,500 motel rooms to go up along Interstate 20 and Highway 83-84/277.

The rapid development of biotechnology and scientific research has caused Texas Tech University School of Pharmacy to expand its research offices and create new jobs. Receptor Logic, for example, moved its laboratory from Amarillo to Abilene to lease lab space in the new TTU Health Sciences Center School of Pharmacy building. In addition, Genesis Networks has had great growth, hiring approximately 150 programmers in the last 2 years.

Just to the southwest of Abilene, Dyess Air Force Base has had many upgrades, from new housing to hangers and runway reconstruction — all of which has benefited the region’s construction industry. There are several more years of work yet to be done.

Abilene is a regional medical center with two major hospitals that have both been doing extensive expansions. The hospitals have further expansions planned through 2010 — one doing an $85 million expansion of new buildings and infrastructure, and the other just completing a $25 million expansion. New physicians offices are being constructed around these expansions as well.

With strong retail sales, a nice supply of available Class A office space and new multifamily units built this year, Abilene is poised for growth in 2009. The city has a particular need for new restaurants in order to meet demand. Many developed commercial land sites are available and ready for users.

— Scott Senter is president of Senter Realtors in Abilene, Texas.

The Rio Grande Valley: International Trade Cushions Economy

Sixty years ago, the Rio Grande Valley of South Texas — made up of the four southernmost counties in Texas: Cameron, Hidalgo, Starr and Willacy — was a rural, agriculture-based economy characterized by sporadic growth. However, through international trade, the area has been transformed into a Mecca for first-rate retail, industrial, medical and educational facilities.

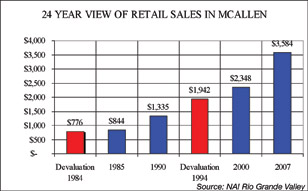

In 2007, total retail sales in the Valley were $11.25 billion as compared to $9.59 billion in 2005. The purchasing power of the Mexican peso compared to the U.S. dollar has fallen by nearly 30 percent since August of 2008. However, concerns about the peso have not historically had a negative effect on retail trade over time (see 24 Year View of Retail Sales in McAllen).

One look at the most recent developments is proof positive of the continued strength of retail along the South Texas border. These developments include Simon Properties’ Palms Crossing at the front door of the McAllen Convention Center; Weingarten REIT’s new H-E-B/Target-anchored center in Mission; the Chelsea Outlet Center in Mercedes; a new JC Penny-anchored center in Edinburg developed by First Hartford Realty Corporation; and several new Kimco and Weingarten retail developments of equal size and scale in Brownsville and Harlingen. Wal-Mart, Kohl’s, Target, Academy and Best Buy have built multiple stores in the market in 2007 and 2008. National restaurant chains, including P.F. Chang’s China Bistro, Macaroni Grill, Mimi’s Café, BJ’s Brewhouse, Cracker Barrel and Cheddars, have each established a McAllen presence in 2008.

In 2007, Rio Grande Valley ports, taken as a whole, rank sixth nationally in bi-national trade, with $33.7 billion. Hidalgo County ranked seventh with $21.7 billion. This growth in trade value is attributable to the Valley’s location and its successful marketing to Global 1,000 manufacturers. This fact, coupled with growth in retail trade, points to the real importance of the area’s proximity to Mexico, as well as America’s need for continued good relations with its southern neighbor.

Tens of thousands of American jobs are directly linked to the region’s growth in trade flow. The Valley labor force grew from 314,000 to 427,000 between 1995 and 2008, and the unemployment rate decreased from 18.4 percent to 7.6 percent during the same time period.

While current national and global economic issues impact the nation, the Rio Grande Valley of South Texas may be cushioned by its status as the gateway to international trade and commerce in the Americas. The region’s proximity to Mexico provides a second economy on which growth is driven. In spite of the global financial crisis, the Valley economy remains strong, investment opportunities are good, and prospects for 2009 and beyond are bright.

— Michael J. Blum is partner and managing broker with NAI Rio Grande Valley in McAllen, Texas.

Fort Worth: Faring Well with Some Impact

The Fort Worth commercial real estate market has been somewhat isolated from the national economic climate. Fort Worth fared very well in the first half of 2008, but the market has felt some impact with recent drops in oil and gas prices. In the first quarter, rental rates and occupancy levels hit an all-time high. In 2009, approximately 500,000 square feet of office space should to be added into the marketplace. Thus, tenants will have options that have not been available in the last 4 years. The three main reasons for this will be the completion of new office product, excess in sublease inventory, and continual consolidation in the oil and gas industry.

— George Duncan is executive vice president of Jones Lang LaSalle in Fort Worth, Texas.

Lubbock: Activity on a Roll

Commercial activity is on a roll in Lubbock, which has been largely unaffected by the national downturn. Permits for new commercial construction in the first quarter of 2008 alone was $135.7 million, up more than 43 percent over 2007. New activity in North, Central and Southwest Lubbock is driving the economy, along with another good cotton crop, the growth of Texas Tech University and a massive state freeway project cutting across the city.

The Overton Park redevelopment project, a 325-acre housing and commercial project between the Texas Tech campus and downtown Lubbock, has more than $200 million in projects under construction. These include a high-rise hotel, two large multifamily developments and 20,000 square feet of retail space. The new 548-acre Lubbock Business Park near the Lubbock Preston Smith International Airport on the north side of town has attracted its first two new companies, totaling more than $13 million in construction. The business park is spearheaded by the Lubbock Economic Development Alliance, and it includes a 225,000-square-foot auto parts distribution center and a 61,000-square-foot industrial bag manufacturer. New projects in Southwest Lubbock range from a $40 million mature living development to a $7.5 million medical complex. Current bank, office, retail and hotel projects in this high growth area top $12 million.

Anchored by the stability of agriculture, four local universities and two vibrant regional medical centers, the outlook in Lubbock is very bright.

— Marc McDougal is the president of McDougal Realtors in Lubbock, Texas.

Midland/Odessa: Capitalizing Off Oil Prices

While the nation as a whole faces an economic recession, the Midland/Odessa commercial real estate market is capitalizing on the momentum of record-high oil prices not only remaining steady, but continuing to grow. Much of the oil and gas activity that is boosting the overall Midland/Odessa economy is based on projects that were developed anywhere from 6 to 12 months earlier.

Growth in the medical industry, especially in Odessa, has progressed at a rapid pace, with Odessa Regional Medical Center recently completing new medical office facilities on its campus and Texas Tech Health Sciences Center undergoing large-scale upgrades, both of which are in downtown Odessa. And while the Medical Center Hospital is in the process of acquiring property downtown as part of its master plan, it has already purchased 34 acres in Northeast Odessa for an ambulatory care center.

Midland has seen the highest amount of growth on its northwest side, along Loop 250 and toward Odessa along Highway 191. Plans are under way for a retail area at Loop 250 and Highway 80. Hotels and car dealerships have sprung up around the Scharbauer Sports Complex, and the downtown area has the opportunity for growth, as two abandoned buildings have been imploded to make way for new development. A new retail center and apartment complex are under construction near the secondary business district, ClayDesta. The City of Midland has plans to annex land along Highway 191 all the way out to FM 1788.

The 1788 corridor, which is located approximately halfway between the two cities and leads to Midland International Airport, will receive a boost from a planned Performing Arts Center that will be constructed as part of the campus of the University of Texas of the Permian Basin. New light industrial growth has recently occurred at this intersection.

The light industrial market has remained one of the strongest sectors of the overall market. Vacancy rates are nearly nonexistent, and at least three builders are working on large build to suit office/warehouse buildings. The recent redevelopment of the former Texas Instruments campus at the intersection of 1788 and Interstate 20 into a multi-tenant facility has been a positive change for the area.

With the upswing in the local economy, workers have flocked into town. And, until this past year, no multifamily apartment or condo developments had taken place in either city (other than tax incentive projects) since the mid 1980s. In 2008 and 2009, several hundred new units of apartments will be introduced into both cities, and rents have already risen across the city to record highs.

Overall, times in Midland /Odessa are good, and cautious and well-planned growth will remain steady well into 2009. Midland/Odessa has had a very low foreclosure rate, and the local banks remain stable. This market is, and will remain, a smart choice when making a real estate investment decision.

— Kevin Andrews is a broker with The Havens Group in Odessa, Texas.

Houston: Still On Top

Houston continues to be one of the best major real estate markets in the United States, and this trend should continue through 2009. In 2008, crude and natural gas rose at a record pace, and — despite the fact that prices have receded temporarily — a rebound should be expected in 2009.

Houston currently has approximately 180 million square feet of office space. Brokers commonly share the statistic that half of Houston’s office inventory was constructed in the early 1980s, making almost 75 percent of the existing buildings at least 25 years old. Even if a slowdown in the Houston economy occurs, there are many corporations that will find old base building construction and design methodologies unacceptable. Many improvements seen in new construction are driven by a human resources perspective to keep corporate employers ahead of the curve on employee recruitment and retention. Improvements such as taller slab-to-slab floors, translucent exterior glass systems allowing better lighting to employees, modernized elevator systems, and state-of-the-art HVAC systems will continue to promote new developments, which will be more attractive to tenants than existing Class A buildings.

Houston will not escape the credit crunch, as evidenced by the many multifamily, office and retail projects that have been shelved recently. In some respects, this delay will be good for local property values and construction costs, which had increased at rates that made numerous proposed projects economically unfeasible.

Finally, the global energy crisis must be addressed and hopefully Houston will discover and spearhead many of the solutions needed to continue the expansion of the local economy.

— Tim Relyea is vice chairman of Cushman & Wakefield of Texas in Houston.

El Paso: Surprisingly Dynamic Bright Spot

Throughout most of 2008, the West Texas economy has enjoyed enviable growth that is counter to national trends. Numerous articles have been written about El Paso’s healthy, robust economic conditions. Moody’s Economy, the University of Texas and many others have labeled El Paso as an “expanding economy.” Residential mortgage default rates have actually declined, and foreclosures are considerably low.

There are a number of factors that have benefited El Paso and help to drive its economic engine, including the continued expansion of Fort Bliss, which has infused billions of dollars into the local economy; the success of Juarez, Mexico, as an outstanding world-class manufacturer; the relative cost-competitiveness of industrial real estate on the United States/Mexican border; and robust trade between El Paso and Northern Mexico.

Texas and the rest of the globe recoiled from the unprecedented spike in energy costs, diminishing sources of capital and rampant instability in the equities markets. These pressures continue to force manufacturers, both domestically and internationally, to evaluate their supply chains and their overall business costs. Many have found that the El Paso, Texas/Juarez, Mexico, region is a competitive, safe and cost-effective solution.

Even with the bullish long-term prospects for this area, the contractions of the global economy have been felt here as well. There have been recent announcements for retail store closures, manufacturing plant shutdowns and condensed production schedules, just as in other areas of Texas and the nation.

The coming year will be a time of transition for West Texas and El Paso. The relative dearth of capital and lingering global pressures will prevent and/or curtail any planned speculative industrial and commercial developments. This will be good news for existing owners. Industrial vacancy rates should decline past historic low levels, and rental rates will begin to rise. Retail commercial and office vacancy rates will improve more slowly and not to the levels that the industrial submarket should enjoy.

— Brett Preston is a partner with RJL Real Estate Consultants in El Paso, Texas.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|