| COVER STORY, DECEMBER 2007

PROPERTY TAXES: CONSIDERATIONS BEFORE, DURING AND AFTER THE SALE

Felix Berry

Ad valorem taxes are one of the largest expenses for business property owners. In a merger or acquisition, property taxes are a critical component of the deal and should be thoroughly researched to minimize the cost of ownership.

A state- and/or MAI-certified property tax consultant is an important addition to any acquisition team. A valuation expert, who understands the intricacies of property assessment in a particular tax jurisdiction, can evaluate opportunities, analyze alternatives and help companies make effective business decisions.

Pre-acquisition Analysis

A pre-acquisition property tax analysis ensures there are no unpleasant surprises after the papers are signed. It’s best to know up front about any risks relating to assessment practice, market trends, aging equipment, obsolete inventory and needed capital expenditures.

The process starts with a valuation of the tangible assets being acquired. Do these assets require a discount or premium to their stated book values? Detailed market research will determine whether the tax burden is equitable to competing properties. An on-site inspection can uncover exemptions and abatements that can lower taxes for years to come.

By analyzing and evaluating the financial data and prior assessment procedures used, an independent third-party opinion of value can be determined. This third-party assessment review is a valuable tool to negotiate a fair purchase price and ultimately get the best return on the investment.

The extra set of eyes provided by a third-party assessment can also supply value-added services to help minimize the transfer tax and assure the proper recording of assets for change of ownership and income and expense statements.

Budgeting for Property Taxes

A good rule of thumb is to budget for property taxes based on 95 percent of the building’s purchase price, depending on the property type. This includes the price of real and personal property excluding intangible value.

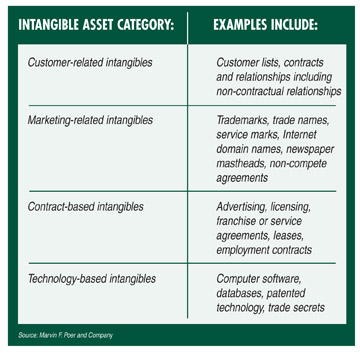

Identifying intangible value can produce impressive tax savings. To meet the definition of intangible, a non-monetary asset without physical substance must be identifiable. It also must arise from contractual or other legal rights. (See chart for examples)

The recognition and measurement of intangible assets must be assessed on a case-by-case basis. Following the identification of an intangible asset, the next step is to determine its fair market value.

While specific techniques may vary somewhat, the valuation of intangible assets relies upon the same basic approaches — cost, market and income — as the valuation of real estate. Although market methods are best where available, the lack of market evidence means that income methods are more often applied. Valuations should include thorough support for each major assumption.

Key challenges involved with valuing intangible assets include:

• Selecting the appropriate economic life for each item or category. Assets such as strong brand names may have a relatively long or even indefinite life. Others such as customer relationships or databases may be amortized over a shorter period.

• Double counting of intangible value. Several assets may contribute to the same stream of earnings, such as a well-known trademark and the underlying technology.

• Long-term implications of identifying certain intangibles. In the event that a brand name is changed following the acquisition, this could lead to a substantial write-down.

When all required intangible asset valuations have been performed, the conclusions should be compared and reconciled to the purchase price. The determination of appropriate assumptions requires experience and judgment due to the subjectivity involved.

Purchase Price Allocation

To quantify the complex valuation issues concerning real and intangible assets, purchase-price allocation is a process that assigns fair market values to all major assets and liabilities of an acquired enterprise.

The main goal of purchase-price allocation is to bring greater transparency to the acquisition process and to arrive at the net residual amount, which will be attributed to goodwill. This is important for both federal and local property taxes. For federal income taxes, correct depreciation is key. For property tax purposes, intangible value is generally considered tax exempt.

In 2001, the U.S. Financial Accounting Standards Board released the Statement of Financial Accounting Standards (SFAS) 141, Business Combinations and SFAS 142, Goodwill and Other Intangible Assets. SFAS 141 requires companies to appraise the fair market value of assets and liabilities for presentation in their financial statements. Under SFAS 142, goodwill and indefinite-lived intangibles are no longer amortized.

These rules require companies to assess the fair value of recorded goodwill and other intangibles on at least an annual basis and sometimes more often. An inventory can maximize opportunities to further componentize assets for faster depreciation.

Companies should consider purchase-price allocation as part of the due diligence process before completing a deal and should take the results into account when agreeing on the final purchase price.

After the Sale

Once a property is purchased, there are many opportunities to minimize tax exposure. Companies should consider outsourcing the following services to save them both time and money:

• Market value analysis

• Ongoing identification of intangibles

• Real estate tax compliance

• Business personal property tax returns

• Eliminating double assessments

• Real and personal property appeals

• Inventory barcoding and valuations

• Fixed asset management

• Capitalization and controls

• Booking exemptions and retirements

• Audit defense

As the costs of government services grow and property tax laws become more complex, property values will undoubtedly rise. Managing and minimizing property taxes is an effective strategy to benefit the company’s bottom line.

Felix Berry is a senior business development executive for Marvin F. Poer and Company’s Irvine, California office.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|