| FEATURE ARTICLE, DECEMBER 2006

UNDERSTANDING INVESTMENTS IN MEDICAL OFFICE BUILDINGS

Jim Clark

During the dot-com boom, investment in general office buildings proved to be a valuable activity. Investments in medical office buildings lagged behind as a secondary or tertiary option. Over the last few years however, sales of medical office buildings have grown to $2.9 billion annually, nearly quadrupling since 2001. 1 Demographic shifts, improvements in healthcare technology and low vacancy rates support the sector’s growing popularity.

Medical Office Inventory on the Rise

Several market trends have increased the inventory of medical office buildings available for ownership by organizations other than hospitals.

In 2001, the government released new regulations that deal with self-referrals, commonly known as the Stark Law. This interpretation discourages hospitals and physician practices from having a financial relationship and gives medical providers an incentive to focus on patient care. Under certain circumstances, hospitals leasing space to the physician practices they rely on for patient referrals can be an unethical and potentially illegal activity. Third-party ownership and management of hospital-affiliated medical office buildings substantially reduces the risk that hospitals will violate fraud and abuse statutes.

At the same time, medical providers are increasingly focused on investing capital in their medical businesses. In light of changing patient demographics and declining reimbursement rates from insurance companies, Medicare and Medicaid, medical providers must compete for business and efficiently manage the finances of their practices. Third-party ownership of real estate with long-term leases is an attractive alternative to investing their capital in bricks and mortar. By selling their real estate assets, these groups can generate the capital for the medical technology they need to provide more cost-effective service to their patients.

In addition, healthcare providers looking to increase their credit position, balance sheet and capital assets often liquidate their assets through the sale of their real estate. 2

Hospitals are contributing to the availability of medical office buildings by modernizing existing properties and building new ones. This trend has led to the development of new, smaller, specialty healthcare facilities as well as improvements to existing general acute care hospitals.

The Medical Office Building Advantage

As savvy investors are beginning to realize, there are several factors that promote the viability of an investment in medical office buildings. Low vacancy rates, demographic shifts and strong growth in the healthcare industry have drawn investors’ dollars away from the general office market and into medical office buildings.

The value of medical office building sales grew from about $750 million in 2001 to about $2.9 billion last year. During that same period, sale prices increased and capitalization rates decreased. The current average price per square foot of a medical office building is about $200, compared with about $125 per square foot in 2003. 3

Low Vacancy Rates

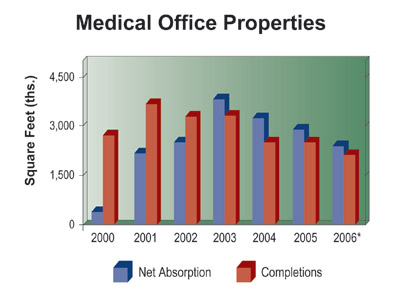

Statistics show that medical office buildings have lower vacancy rates than the average office building. In 2000, vacancy rates for the general office space and medical office space were nearly identical at 8.1 percent and 7.9 percent, respectively. Following the dot-com bomb and start of the recession, however, general office vacancy increased to 13.6 percent in 2001 and to a cyclical high of 16.9 percent in 2003. While the medical office sector witnessed an increase in its vacancy rate during the same period, it was smaller than that of the general office market. The medical office market reached its cyclical vacancy peak in 2002 at just 9.4 percent. Since medical office vacancy did not post a dramatic spike, its rebound has been far less pronounced than that of the general office market. Nevertheless, projections for 2006 have the medical office vacancy rate at 8.2 percent by year’s end, 5.5 percent less than that of the general office market. 4

Demographic Trends Increase Demand for Healthcare

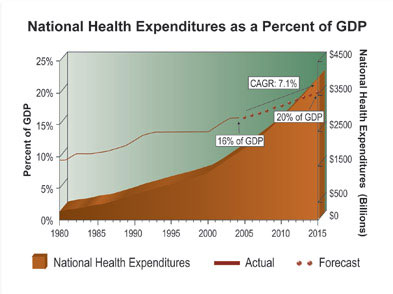

Benefiting from long-term demographic trends, healthcare is the nation’s largest industry, representing about 16 percent of the gross domestic product (GDP) of the United States in 2005 with a projected 7.1 percent cumulative annual growth rate to 2015. In the United States, the segment of the population 65 years and older has the highest expenditures for healthcare. As the remaining baby boomers enter this demographic segment, as chronic illnesses increase and as new advances in science and medical care increase the average life span, the need for medical office space will continue to grow. In 2005, this segment of the population accounted for 37 million people (12 percent of the population) and it is projected to grow to 71 million people in 2030, an increase of more than 90 percent.

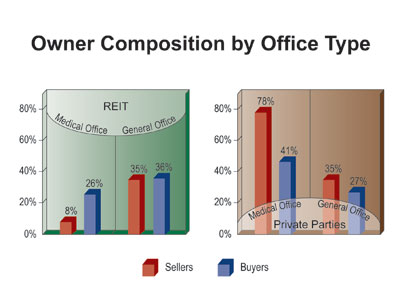

Institutional Ownership of Medical Office Buildings

The ownership of medical office buildings is changing in character. Institutional ownership is growing while private party ownership is decreasing. During the past year, for example, only 8 percent of sellers were REITs or institutional owners, while they accounted for a full 26 percent of buyers, more than three times the rate of sellers. Also during the past year, private parties accounted for 78 percent of sellers but only 47 percent of the buyers, showing a decrease in ownership by private parties.

Compare this to all other office space where ownership remained even. REITs or institutional owners accounted for 35 percent of sellers and 36 percent of buyers, and private parties accounted for 35 percent of sellers and 27 percent of buyers. 5

Independent Physician Practice Groups

Reversing a trend from the 1990s, many physician groups have reacquired their practice assets and real estate from national physician management companies in order to gain market share. Other physicians have left hospital-based or HMO-based practices to form independent group practices. These physician groups are interested in properties that will house medical businesses that regulations permit them to own.

Growing Outpatient Service

There is a growing trend for physicians in specialties to partner with hospitals, operators and financial sponsors to build specialty hospitals in suburban areas near patients and physicians, in addition to urban hospital settings. Developed to treat specific diseases on an outpatient basis, these outlying hospitals are originated by physicians in various specialties including cardiology, ophthalmology, oncology, women’s health, orthopedics and urology.

Location

The locations of medical office buildings can be placed into three categories: “on campus” (at or adjacent to the hospital campus), “near campus” (within a mile of the hospital) and “off campus” (in outlying suburban areas).

An on-campus office building offers patients the convenience of seeing physicians and specialists in one trip, while offering physicians the ability to see patients without leaving the hospital grounds. A near-campus building is much less convenient to physicians but still provides reasonable access to the hospital and can be found at a lower rent cost to the physician.

In order to operate profitably despite reduced reimbursement rates, physician groups and other medical services providers are aggressively trying to increase their patient populations. Off-campus medical office buildings in areas of population or patient growth help them do this and provide lower overhead costs. They also allow physicians to build a practice independent of the hospital.

Tenants by Specialty

The average tenant in a medical office building tends to stay longer than the typical general office tenant. Most medical office tenants invest large sums of their own money in office improvements which compels them to stay.

• Specialists — Generally, specialty physicians are the best tenants. They are less affected by healthcare third-party payer issues and most have active, profitable practices. A balanced mix of specialists is preferable. High concentrations of one specialty increase the owner’s risk.

• Dentists — Dentists are excellent tenants. They are generally available for long-term leases and invest large sums into their offices.

• Radiology — Radiologists are excellent tenants. Large, expensive equipment makes it difficult for them to move, but they require extensive monitoring for the disposal of wastes.

• Labs — Labs are good tenants, but they require many more improvements than most.

• Hospitals — Hospitals provide stable rent for a period but cannot be counted on for renewal like most other medical tenants. As changes to their business model or facilities occur, they are more likely to vacate at the end of a lease term. Hospitals frequently lease space in on-campus buildings for hospital-sponsored practice groups, administration or to serve as incubator space when recruiting new physicians.

• Surgical centers — Surgical centers can be excellent tenants with large, expensive equipment and government-approved facilities. Generally owned by a group, they can also more readily break up. It is essential to obtain personal guaranties from the physician partners.

• Primary care physicians — These physicians have been losing money for some years now. Exposure to large groups of primary care physicians is risky.

Conclusion

As investors continue to watch the medical office building sector for signs of growth, they can look to the healthcare industry as a whole—which continues to grow at a record pace. Healthcare spending in the United States is growing at a rate of more than 7 percent per year and is expected to double to about $4 trillion by 2015. 6

This growth, along with low vacancy rates, favorable demographic trends and increases in medical technology, make investments in medical office buildings a lasting, valuable opportunity.

Jim Clark is president of Bellevue, Washington-based Western America LLC.

1 Real Capital Analytics (Real Capital Analytics’ data is based on independent reports of properties and portfolios $5 million and greater).

2 Ziegler Capital Markets -- Healthcare Finance.

3 Real Capital Analytics.

4 Marcus & Millichap Research Services.

5 Real Capital Analytics.

6 Centers for Medicare and Medicaid, Jan 2006 and U.S Dept of Commerce, Bureau of Economic Analysis.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|