| COVER STORY, DECEMBER 2006

BROKER OUTLOOK 2007

Austin

Austin is a metropolitan area where people want to live, work and play. It was selected this year as one of “America’s 50 Hottest Cities” for business relocation and expansions, the city ranked fourth in “Best Overall Standard of Living” and also was named top metropolitan for future business locations, according to Expansion Management magazine.

Several companies made the decision to do just that by relocating or expanding in the area. Freescale, for example, selected Austin for its world headquarters. AMD (Advanced Micro Devises) chose Southwest Austin to build its new office campus. Acccurate Elastomer, which is a San Diego-based manufacturer for the electronic industry, selected Elgin for its relocation site of manufacturing and headquarters operations. CompassLearning, an education technology solutions company, relocated its corporate headquarters to downtown Austin while Dimensional Fund Advisors, a Los Angeles-based financial services company, announced the relocation of a new, full-service office that will eventually employ 800 people in Austin. Hewlett-Packard is building two new data centers in Austin, while Samsung broke ground on its new 300,000-square-foot semi-conductor plant.

With top companies moving into Austin and the expansion of companies already in the area, job growth will continue to increase. Mark Dotzour, with the Texas Real Estate Center at Texas A&M University, projects that the area employment growth will continue to grow during the next 12 months at a rate just under 3 percent, which will add approximately 20,800 jobs to the Austin area. The local economy is expanding at an above average pace due in part to the lower living and business cost and affordable housing. A healthy 5-year real estate cycle is predicted for the area as well.

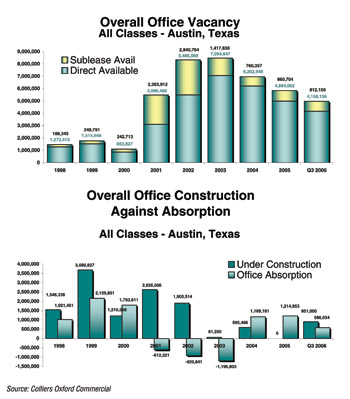

Austin’s office market is the strongest performing property type with the highest rent and occupancy seen during the last 5 years. Nearly 1 million square feet has been absorbed year-to-date with the Northwest sector continuing to be hot. New developments are out of the ground and will be on line for occupancy in 2007. Rents will continue to rise due to the high occupancy and cost of new construction.

The Northwest sector has seen the highest absorption, and all classes of office buildings have seen rental rates increase. The average asking rental rate citywide is $22.02. The highest rental rates are still seen in the central business district (CBD) at $24.66 followed by the Southwest submarket at $23.70 and the Northwest sectors at $22.82. Class A properties are averaging $25.90, Class B is $18.95 and Class C is $15.40.

Citywide vacancy continues to decrease. The Southwest has the lowest vacancy (8 percent) followed by the Northwest sector (12 percent). During the next several years, with positive job growth, these rates should rise steadily.

The sublease market is basically non-existent with it accounting for around 2 percent of total vacancy. The sublease rental rates are not much less than rates for direct space, running about $1.00 per square foot less than direct rates. The sublease market will no longer have a significant impact on the market in the future.

Due to the Southwest and Northwest sectors approaching at or below 10 percent vacancy, new construction in speculative office space will reach near 1 million square feet in the next 12 months. Rental rates on this new construction will range from $28 per square foot per year to $32 per square foot per year. Brandywine’s 211,000-square-foot office building complex at the corner of South Capital of Texas Highway (Loop 360) and Loop 1 (Mopac Expressway) is well underway for a mid-year 2007 occupancy, and Lincoln Properties’ 147,000-square-foot project at Las Cimas is scheduled for completion by the fall of 2007.

Northwest Austin has 35 of the 40 largest employers within a 10-mile ring around the Arboretum area. Large blocks of space are impossible to find and speculative development was kicked off by Trammell Crow Company’s Austin group. The project, Research Park Place, is located on the corner of Highway 183 and Oak Knoll and has 250,000 square feet available in two buildings. With large blocks of space nearly impossible to find in the Northwest area of town, this project will lease up quickly.

In 2007, with office space shrinking overall and large blocks of space unavailable and projected job growth positive for the areas, rental rates will continue to rise on the average and speculative building will increase.

Aspen Properties’ purchase of 47 acres in North Austin on Highway 183 will have a significant impact on the Austin area. They plan to add 1.4 million square feet of office space through an expansive new Class A office campus. This campus will have a significant impact on this area of town. Class A office space is basically non-existent in this sector leaving companies with little to no options for lease space. Phase I of the project is slated to begin in 2007 adding 297,000 square feet. With all the growth in the corridor and people wanting to live and work within the same area, businesses will be fighting over the opportunity to relocate to this project.

Austin’s industrial market in 2006 has experienced positive absorption with relatively stable rental rates in the first half of the year. In the last half of the year, for the first time since 2001, rates and occupancy are rising significantly. With this gain in rates and occupancy at 86.4 percent, industrial developers are positioning themselves to take advantage of the strong market conditions. The positive absorption trend in warehouse and Flex/R&D has continued for about 3 years. Rental rates have continued to inch up especially in the warehouse market while Flex/R&D has seen little to no change.

The real story in the industrial market is that construction is beginning once again. More than 320,000 square feet of new space will have been delivered by the end of 2006. The look for 2007 is positive with new projects such as Trammell Crow’s Expo Business Park scheduled to move in April and several other projects coming out of the ground in the Southeast sector.

Austin is one of the country’s top 10 markets to watch in retail real estate thanks to exceptional job growth, robust population gains and overall market expansion. The total retail market currently is approximately 32 million square feet with a 93 percent occupancy rate. The retail market remains strong with the overall market absorption remaining positive and rents climbing. East Austin leads the city with absorbing more than 53,300 square feet of space. West Austin follows close behind at 43,250 square feet and the North sector at 36,414 square feet. Rental rates are strong and new space rates continue to rise, however, as more developments are completed vacancies will begin to increase due to natural attrition.

There is a trend of anchor tenants and smaller tenants moving to new lifestyle center and power center developments. These tenants are moving within the same submarkets they are currently occupying. Due to tenants new to the Austin market, we have not seen a substantial increase in vacancies. Many new centers are in peripheral areas around other centers.

|

On November 15th, IKEA opened a new store just north of Austin in Round Rock, Texas. The 252,000-square-foot store is the company’s third Texas location. Houston-based Tribble & Stephens provided construction services.

|

|

There are a couple of retail projects that need to be mentioned due to the impact their locations will have on the areas of Austin where they are located. The Domain, developed by Simon Group with Endeavor Real Estate Group as its local partner, is located on Loop I North (Mopac Expessway) and Braker Lane (some refer to this location as Arboretum 2). The project will be anchored by Austin’s first Neiman Marcus store and a Macy’s. The project is 95 percent leased. Endeavor also was the developer on South Austin’s SouthPark Meadows located at Slaughter Lane and Interstate Highway 35. This retail area has changed the landscape of South Austin and brought big box retail to those who live and work in the area. The Premier Outlet Mall between Round Rock and Georgetown, which is another Simon project, opened this summer with the new IKEA furniture store following close behind. Construction has begun on the new Galleria Mall at Bee Caves. This mall will have a significant impact on the Bee Caves/ Lakeway area once completed.

Other areas seeing a great deal of new retail development include intersections along State Highways 130 and 45 and Highways 290 and 71. Retailers are looking closely at these new trade areas along the SH-130 corridor, watching residential expansion that is expected in these areas. Larger retail tenants should pop up along the SH-130 corridor including Target, HEW and Wal-Mart.

In the multifamily arena, vacancy rates have continued to improve throughout Austin, strengthening the apartment market. Rent rates are continuing to increase along with rents becoming more stable with the burn off of perks. The vacancy rate is around 5.8 percent with the average rent running $723. The absorption rate for apartments has improved over the same period a year ago.

Even though there have been a large number of new apartments built this year, the absorption and vacancy rate has remained stable. This improvement in the market has been mainly due to the continuing strength of Austin’s employment rate, which continues to be better than the rest of Texas and the nation.

It will be a challenge during the next year for apartment developers to maintain the present vacancy levels based on the number of apartment units permitted to be built in the next 12 months. Adding to this challenge during a longer period of time is the development of a large number of units in Austin’s CBD. There are currently 5,400 units in the CBD with 30 new projects either under construction, planned or projected. This will add an additional 5,000 units to the downtown area.

— Sue Gravett is president of Henry S. Miller Commercial Austin/TCN Worldwide.

Dallas/Fort Worth

The Dallas/Fort Worth office market ended the third quarter of this year with a vacancy rate of 21.2 percent, which was a decrease of 0.2 percent over the previous quarter. According to CoStar’s third quarter absorption numbers, Dallas/Fort Worth had 1.1 million square feet of positive absorption. Class A office space rates increased about $0.50 per square foot, from about $18.40 per square foot full service to $18.80 per square foot. Class A vacancy remained constant while Class B space had an absorption of approximately 600,000 square feet. Class C had about 39,500 square feet of positive absorption.

Leasing activity in all product types has been steady, but not robust. The Dallas economy has experienced good internal growth and the tenant demand is great among the corporate sector, which has impacted all the sectors — office, industrial, retail and residential. In addition, the job growth in the Metroplex has been positive through the third quarter, which has had a positive impact on the leasing of commercial real estate.

Tenants moving out of large blocks of space in 2006 include Hunt Consolidated, vacating more than 300,000 square feet in Fountain Place, a 1 million-square-foot office tower in downtown Dallas. Hunt will move into a newly constructed 400,000 square foot corporate headquarters also located in downtown Dallas. In another deal, Valor Telecommunications vacated approximately 60,000 square feet in Las Colinas Towers.

Some of the large deals for tenants moving into Dallas/Fort Worth include Countrywide Mortgage moving into the Richardson Corridor; T-Mobile moving into Frisco; and The Home Depot moving into the Platinum Corridor (Addison/Tollway). These relocations total more than 400,000 square feet.

The submarket for office that has enjoyed the most growth is Uptown Turtle Creek. This submarket was one of the leading sectors for office absorption and shows a vacancy of 10 percent. Uptown Turtle Creek’s major growth in residential (particularly high-rise), retail and grocery stores as well as its close proximity to the central business district (CBD), the Victory development and Highland Park are all joint cards for the market. The Uptown market typically hovers around 10 percent vacant with a historical high of only 18 percent.

In addition to the Uptown market, other submarkets that are poised for growth are Las Colinas and Far North Dallas. All of these submarkets are driven by residential growth, job growth and transportation. For example, the Las Colinas submarket experienced the height of the submarket vacancy rate last year with 33 percent and has reduced that vacancy rate to a current vacancy rate of 22 percent. This is due to the urban center being rezoned for residential, which is driving the resurgence of Las Colinas.

Job growth drives demand, and all indicators are showing that the Dallas/Fort Worth market’s job growth is continuing to improve. Plano, Frisco and Flower Mound are all experiencing growth in different product types (office, industrial, retail) — all due to the job growth in those areas. With the continued job growth, the real estate trend will continue to improve. Absorption in specific product types will lead to reduced vacancies. Investment activity is still brisk and will also be driven by the increase in job growth and the demand for product.

— Bernard Deaton is executive vice president and managing partner for Bradford Companies/CORFAC International in Dallas.

Strong Fundamentals, Savvy Development Fuel Dallas/Fort Worth Area’s Retail Sector

The Dallas/Fort Worth market experienced unprecedented interest from out-of-state investors this year. Investors were attracted to the region’s strong local economy, which was supported its booming population and robust job growth.

Local retailers absorbed new and second generation retail space at a rapid pace. To date, net absorption stands at approximately 2.5 million square feet, up substantially from 670,000 square feet in 2005. Occupancy is expected to remain near 87 percent, despite a number of store closings. Of the 29 recently vacated Mervyn’s locations, 19 stores representing 1.5 million square feet have already been either leased or purchased by expanding retailers such as Hobby Lobby, Burlington Coat Factory and JC Penney.

In the outlying suburbs, lifestyle centers and junior department stores lead retail expansion. Growth has been particularly strong in places like Mansfield, Keller, Flower Mound and Cedar Hill. Thirty miles south of downtown Dallas, The Marketplace at Waxahachie retail center exemplifies the strong retail potential surrounding the Dallas/Fort Worth Metroplex. Constructed this year, The Marketplace at Waxahachie center was 75 percent pre-leased and boasts a lineup of Beall’s, Dollar Tree, Hasting’s, Hibbett Sports and Sleep Experts. Further retail expansion is expected next year in areas such as Terrell, Weatherford and Greenville.

Stylistically, Dallas/Fort Worth continues to move away from traditional big box-anchored centers with in-line retail. Instead, many of the retail projects planned for 2007 feature credit-worthy national tenants with medical, professional or residential components. Category killers like Costco, Wal-Mart and Target will continue to make the environment difficult for local grocery chains, but niche specialty grocers such as Whole Foods and Central Market will perform well. Discounters such as Family Dollar, ALCO, Advanced Auto Parts and Dollar General will execute aggressive expansion plans.

A newcomer to the market, national retailer Steve & Barry’s University Sportswear based in Port Washington, New York, opened its first Metroplex location in early summer at Valley View Center in North Dallas, followed by one at Grapevine Mills Mall. Recently, the retailer leased a long vacant Kmart box in Garland. Steve & Barry’s plans to open at least two more locations in the Dallas/Fort Worth market in 2007.

During the past few years, the Dallas/Fort Worth retail sector has benefited from low interest rates, a booming housing market and strong retail sales growth. Similar fundamentals, plus the careful, selective development of underserved areas will allow this momentum to continue in 2007.

— Gavin Kam is a director in the Dallas office of Marcus & Millichap’s National Retail Group.

Houston

Leasing activity has been very strong in all categories, with vacancy rates decreasing and rental rates increasing rapidly due to the high cost of land and less available space, according to Simmi Jaggi, first vice president, and Elizabeth Clampitt, associate, with CB Richard Ellis (CBRE) in Houston.

Several submarkets have seen substantial growth this year, including Clear Lake/Bay Area, Sugar Land, Rosenburg, The Woodlands, Champions/Willowbrook Mall area, Tomball, 290 Spring Cypress to Fairfield, Atascacita and Pearland. “The biggest reason for this growth is interest rates and suburban residential developments in all of these areas, which is spurring retail/commercial development,” Jaggi and Clampitt say.

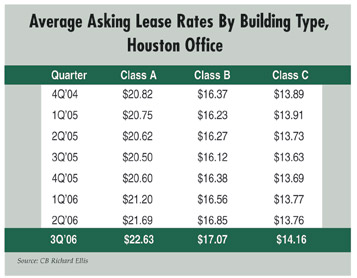

In the office sector, citywide absorption has reached nearly 3 million square feet during the last three quarters, and Class A vacancies have fallen from 15 percent in 2004 to the present 10 percent, according to CBRE’s Third Quarter 2006 MarketView report on Houston’s office market. “The market is no longer tethered to oil prices and slowing job growth will moderate demand,” Jaggi and Clampitt say. “Overbuilding is unlikely and the office market sector remains stable, but tightening rental rates continue to trend upward.”

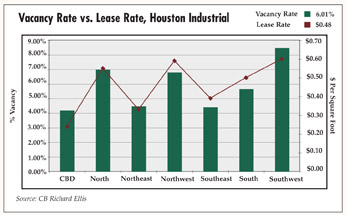

On the industrial front, activity continues to increase as investors and owners alike are showing marked interest in this sector. According to CBRE’s Third Quarter 2006 MarketView report on Houston’s industrial market, a significant amount of development is in the pipeline: 34 buildings totaling 3.59 million square feet are currently under construction. In addition, the market has experienced positive absorption for its 14th consecutive quarter. “Currently the Northwest submarket is experiencing tremendous industrial development, and occupancy for new product constructed today will realistically lease 2 years out,” say Jaggi and Clampitt. “On the city’s east side, Port Crossing Business Center, a 295-acre master-planned, deed-restricted industrial park (located between Barbours Cut and the new Bayport Terminal) has 660,000 square feet currently under construction, with additional space proposed. Plans include 22 rail tracks, accessing both Barbours Cut Terminal and Bayport Terminal and a foreign trade zone application is pending.”

|

Trademark Property Company’s Market Street development in The Woodlands is one of the major projects impacting the Houston area, according to Jaggi and Clampitt of CBRE.

|

|

With the Houston/Sugar Land/ Baytown MSA retail market among the top 50 fastest growing markets in the nation, it’s no surprise that the area’s retail sector is healthy and active. According to CBRE’s Second Quarter 2006 MarketView report, construction is underway on 43 centers that will add an additional 9.53 million square feet to the market. Houston’s overall retail occupancy was 85.41 percent at the end of the second quarter, with rental rates averaging $15 to $33 per square foot. A few examples of retail projects that are underway or in planning include Trademark Property Company’s Market Street in The Woodlands; Vintage Park, a lifestyle center under construction at State Highway 249 and Louetta in Northwest Houston; and CBL Associate’s proposed Pearland Town Center in Pearland. All three developments are mixed-use developments that will positively impact the region.

Urban developments are becoming increasingly popular in the Houston area as well. “Urban redevelopments are emerging at a very fast pace because the demographics for those areas are extremely strong,” Jaggi and Clampitt say. “In addition, the value for the land on some older developments is higher than the investment properties’ rate of return.”

The global energy discussion starts and ends in Houston, according to Jaggi and Clampitt. As the proclaimed “energy capital of the world,” Houston energy companies are driving many of the decisions impacting the world’s future energy picture. This worldwide attention continues to draw interest to Houston for real estate investments, particularly, multi-housing. “For the first time in many years, the major oil companies are contributing to Houston’s job growth,” Jaggi and Clampitt say. “Jobs fill apartments. Investors are connecting the dots and concluding that Houston’s future is quite bright. Our business is up over 100 percent versus the same time in 2005, which was a record year. We expect some slowing for transaction velocity in 2007, but capital allocations for real estate/multi-housing continue to grow. The Katrina hangover and insurance costs have created some uncertainty for investors, but the energy story is outweighing these temporary blips. Our team is getting more offers per assignment, today, than 3 months ago.”

Overall, Jaggi and Clampitt expect to see continued improvement across the board in Houston in 2007. “We will continue to see infill developments and suburban expansions with infill retail, such as grocery-anchored shopping centers and power centers,” they say. “Our current market is achieving all-time highs in every category.”

— Simmi Jaggi is first vice president and Elizabeth Clampitt is an associate with CB Richard Ellis in Houston.

The industrial market in the greater Houston area has continued to strengthen this year with steady activity. A large percentage of the industrial space coming available for 2007 will be new construction, and there is more than 3.1 million square feet of industrial space scheduled for completion in the George Bush Intercontinental Airport area in the next 18 months. Four such projects include Caldwell Watson Real Estate Group’s Green Crossing at Beltway 8 and Ella, a 68,000-square-foot industrial facility, and Round Up Park, a 149,400-square-foot industrial facility located at Beltway 8 and Fallbrook; Simmons Vedder’s 575,165-square-foot Greens Crossing Distribution located at Beltway 8 and Ella; and IDI/Boyd Commercial’s 401,580-square-foot Greenspoint Business Center at Beltway 8 and Interstate 45 North.

There was positive net absorption of more than 3.5 million square feet in the first half of the year, and the second half is expected to continue at that pace, closing 2006 as the third consecutive year of positive absorption. Leasing activity has been extremely strong as oil field service-related companies are rapidly growing, driving the need to acquire and lease new facilities. Among some of the largest industrial spaces leased in Houston this year are 72,568 square feet leased by Harmony Science Academy at 7334 Gessner and 50,000 square feet leased by Wenaas USA at 12211 Parc Crest Drive. Positive absorption and a strong business climate have driven lease rates up and landlord concessions down.

Houston’s Northwest corridor dominated all other Houston industrial submarkets this year. This is primarily driven by that market representing almost 30 percent of the industrial inventory as well as customers’ desires to be close to the people with which they do business. In 2007, because of the anticipated completion of new product and the accessibility to Beltway 8, the George Bush Intercontinental Airport submarket will see tremendous growth and leasing activity. Another anticipated submarket that will experience growth is the Port of Houston where the first phase of the Bayport expansion project was completed last month.

Because of the growth of oil field service-related manufacturing businesses, crane-served buildings with outside storage available for sale in Northwest Houston are the single most demanded product type. Newly developed properties that meet this requirement are trading hands at unprecedented high prices approaching $80 per square foot.

One key trend expected to emerge next year is the availability of new construction industrial product in the George Bush Intercontinental Airport area. It will result in a short-term market over saturation, and, due to high new construction prices, landlords will be unable to offer competitive rental rates. This will drive landlords to provide other concessions to stay competitive.

Another increasingly common trend has been the demands by potential tenants for higher percentages of office build-out than traditionally seen in industrial product. This is the result of the increased hiring of oil field service companies and the need to provide office space within facilities for these new hires.

For the Houston industrial market to continue to improve at its current pace, the key dependent variable is the price of oil funding growth in the major oil companies as their spending drives the growth of all industries servicing their needs.

— Keith Bilski is an industrial service provider with Houston-based Caldwell Watson Real Estate Group.

San Antonio

San Antonio’s office market has performed really well during this past year, according to David Held, senior vice president with Trammell Crow Company in San Antonio. Large blocks of space, what little there was, has been leased rather quickly. “We are absorbing space at a substantially faster pace that what we typically do,” he says. “I believe that our average annual absorption is typically a half million feet, and we are well in excess of that this year so far.”

As for new development, most of the new space that has been coming on line is being developed at a modest, reasonable pace. “We’ve gone years without seeing pure speculative office development, but we are now seeing it on a limited basis,” Held says.

The San Antonio office market’s leasing activity is between good and strong, depending on the submarket and property class. “The Class B market last quarter was exceptionally good, but both A and B are performing very well,” Held says. “Several years back, you’d have nice, Class A office space in San Antonio renting at $17 gross. Today, that same space will lease on an effective basis in the low to mid $20s. As the Class A rates have pushed forward, tenants seeking lower rental rates have turned to Class B spaces, where rents used to be $14 or $15 gross. Now, those rates have gravitated up to $17 to $18.50 range. So, both segments have done well in absorption and rate increases.”

In terms of which submarkets are performing well, the suburban market is far outpacing the central business district (CBD). And, within the suburban market, the U.S. 281/North Central corridor and the Interstate 10/Northwest corridor have continued to make significant strides in net absorption, according to Held. “I think the area that’s seen the most interest recently is the newly defined Far North submarket on Loop 1604 between US 281 and IH-10,” he says. “That area is located over our aquifer, where there are a number of significant issues for developers to deal with. The effect of which has slowed the development process down, and therefore the pipeline is at a healthy level with development not outpacing demand.”

This area should continue to be the most sought after submarket in the coming years as well. “The outer Loop area is going to see a lot of activity. It’s a very desirable area of town to live in,” Held says. “And, where the rooftops go, so goes the development.”

In the future, Held expects there will be an increased desire for build-to-suits as well as increased tenant participation in building ownership as rents continue to rise and the cost of ownership becomes more attractive. “The CBD market will have a net gain occupancy due in part to a tightening suburban market,” he says.“ Some Class A tenants will seek rate relief and flee to Class B buildings, and B tenants will seek C product.”

In addition, Held notes that there needs to be moderate new construction and a continuing strong economy for San Antonio’s office market to continue to improve. “I expect the market to continue to tighten,” he says. “While there’s new product coming on line, demand is strong and I expect the 2007 market to be even tighter.”

— David Held is senior vice president with Trammell Crow Company in San Antonio.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|