| TEXAS SNAPSHOT, AUGUST 2007

Dallas Retail Market

Supported by the creation of more than 80,000 jobs and population growth exceeding 100,000 new residents, the retail outlook in Dallas/Fort Worth remains favorable, despite an expected uptick in vacancy this year. Supply growth will outpace demand, resulting in the first metrowide vacancy increase in 3 years. Net absorption is expected to total 3.9 million square feet this year, while supply additions are forecast to reach 5.7 million square feet, which will lead to a 120 basis point increase in vacancy. Of the new construction scheduled for delivery this year, more than 2 million square feet is pre-leased single-tenant space, including six Wal-Mart stores. After a banner year in 2006, robust retailer demand is expected to push occupancy higher in the Northwest Fort Worth submarket, where only 110,000 square feet is scheduled for completion in 2007, and household growth continues unabated.

Builders added 1.7 million square feet of new retail space during the first quarter, 5 percent less than during the same period last year and 37 percent of this year’s total expected deliveries. Specifically, shopping center and mall construction will constitute 3.6 million square feet of space this year, 64 percent of the projected deliveries. The first phase of the 910,000-square foot Arlington Highlands retail center is scheduled to come on line in the second quarter. The Far North Fort Worth submarket, which includes most of Denton County, is attracting developer attention. The submarket has 100,000 square feet of retail space under construction and 4.1 million square feet in the planning stages, including 1.3 million square feet in the Flower Mound area. Developers are expected to bring 5.7 million square feet of retail space online by year-end 2007, a 2.2 percent increase to inventory but a significant decline from last year, when 7.8 million square feet was delivered to the metro.

Strong retailer demand during the past 12 months has helped push vacancy down 70 basis points to 12.4 percent. During the first quarter, vacancy inched up 10 basis points. Neighborhood/community center vacancy finished the first quarter at 11.2 percent, up 60 basis points from the same period last year, as several projects came on line with vacant space. In the rapidly growing Northeast Fort Worth submarket, absorption has been robust during the last 12 months, pushing vacancy down 670 basis points to 8.3 percent.

Although total deliveries will decrease in 2007, several years of robust construction activity will keep vacancy elevated this year. The metrowide vacancy rate is expected to increase 120 basis points, ending the year at 13.5 percent.

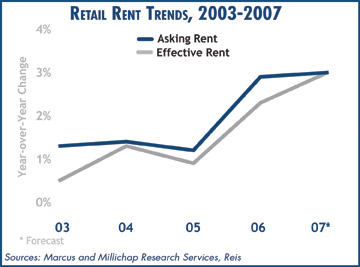

Premiums paid for new retail space supported asking rent growth of 2.6 percent to $15.25 per square foot during the past 12 months. Effective rents were up 2.5 percent to $13.66 over the same period, as the delivery of new space limited owners’ ability to trim concessions. During the most recent 12-month period, the West/Southwest Dallas submarket exhibited the highest asking and effective rent growth in the metro, measuring 4.9 percent and 5.2 percent, respectively. Strong demand and premium rents paid for new space each contributed to the increase. Metrowide revenue growth averaged 3.1 percent over the past year, driven by a 12 percent increase in the Northwest Fort Worth submarket. By year-end 2007, revenue growth is expected to slow to 1.7 percent as occupancy declines. Supported by higher rates for new retail space, asking and effective rents are both expected to climb 3 percent this year to $15.65 per square foot and $13.96 per square foot, respectively.

Investor sentiment for retail properties in the Dallas/Fort Worth area is expected to intensify this year, as out-of-state investors and institutions look to increase their holdings. Attracted by cap rates in the mid-7 percent range, out-of-state buyers are taking advantage of price appreciation in many coastal markets and looking to exchange their properties for higher-yielding assets in the Metroplex. Institutions have been drawn to the Dallas/Fort Worth area due to its favorable long-term economic and demographic outlooks. Unlike many other metros, the relatively strong local housing market also will support healthy retail sales growth this year. In addition, consistently low and stable interest rates, as well as properties with acceptable yields, could help nudge local buyers off the sidelines as the year progresses.

— Brad Kam is a retail investment specialist in the Dallas office of Marcus & Millichap’s National Retail Group.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|