| COVER STORY, AUGUST 2007

A MANUFACTURED FUTURE

Developers build for tomorrow as industrial activity flourishes in the Lone Star State.

Dan Marcec

Across the vast landscape of Texas’ commercial real estate markets, industrial development remains an important part of the economy due to the state’s location as an international entryway, both by port in the Gulf of Mexico and by truck and rail from Mexico. While development surely is cropping up all over the state, Texas Real Estate Business recently interviewed industrial experts from four cities — Dallas, Houston, San Antonio and Austin — in order to depict the current supply and demand of industrial space in these major markets and how that will affect Texas real estate down the road.

Dallas

The Dallas market is seeing a fair amount of land speculation in the industrial sector, specifically on the south side between Interstates 45 and 35, where a new intermodal facility is making way for new industrial opportunities. Generally, tenants are continuing to seek manufacturing and distribution facilities, as the high-tech sector has not rebounded from a lull. Because of the highly accessible rail services in the region, tenants are looking at distribution space.

“Dallas has been earmarked as an excellent distribution hub, and companies want to be in this market to service their customers,” says Scott Ryan, senior associate in the Dallas office of Marcus & Millichap. “Manufacturing space is being sought after because it’s a lot cheaper, and as a result, we are seeing quite a few companies in this sector relocating from California to the Dallas/Fort Worth Metroplex because incentive packages are much greater and employment is cheaper.”

Supporting the distribution market, an increase in manufacturing only a day’s truck drive away in Mexico has catalyzed growth in the Dallas market, creating an efficient avenue for distributing products manufactured south of the border. In addition, costs for construction and finishing tenant improvements have increased substantially, causing an increase in costs for occupants or a decrease in returns for landlords that have new product competing with revitalized properties.

While build-to-suit activity has been quite limited, there are two types of industrial product hot on the market, according to Ryan: one is the big box, which consists of a 600,000-square-foot or so facility that can house one or two tenants — these generally are being developed up by REITs and institutions; on the other hand, companies are leasing “shallow bay” product, characterized by shallower heights, front-loading, and higher-end office finishes that demand higher rent — these range from 100,000 to 150,000 square feet and can house up to six tenants.

“Flexibility continues to be a major motivator for the industrial space user,” says Trey Fricke, managing partner of Lee & Associates’ Dallas/Fort Worth office. “This flexibility can be an alternative for transportation sources, disaster strategy, flexible lease terms, surplus land for expansion or leasing with large landlords that offer lease portability.”

For all types of industrial product, the vacancy rates stood at approximately 9.8 percent at the end of second quarter 2007, according to Ryan, declining 10 basis points from first quarter and 20 basis points from the end of 2006. Fricke explains that the rental rates average around $3.00 per square foot triple-net leased for large bulk distribution, with quoted rates of $3.25 to $3.50 per square foot triple-net leased. For shallow bay distribution, the rates are increasing from $3.35 to $3.75 per square foot, with rates quoted from $3.25 to $3.95 per square foot triple-net leased. Ryan says that the overall rates average out to approximately $4.85 per square foot, while flex space holds the highest averages around $7.64 per square foot.

Several major leases were signed in the first quarter, including Cadbury Schweppes inking a 594,000-square-foot deal in the Eastern Lone Star/Turnpike submarket; Stacey’s Furniture signing on for 379,000 square feet in the Lewisville submarket; Universal Display leasing 275,000 square feet in the East DFW Air/Las Colinas submarket; and APL Logistics occupying 420,000 square feet in the Upper Great southwest submarket. Other leases of note include Browder Brothers (358,040 square feet); Lego Systems (402,500 square feet); Proctor & Gamble (expansion to 630,000 square feet); Kraft (420,000 square feet); and EGL, Inc. (400,000 square feet).

Looking toward the future, a large amount of speculative development surrounding the DFW Airport needs to be absorbed, but projects in that submarket historically have leased well. Ryan estimates that between 4 million and 7 million square feet of speculative space is coming on line in the market.

“The industry should focus on South Dallas and the area surrounding the airport,” he says. “Land is becoming scarce across the country near major airports, and there’s still a lot of room for absorption near DFW; however, rents are increasing and companies value space in this higher end submarket because of its proximity to the airport, the employment base and its triple-free port zone, allowing tax incentives and abatements.”

“For new transactions to the market, the DFW Airport often tops the list based on its central location and immediate access to the airport,” Fricke says. “The South Dallas sector has significant new speculative development, which should be followed by positive absorption. The Dallas developers are savvy enough not to build spec in areas that will not lease.”

Houston

Industrial development has been rampant in the Houston market, especially near the port, where 3 million square feet of space currently is under construction. Employment growth has fueled the demand for construction, advancing 11 percent over the past 5 years. Activity is strong throughout the market, and the economy is likewise trending positively.

“We’re seeing bigger transactions than years past, and that is not confined to leases, but sales as well,” says Glynn Mireles, first vice president with CB Richard Ellis in Houston. “Institutional owners, capital and large corporations are acquiring properties, sale/leasebacks are abounding, and significant transactions are occurring in all markets, which are hitting on all cylinders.”

Logistics firms are seeking space, and though the vacancy rate stands at 6 percent right now throughout the city, a lot of speculative product is going on the market. In a place with such strong demographics and heavy activity, absorption should not be a problem. Institutional companies are building distribution centers and some flex space, and entrepreneurs are constructing quasi-manufacturing and distribution space more on the freestanding side. Some build-to-suits are underway, but distribution and manufacturing driven by the oil and gas industry is dominating the market.

“There is great activity occurring in our market, which is a good thing, and the economy is doing well, but I am slightly concerned with overbuilding in the southeast market,” says W. Greg Murphy, senior vice president, director of industrial properties for Weingarten Realty Investors. “No one has a crystal ball, but there is 3 million square feet of vacant space in the port submarket, with 3 million square feet under construction. The port traffic is expected to grow, but 6 million square feet on the market in a 20 million-square-foot sector could be a problem while absorption takes a couple years to catch up.”

Rental rates vary from submarket to submarket, but generally flex space is going for approximately $8.00 per square foot, while distribution remains in the $4.50 to $4.75 per square foot range. “Rates vary depending on several things,” says Murphy. “Does the product have good truck ports, good clear height, and is it Class A or Class B? State-of-the-art product will demand higher rents, and the 50,000-square-foot user will pay more than the 200,000-square-foot user, all things being equal.”

Some of the largest leases signed in the last few months include Room Store taking 275,000 square feet; Hoover Material Handling inking a deal for 265,000 square feet on Highway 6; DFC Logistics signing on for 170,000 square feet; Pack-well leasing 420,000 square feet on Porter Road; and Canal Cartage occupying 270,000 square feet at Bayport North Distribution Center.

“The east and north submarkets are seeing a lot of speculative development, and the northwest is building out as well,” says Mireles. “Oil and gas and housing have been our drivers, the latter of which has seen a little bit of a slowdown, but generally everything is looking good and we should have a record 2007.”

In the future, the northwest is seeing the most rental rate growth, and the western corridor near Grand Parkway and Interstate 10 is becoming popular near Katy. The school district in that area is growing by nearly a classroom a day, so as residential continues to flourish commercial will follow.

“Houston is generally healthy, and things will continue to tick along well,” says Murphy.

Austin

Due to occupancy and land costs, rents are on the way up throughout the Austin industrial market, as growth of the state as a whole is creating a demand for distribution space. With interstate access and a central location as the capital of Texas, Austin is seeing new companies arrive, and retail has been successful, all adding to this growing demand.

“Our history in Austin has been the University of Texas and state government, but R&D and flex space is coming in as a big trend in real estate here, absorbing some office users deterred by rising rents,” says Curtis Mercer, CCIM and RPA for the Don Cox Company in Austin. “Manufacturing demand is waning slightly, as some of the tech-oriented companies have relocated, but at the same time, businesses like Samsung are ramping up their manufacturing activities, and call centers and data centers are coming in to utilize flex space.”

Mercer reports that rents for R&D and flex space are averaging approximately $8.40 per square foot, while warehouse and distribution is seeing rents in the $6.50 per square foot range, but these figures depend on the location and the product as well. According to Oxford Commercial’s 2nd Quarter 2007 Market Status report, the vacancy rate overall for the Austin industrial market is 9.1 percent, with R&D flex space checking in at 11.5 percent; warehouse/distribution at 5.8 percent; and manufacturing with the least availability at 3.1 percent.

“Austin is more of a service center, and in industrial we see mostly 24-foot clear bulk warehouses with 5 to 10 percent finish of office,” says Tim Harrington, vice president at Oxford Commercial. “There is a lot of product currently on line, and it will be interesting to see how absorption occurs; most of the development is occurring in the southeast near the airport, with more than 1 million square feet planned or underway.”

In that southeast submarket, the Ben White and Interstate 35 interchange has been completed, and as the airport continues to mature development should continue there. The north central submarket, with access to I-35 and MOPAC 183, offers restaurants, hotels, all levels of housing, and in a market where traffic continues to become more congested, developers are looking to plan projects where their tenants can have close proximity to live, work and play.

|

A 328,000-square-foot facility is going in at highways 71 and 183 in Airport Commerce Park, which is located in the Southeast submarket of Austin, Texas.

|

|

With many of the submarkets performing strongly, it’s no surprise that a significant number of developments are underway. At highways 71 and 183 in the southeast submarket, a 328,000-square-foot facility is going in at Airport Commerce Park, which is divisible to 37,000 square feet in some space, planned for either distribution or flex space. Also near Highway 71 and I-35 is the South Park Commerce Center IV, a 417,000-square-foot facility underway by Transwestern Developments.

Oxford tracks developments planned and under construction in the market, and, especially on the north side of Austin, construction is progressing at a furious pace. In the northeast submarket, both the 179,000-square-foot Northeast Crossing and the 50,400-square-foot Cross Park Building B are underway. North Tech Buildings 8 & 9, encompassing 51,448 and 56,980 square feet, respectively, as well as the 178,254-square-foot Lincoln Vista Phast II, all are underway in Round Rock. Further, at Harris Ridge in the north, Buildings 1 & 2, both comprising 72,900 square feet, are in development. Finally, on the northwest side, three business parks are producing new facilities: Pearson Business Center has three buildings totaling nearly 300,000 square feet underway; Davis Springs Corporate Center is developing approximately 200,000 square feet in three buildings; and two structures totaling 86,000 square feet at Cameron Creek Business Park are in development as well.

“Keep an eye on the State Highway 130 corridor, which is a toll road but has reduced time for trucking lines coming in and out of Mexico, as well as on leasing activity in Round Rock,” says Mercer. “Land cost and zoning will be important factors in the growth of the southeast submarket, and land availability may be in issue in the northeast.”

San Antonio

As construction increases along the Interstate Highway 35 corridor in San Antonio, industrial development is inching further from the city. Most of the new construction is speculative, heavily influenced by the Toyota plant recently built in the area. Larger buildings, greater clear heights, ESFR sprinkler systems and larger truck courts all are common features of the new product coming online.

Development is occurring in all sectors, with the Port of San Antonio increasing its influence as a multi-modal international business park. The southwest submarket has significant land available, and while the north/central submarket has the lowest vacancy rate (5.7 percent), the northeast and Port San Antonio submarkets are adding the most space due to easy access to interstates 35 and 10.

According to Rick Stagers, vice president of Grubb & Ellis Company in San Antonio, rental rates average $4.21 per square foot for general industrial space, while absorption rose 169,373 square feet bringing vacancy down to 9.5 percent. For the warehouse/distribution sector, rental rates currently average $3.87 per square foot, with negative absorption of 17,514 square feet occurring, leaving the vacancy unchanged at 9.5 percent. For R&D/flex space, vacancy dropped to 10.6 percent with 37,484 square feet of quarterly absorption, while this sector retained the highest rents at an average of $8.44 per square foot.

“Overall asking rents saw a bump for the first quarter, rising $0.24 to $5.04 per square foot triple-net leased,” says Stagers. “The rise in rents is a good sign after San Antonio’s asking rents declined over the previous two quarters; overall, 189,343 square feet of space was absorbed in first quarter 2007, dropping the vacancy rate to 9.7 percent.”

Distribution space is in greatest demand overall, while manufacturing is becoming more common with Toyota suppliers continuing to enter the market. Flex construction is concentrated in the northern submarkets, while distribution is spread throughout the city.

“Flex space is a popular, lower cost alternative to office users, with single-story space and good parking; these projects have been leased very soon after they’ve hit the market,” says Stagers.

Cross & Company, a local developer, is taking advantage of a niche opportunity in the city of Shertz, Texas, located up the I-35 corridor toward Austin, where due to its friendly business atmosphere, significant development is underway. In order to take advantage of demand from smaller users, Cross is developing a 43,000-square-foot industrial condominium project at 17357 Bell North Drive, which is divisible down to 5,600 square feet.

“This kind of product is useful for typical small warehouse users or small branches of national distribution companies that are well capitalized but don’t need as much space,” says Ryan Smith, vice president of Cross & Company. “Construction costs have made it prohibitive for a small use to build a facility affordably, so we saw this opportunity; it just so happens we own two buildings and 60 acres in this submarket, on which we’re very bullish, so we wanted to see how this kind of project would fare.”

Some major leases recently signed in the area include Bison Building Materials, Ltd. occupying 111,000 square feet at 827 Coliseum; LCW Automotive taking 55,638 square feet at Macro Distribution Center #4; and Global Operations Texas, LP, inking a deal for 64,405 square feet at Richland Hills Center.

Significant developments include Union Pacific’s new $90 million, 300-acre intermodal facility in the southwest submarket, expected to open in early 2008. Further, Trinity Asset Development Company is planning to construct 3 million square feet of product along I-35 in the Tri-County area of northeast San Antonio, and Enterprise Industrial Park in the same region is expected to encompass approximately 2 million square feet. At Port San Antonio, Titan is developing 1 million square feet of rail-truck distribution space.

“Looking toward the future, the IH-35 corridor will continue to dominate new development, especially in the Tri-County area just north of San Antonio that continues to attract tenants and developers,” says Stagers. “Another component that has contributed to the demand for warehouse/distribution space is an increase in retail activity, and with retailers opening multiple locations, there is more demand to have inventory readily available in the local market.”

InterPort Distribution Center Adds Significant Space Near Port of Houston

|

InterPort Distribution Center

|

|

In Pasadena, Texas, near the Port of Houston, First Industrial Realty Trust — along with contractor Cadence McShane Corporation — is developing a two-building industrial facility called InterPort Business Park, which will add 1.3 million square feet of warehouse and distribution space to the submarket. The first phase, a 598,000-square-foot speculative warehouse and distribution facility called InterPort Distribution Center, is situated on 40 acres at 13001 Bay Area Boulevard, designed for single- or multi-tenant use.

Constructed of tilt-wall panels, InterPort Distribution Center features a 30-foot clear-height and 104 truck docks, as well as generous trailer parking and 229 vehicle spaces. Offering the advantages of new construction, the property will accommodate a user’s demand for racking systems, storage, and inbound and outbound material flow.

“Leasing interest remains extraordinarily high due to the development’s location at the Port of Houston between the Barbours Cut and Bayport container terminals off Highway 146 near the Gulf of Mexico,” says Sheri Tantari, senior vice president of marketing at Cadence McShane. “This master-planned commercial and industrial park offers intermodal capability with immediate access to the Union Pacific rail line.”

Powers Brown Architecture is responsible for the design of the property, maximizing an efficient layout. Primary access to the external truck docks near the rail line was key to creating effective transportation of products and materials. Overall, the InterPort Business Park encompasses 88 acres.

“When complete, the park will serve to focus even greater levels of distribution through the Port of Houston continuing to energize this popular industrial channel,” says Tantari. “The project will contribute toward the addition of new jobs to the area and will also provide a footprint of excellence to the design, construction and tenant population within the Port of Houston.”

— Dan Marcec |

FedEx Freight Facility Kicks Off Development at Satsuma Station in Houston

Fronting Highway 290 on the northwest side of Houston, Pinpoint Commercial currently is developing Satsuma Station Industrial Park, a 115-acre tract of land under construction. The first building on the property, a 154,000-square-foot build-to-suit project for FedEx Freight, is underway with completion expected in second quarter 2008.

“After utilizing 11 acres for stormwater detention and building the FedEx facility on 44 acres, we’ll have 60 acres of developable land on the property,” says Charles Turner, chief financial officer of Pinpoint Commercial. “Our goal is to have build-to-suit projects, and we’re confident that there is enough industrial demand this close to the city that we will become a premier park in this submarket.”

Originally acquired by Pinpoint in two parcels, Satsuma is located on the highway with visibility to the freeway. There was some concern that the site — formerly used for crude oil storage — would have environmental issues, but the company came in and tested the land, found that there were no problems, and went ahead with construction.

“There is a lot of build-to-suit demand in this market, and our advantage is to control the land we have to develop, as there is little of that anywhere, especially in the northwest submarket,” says David Toone, principal for Satsuma Station. “The project’s location is ideal for a wide range of industrial users, and we may do some spec building for smaller tenants; overall, we have value in the land with the infrastructure in place that will make it very competitive.”

FedEx Freight, the first tenant at Satsuma Station, found their way here by looking for its first major facility in the Houston market. Needing an 80-foot-wide cross dock, 243 doors for the loading and unloading of up to 500 trucks a day, the company has to be very particular about their specifics, but Pinpoint was able to work out the details and now the project is underway.

“The impact of this project — in addition to its location and access — is its versatility,” says Turner. “We have a variety of land to support up to 400,000- to 500,000-square-foot buildings, and we’re looking to find traditional users; we’ll have more than 1.5 million square feet at total build-out.”

— Dan Marcec |

Dallas Logistics Hub Creates Massive Impact South of the Metroplex

With a projected build-out of 20 years across 6,000 acres, The Allen Group and its development associates expect the Dallas Logistics Hub to have a huge impact on the local industrial market. Master-planned for both speculative industrial and office space as well as build-to-suit opportunities, the development will add a projected total of 60 million square feet of commercial space to the market. DLH Buildings 1 & 2 — a 633,000-square-foot cross-dock facility and a 192,000-square-foot warehouse/distribution property, respectively — are both being constructed speculatively and are expected to be complete by February 2008.

“Maximizing building coverage and clear-height while minimizing development costs, balancing building size and trailer parking demands to meet the needs of today’s users, and providing a high-performance and sustainable core-and-shell building without negatively impacting the bottom line lease rate were all important aspects in designing the new buildings,” says Daniel McAuliffe, president of Allen Development of Texas.

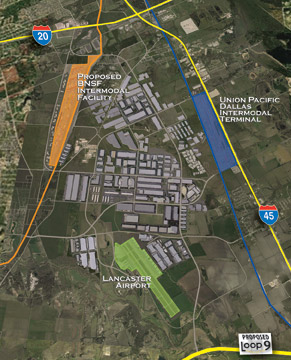

Eventually, the project will spread across four municipalities, including Dallas, Lancaster, Wilmer and Hutchins, Texas. Situated adjacent to Union Pacific’s Southern Dallas Intermodal Terminal, a proposed BNSF intermodal facility and four major highways — Interstates, 20, 35 and 45 as well as Loop 9/Trans Texas Corridor — the project is perfectly situated as a distribution hub for in and out of Dallas. Aside from developer The Allen Group, other companies involved with the project include GSO Architects, responsible for the design; Kimley-Horn & Associates, civil engineer; Guaranty Bank providing financial services; and MYCON and 3i Construction as general contractors.

When build-out is complete, the total economic impact of Dallas Logistics Hub on the entire Dallas Metroplex is estimated at $68.5 billion, and the project is expected to create 31,000 direct jobs as well as 32,000 indirect jobs, clearly having a phenomenal influence on the local economy.

“Dallas Logistics Hub is one of the most sophisticated logistics parks in the country, because of its unique infrastructure surrounding 6,000 acres,” says McAuliffe. “With the increase of international trade and frequent west-to-east freight movement, all the transportation options here will set this project apart; there are very few land sites, if any, available in the country that can offer companies key ingredients for the fast, efficient and on-time delivery of their products.”

— Dan Marcec

|

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|