| COVER STORY, AUGUST 2006

HEAD TO THE BORDER

Production sharing continues to make the Texas/Mexico border one of the hottest manufacturing regions in the world.

Claude Billings

Intense competitive pressure for Global 2000 companies to reduce costs has positioned the U.S./ Mexico border region as North America’s leading manufacturing and services platform to compete against China, India and other rapidly developing economies. Proximity to the U.S. consumer market, increased logistics costs and Mexico’s technical labor force make the U.S./Mexico border region an important area for manufacturing and logistics facilities.

The primary driver, production sharing, occurs when multiple countries participate in the manufacturing of a finished product. Each country contributes to the final product by capitalizing on that country’s strength, such as low cost labor, technical design expertise or proximity to a specific market. For non-time critical parts, the resources do not necessarily have to be near the final assembly location or the market destination.

More than 30 percent of the world’s consumer market is located in the U.S. The demand for these goods and services ranges from computers to automobiles. Many of these products are time sensitive, have a short shelf life or cannot be cost-effectively shipped via containers from Asia or Europe.

Distribution and logistics costs from Asia and Europe to the U.S. can easily offset the lower labor cost advantages. The total cost to get the product to market and the value placed on the speed to market for given products generally influence the final assembly plant location. This coupled with the technically experienced workforce makes the U.S./ Mexico border an attractive platform for production sharing.

One example of the global production sharing concept is the manufacture and assembly of flat screen televisions by a major consumer electronics company. The glass panels used in the televisions are manufactured in Asia, but the final assembly is done in Mexico. It is cost effective to produce, pack and ship the “non-time sensitive” panels in containers from Asia to the U.S., then to Ciudad Juarez, Chihuahua, Mexico. In Mexico, the electronics are added and the newly created bulky, time-sensitive final product is shipped to the U.S. This point of final production drives suppliers to locate closely. Capital intensive suppliers tend to locate on the U.S. side of the border and more labor intensive supplier operations will locate in Mexico.

Other large bulky products such as major home appliances have a similar supply chain.

The automotive industry is another example of global production sharing. In several cases, these companies have located their final assembly plant in the U.S. and the suppliers located in an adjacent supplier park. The supplier’s location is influenced by the major manufacturer, the time critical nature of the supplies and the shipping costs.

Texas cities along the Mexico border such as El Paso, Laredo and McAllen have enjoyed production sharing activity for more than 30 years. El Paso/Juarez remains the world’s largest bi-national production region. Recently, gateway cities such as San Antonio, Austin and Houston have become participants in this production sharing activity. The recent shift of labor intensive industries, such as textiles, garments and small appliances, to lower labor cost countries has provided Global 2000 companies an opportunity to optimize their supply chain. This shift also redefined the criteria for products that could benefit by being along the U.S./Mexico border region. Basically, these criteria include products that are bulky and weight sensitive, time sensitive to reach the consumer, mass customization (many variations for a basic product line) and/or require technical design changes during production. The proximity to the U.S. market continues to be an influencing factor for manufacturing site selection. The significant recent investment in manufacturing facilities along the Texas/Mexico border by companies such as Toyota, Electrolux, Whirlpool, Springs Industries, Lexmark and Foxconn (a Chinese company that is a global leader in electronics) demonstrate the importance of North America’s production sharing region shown on the map below.

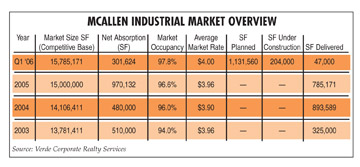

Based on research through the first quarter of 2006, the markets covered by Verde Corporate Realty Services have experienced a positive net absorption in the industrial sector. In addition, with the exception of the north submarket of Houston, all areas show a stabilized or increased average rent rate since 2005. Market occupancy rates are stable or are increasing.

In summary, demand for industrial space along the border and the gateway cities is increasing. Manufacturing facilities on both sides of the border generate demand for suppliers to relocate to the region. The cost effective production sharing capability of the U.S./Mexico border region combined with strong consumer demand in the U.S. continues to make this region attractive for Global 2000 companies.

Claude Billings is a vice president of Verde Corporate Realty Services in El Paso, Texas.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|