| COVER STORY, APRIL 2007

OFFICE AND INDUSTRIAL LEASING

San Antonio Office Market Heating Up

Just as springtime temperatures are on the rise in Texas, the San Antonio office market is also heating up. At the close of 2006, the office market reported a citywide vacancy rate of 13.8 percent, according to the fourth quarter survey of more than 23.7 million square feet of multi-tenant office space conducted by NAI REOC Partners. This is a marked improvement compared to a year ago when citywide vacancy stood a much softer 16 percent. The Class A market in particular closed the year with a vacancy rate less than 10 percent for the first time in 4 years, dropping from 12.7 percent at year-end 2005 to 9.8 percent at the end of 2006.

The local office market topped 812,000 square feet of positive net absorption in 2006 — the most recorded in any 1 year since 1992 when the market netted approximately 928,000 square feet led by the relocation of Southwestern Bell from St. Louis. Demand for space has tightened vacancy and prompted developers to pursue new construction more aggressively.

While less than 258,000 square feet of new speculative office projects reached completion in 2006, a wave of new speculative projects totaling nearly 1 million square feet is expected to impact the market in 2007. Class A projects such as the La Arcata Office Building (97,490 square feet) and Union Square II (131,000 square feet) are scheduled to come online early in the year. Other projects such as the two buildings at Heritage Oaks (84,000 square feet each) and Shavano Center III (63,000 square feet) are well underway.

Meanwhile a growing list of projects planned or just getting started includes Plazas Las Campanas (85,000 square feet), Concord Park Two (120,000 square feet), Farinon Office Building (94,000 square feet), Westover Hills Office Park (105,000 square feet), 4500 Lockhill Selma (99,000 square feet), and the redevelopment of the former Albertsons building at 6415 Babcock (61,800 square feet), just to name a few. In addition, the market has seen an increasing trend of mixed-use projects that combine lower-level retail space with upper-level office space in projects such as The Legacy, Ventura Plaza and Warren’s Corner. High-end projects such as The Reflection and Quarry Village will incorporate the urban village concept by adding a residential component to the mix of office, retail and restaurants.

Supported by tighter vacancy rates, the cost of leasing space increased 3.7 percent over the year to reach the highest average rental rate on record. The citywide average quoted rental rate rose $0.67 to $18.65 per square foot annually on a full-service basis. Likewise, the average quoted rental rate for Class A space climbed $0.92 to reach $21.64 — a healthy increase of 4.4 percent compared to this time last year. In addition to increased rental rates, tenants faced with negotiating leases are finding that concessions that were once common in the marketplace are now much more limited. “It has taken nearly 5 years, but the market has finally returned to where it was in 2001 just prior to 9/11 and the fall-out of national recessionary influences that subsequently rippled through the San Antonio market,” says Brian Harris, CCIM, senior vice president/partner of NAI REOC Partners. In fact, the record shows that the citywide vacancy rate at year-end 2001 stood at 14.1 percent and the Class A vacancy held at 8.7 percent — relatively close to where the market currently stands.

The biggest difference between then (2001) and now is the overall health of the downtown market. In 2001, the Central Business District (CBD) recorded a vacancy rate of 15.9 percent while the CBD Class A submarket stood at an amazingly tight 2.3 percent. In contrast, the CBD vacancy rate at the close of 2006 posted the highest of the city’s submarket vacancy rates at 20.1 percent, up from 18.5 percent at year-end 2005. The CBD Class A submarket recorded fourth quarter vacancy rate of 18 percent, up from 16.6 percent last year at this time.

While San Antonio’s CBD remains an active city center, bustling with healthy convention business and tourism, hotel and residential development, river expansion plans and redevelopment projects, the office market downtown presents a significant challenge. Although the overall downtown average rental rate increased to $18.53, an increase of $0.38 compared to last year at this time, landlords of Class A buildings held rates steady in an effort to entice tenants and to encourage activity. The quoted rental rate for Class A space downtown now averages $21.41, down $0.02 from 1 year ago. With the current average rate downtown now less than the $21.71 average quoted rental rate for suburban Class A space, perhaps tenants will reconsider their options.

Certainly Equastone showed confidence in San Antonio’s downtown market with its recent acquisition of One Riverwalk Place (261,431 square feet) at 700 North St. Mary’s Street. In addition to One Riverwalk, several other major buildings recently changed owners as investment activity in the office market heats up. The Forum complex (381,000 square feet) was purchased by Intercontinental Developers of Boston and both CityView (225,218 square feet) and Fountainhead Tower (174,108 square feet) were acquired by KBS Realty Advisors. All three projects are Class A buildings located along the IH-10 corridor in the Northwest market.

“Expanding corporate confidence has resulted in 3 years of solid positive net growth for the local office market and the momentum is expected to be sustained throughout 2007,” says Todd Gold, CCIM, president of NAI REOC Partners. Anticipated job growth will continue to fuel the market resulting in moderate increases in rental rates supported by improved occupancy. Increased speculative construction is expected to keep pace with demand and investors will continue to seek opportunities in the growing San Antonio market.

— Kim Gatley is director of research for NAI REOC Partners in San Antonio.

New Construction Continues to Dominate Houston’s Industrial Market

During the final quarter of 2006, Houston’s industrial vacancy increased for the first time in 3 years, rising by 30 basis points to 5.8 percent as new space deliveries outweighed tenant demand, according to John Nicholson, vice president of Grubb & Ellis in Houston. “However, vacancy is still down 32 basis points from this quarter a year ago after reaching its lowest level in 8 years during the previous quarter,” he says.

In terms of new construction, the development cycle is in full swing with nearly 4.1 million square feet of speculative space delivered to the market in 2006 — its highest level of space completions since 2001, according to Nicholson. “The largest completion last year took place in the East/Far Southeast submarket as Clay Development delivered a 900,000-square-foot facility near the Port of Houston, which is one of the largest industrial speculative developments ever constructed in the Houston area,” Nicholson says. The building, which is part of the 200-acre Underwood Business Park, currently is home to one tenant and has approximately half of its space still available for lease.

A growing demand for space — fueled by a strong economy and the increasing capacity at the Port of Houston with the recent opening of Phase I of Bayport Container Terminal — has made Houston a hot spot for industrial construction in past year, according to Nicholson. “The Port of Houston Authority announced that the Port of Houston reported all-time highs in operating value, container volume and tonnage in 2006,” says Kathryn Koepke, manager, research and consulting, with Houston-based O’Connor & Associates. “Executive director Thomas Kornegay indicated that preliminary estimates of earnings in 2006 increased by $10 million to $164.7 million.”

Another strong area of town is in the Far Northwest submarket, where there are 23 buildings totaling nearly 2.2 million square feet under construction. “Following closely behind, the East/Far Southeast currently has 1.7 million square feet of new construction underway and more than 2 million square feet in the planning stages,” Nicholson says. “As construction moves forward, overbuilding will remain a concern primarily within these submarkets.”

According to Nicholson, one key trend that is expected to emerge this year is the availability of new product in the George Bush Intercontinental Airport area. ProLogis, for example, plans to develop more than 1.2 million square feet of distribution space in nine buildings as part of a 68-acre master-planned industrial park along Interstate 45 near Beltway 8.

Another big developer, Duke Realty, which opened its first Houston office last year, is expanding its presence by picking up prime development spots for light manufacturing and distribution space in two separate plots in the North and Northwest submarkets. At the 51-acre Westland Business Park, which is located at Texas 290 and the West Road/Eldridge Parkway exit, Duke plans to build a 262,800-square-foot facility that is scheduled for completion this July. To the north off Kenswick Drive, the 52-acre Houston Intercontinental Trade Center is seeing construction begin this quarter on a 158,400-square-foot facility that will be complete in the fall. “Even bigger plans are in store for the sites, as Duke eventually wants to build a total of 1.6 million square feet of industrial space on the sites,” Koepke says.

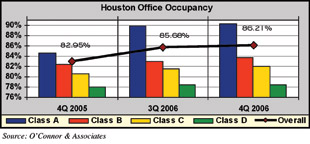

Looking ahead, large institutional investors are becoming more and more active in Houston due to the influx of institutional-grade product coming to the market, according to Koepke. “A lot of new development has put downward pressure on occupancy levels, but absorption levels are strong,” she says.

Austin Office Condos are Hot in 2007

As more and more companies are locating to the state’s capital — and as many of those that are already in Austin are beginning to expand — now seems to be the time to invest in office condominiums. Rate are ticking back up, and things are starting to sell, according to Sue Gravett, principal and president of Henry S. Miller Commercial Austin, Inc./TCN Worldwide. “Our office condo market is hot,” Gravett says. “And, it’s not just lawyers and doctors anymore, we have CPAs, architects and many others that are going for condos. That particular part of Austin’s office market is strong right now.”

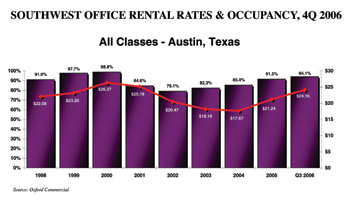

Austin’s office market, which currently sits at around 35 million square feet, is back up to higher occupancy rates, leading to little or no concessions. “We are seeing higher rent rates,” Gravett says. “From January to December 2006, rates climbed to $1.60 per square foot. Now, the average rent across the city is running at about $22.30.” Broken down by submarket, in the central business district (CBD) the average rent is $25.55 with slightly more than 17 percent vacancy. The Southwest and Northwest submarkets are strong with very little space available. “The Southwest has the lowest vacancy rates at 5 percent with rents averaging $25, followed by Northwest at 10 percent vacancy and $22.82 rents,” Gravett says. “The Central and Southeast submarkets have the highest vacancy rates in the area at 21 and 20 percent, respectively. The rents are averaging $19.50 in Central Austin and $17.97 in the Southeast.”

The Southwest and Northwest submarkets currently are Austin’s hot areas for new office development. In the Southwest, Brandywine has the 211,000-square-foot Park at Barton Creek Class A office project under development near the intersection of MoPac Expressway and Capital of Texas, and Dallas-based Champion Partners was set to complete Parkway at Oak Hill, a 145,788-square-foot facility located at 4801 Southwest Parkway, last month, as of press time. To the north, Trammell Crow Company is bringing a building out of the ground that is 250,000 square feet; Aspen Properties is planning another 150,000 square feet to be added to the excess land on its Prominent Pointe project; and Cousins Properties has 170,000 square feet its getting ready to add to the sector. “Considering there is such little vacancy in that area, and considering it’s the high-tech corridor where a lot of the high-tech companies are located, this will finally give some large chunks of space,” Gravett says. “We may see some companies moving around.”

Even though there is a considerable amount of new square footage being added in 2007, the buildout dollars for second generation space is climbing, according to Gravett. “What I’m seeing is that when a company leases second generation space, if they want carpet, paint and only a few walls moved, we’re looking at $15 to $20 per square foot,” she says. “In Austin, that’s much higher per square foot than in the past few years. Landlords are wanting to see tenants commit by contributing dollars to their finish outs.”

Another trend in Austin’s office market is landlords’ use of a model tenant suite, which typically features a perimeter of hard-walled offices and an interior with a reception area, board room, kitchen and cubicles. “What’s interesting is that landlords are showing tenants this model and will do very little revision to it,” Gravett says. “It’s no longer where you can start with a clean slate. Tenants are getting very little design input.”

Overall, Austin has had a strong comeback since the dot-com bust in 2000 and 2001. According to Gravett, the unemployment rate ended last year at 3.8 percent, and there is a positive economic forecast for the city’s future. “All of the economists are saying that Austin looks strong for the next 5 years,” she says. “We’ve had a lot of investors that have come into the market, and they have purchased close to a billion dollars in sale in 2006 in office buildings. Companies desire to be here.”

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|